What Impact Would Not Raising the Debt Ceiling Have on the TSP?

At the monthly Federal Retirement Thrift Investment Board (FRTIB) meeting, one participant asked how a government default would impact the Thrift Savings Plan (TSP).

Typically, when there is a debate about raising the debt ceiling limit imposed by Congress, which has happened several times in recent years, the Treasury Department suspends investments in the G Fund. Interest is eventually paid on investments after the debt limit issue is resolved. The “exceptional circumstances” issue does not impact the ability of participants to make other changes to their TSP account.

Kim Weaver, Director of External Affairs at FRTIB, indicated at the monthly meeting that the situation is different this year. If the government should go into default, we will learn at that time how the Treasury Department will handle issues involving the TSP.

That is not a response TSP investors will like to hear. It is understandable, as a government default has not happened in the past. Federal officials will have to make policy decisions should a default occur.

But the executive branch has both the power and the obligation to make debt-service and Social Security payments, and it has broad authority to prioritize the most pressing of the government’s remaining obligations. For those reasons, it may well be that hitting the X date—and a short lapse in the government’s ability to raise revenue—looks like a temporary government shutdown that follows an appropriations lapse.

The Phony Debt-Ceiling ‘Calamity’ – WSJ

The real answer to the question is that “We will find out when we get there” if the debt ceiling is not raised.

TSP’s Office of Participant Experience (OPE)

The Office of Participant Experience (OPE) is a new organization. It combines two previous organizations. Jim Courtney, previously the director of communications and education for the Thrift Savings Plan, now is in charge of the new organization.

He described the role of OPE this way:

We create an excellent participant experience through effective program operations, outreach, and external partnerships.

As part of this effort, three new ways exist to contact the TSP. These include Ava, a virtual assistant. This computer program provides answers to many questions posed by participants. Live-agent chats are also available to TSP investors through “inside my account” at the TSP. And finally, participants can email the ThriftLine by email at ThriftLine@tsp.gov.

As part of the new TSP experience, some 800,000 people have also downloaded the TSP application, enabling participants to handle a number of typical TSP transactions. There are more than 5.1 million mobile app logins compared to about 4.8 million Thriftline calls and more than 40 million website logins.

TSP Funds’ Performance So Far in May: I Fund (Still) Has Best 2023 Return

As of the close of markets on May 22, 2023, all TSP Funds have a positive return so far in 2023. Only the F Fund is down so far in May for the month but it is still up 2% for the year.

The I Fund has the best performance among the TSP core funds, with a return of 11.84% so far in 2023. The three most aggressive Lifecycle Funds have the best performance among the L Funds. These three have each returned 9.98% so far this year. The S Fund is also showing improved returns, with a return so far this month of 1.93% and a 5.54% return for the year-to-date.

| Fund | Month-to-Date | Year-to-Date |

|---|---|---|

| G Fund | 0.22% | 1.50% |

| F Fund | -1.70% | 2.00% |

| C Fund | 0.70% | 9.92% |

| S Fund | 1.93% | 5.54% |

| I Fund | 0.09% | 11.84% |

| L Income | 0.22% | 3.64% |

| L 2025 | 0.27% | 4.82% |

| L 2030 | 0.37% | 6.70% |

| L 2035 | 0.38% | 7.20% |

| L 2040 | 0.40% | 7.70% |

| L 2045 | 0.42% | 8.12% |

| L 2050 | 0.44% | 8.55% |

| L 2055 | 0.65% | 9.98% |

| L 2060 | 0.65% | 9.98% |

| L 2065 | 0.65% | 9.98% |

I Fund Participation Continues to Grow

Last month, a FedSmith article noted: “$245 million was transferred into the I Fund. Perhaps the I Fund transfers were due to the fact that the I Fund showed the highest return among stock funds for the year-t0-date at the end of March.”

That trend of moving into the I Fund has continued.

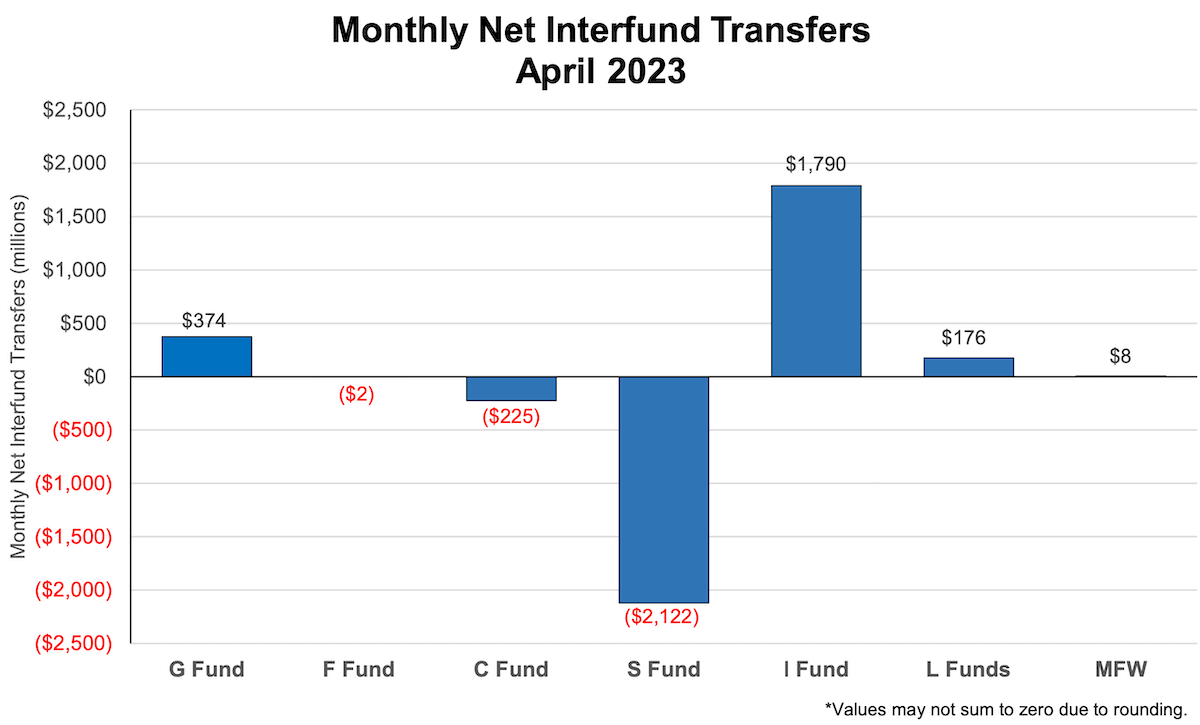

In April, almost $1.8 billion was transferred into the I Fund. At the same time, more than $2.1 billion was transferred out of the S Fund, and $225 million was transferred out of the C Fund. This chart displays the inter-fund transfers for the latest month.

With the April interfund transfers now recorded, the participant allocation in the I Fund is now up to 4%. That is up from 3.7% in the previous month.

The increasing percentage in the I Fund is likely to go higher with headlines about a possible government default and the possibility of a weakening dollar. As a share of total assets in the TSP Funds, the I Fund has gone up to 9.2% in the last month compared to 8.8% in March. At the end of December 2022, total assets in the I Fund were at 8.5% ($66.7 billion).

To put this into perspective, total TSP assets at the end of April were $766 billion. Most TSP participants do not do interfund transfers in a given month. In all likelihood, most of the IFTs are from the more active traders among TSP participants.