Is your Thrift Savings Plan (TSP) account FDIC insured?

It never was and never will be, but there is a silver lining.

The Risks You Take

FDIC insurance only works for accounts like checking or savings accounts and investments are rarely covered.

But here is the good news. If you own an investment (such as Apple stock, or the C Fund), then even if your bank/brokerage (like Vanguard, Schwab, or TSP) was to go out of business, you would still own your investment. You would just have to move it to another institution.

Note: Because the TSP is tied to the federal government the odds of the TSP going under are very small.

But What If My TSP Goes to $0?

So we now know that your retirement investments are still okay even if the institution that holds those investments goes under. But what happens if the investments themselves lose money?

If your investments, such as the C Fund, go down in value, then there is no government insurance out there that will save you. If your investments lose money then you lose money. If your investments earn money then you earn money.

Since we all like taking the earnings when the TSP goes up then we are all going to have to accept the times that the TSP goes down.

Too Much Risk?

The G Fund is probably sounding really good at this point. For those that don’t know, the G Fund is the fund in the TSP that the Fed guarantees won’t ever go down in value. That is why many federal employees move most, if not all, of their TSP accounts to the G Fund as they approach retirement.

But is that safer than investing in the C Fund? Nope! It is just a different type of risk.

What is Your Favorite Risk?

When you invest mostly in the C Fund then you have to deal with the short-term volatility that comes with it, but you’ll probably get good growth over time.

Is there risk involved with the C Fund? 100%!

But when you invest mostly in the G Fund then you risk getting next to no growth on your retirement savings which allows inflation to eat you alive. The G Fund may not have short-term ups and downs, but over time the purchasing power of your money is going to plummet.

The G Fund has risks and rewards just like the C Fund. You just have to decide which risks and rewards you are more comfortable with.

A Balanced Approach

For most people retiring, it makes sense to have some conservative investments (like the G Fund or F Fund) as well as some aggressive investments (like the C Fund, S Fund, and I Fund) in their retirement portfolios.

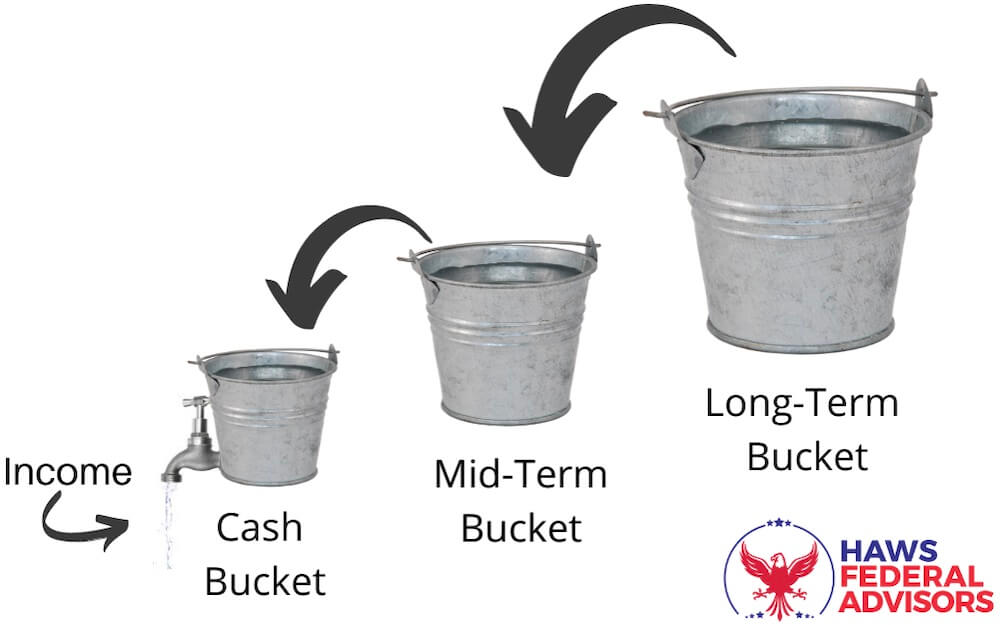

After all, we all want some money to ensure we can go on the 2-week cruise next year but other investments to ensure that our money never runs out. A great way to accomplish both of these goals is by using the bucket system which I explain in depth in this article.