Author’s Disclaimer: This was not written with permission from the Treasury Department, and I am not representing them. These words and ideas are my own, and they are also true.

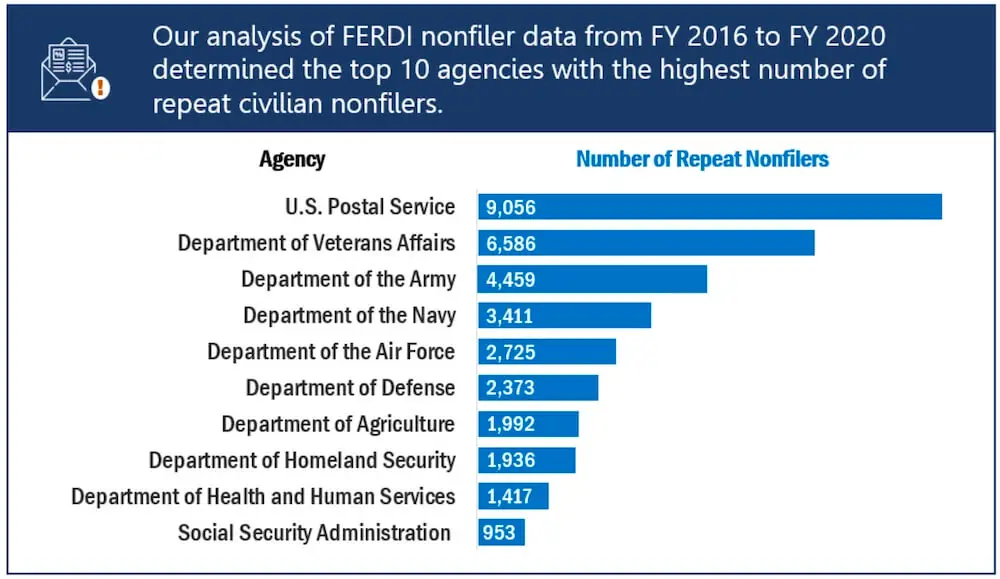

There are currently over 2,000,000 federal civilian employees. Well over 100,000 owe taxes, and more than 40,000 are due to non-filing.

The IRS knows this, but as a matter of practice, it has only policed its own employees. However, potential changes are coming. If you are among the many who have not filed, you can get ahead of the curve before it’s too late. And it very soon may be too late.

What I know: At worst, your agency may change its policies on tax filing and you’ll lose your job. At best, the IRS will file returns for anyone who has income reported from any source. These returns will be unfavorable as they will be completed 3 or more years after the due date. This 3-year mark is when you can no longer claim refunds.

I can think of 2 very good reasons Feds should be punished if they fail to file.

First, there is a growing number of non-filers in our ranks. This is a failure on the part of every agency that does not insist its employees file their taxes. Those with a tax debt on their credit may lose, or fail to qualify for, a security clearance.

This brings us to the second reason: Aside from hampering one’s career, not filing hurts the employee due to missed refunds and incurred penalties/interest.

As such, I made a recent recommendation in response to a TIGTA report citing that the IRS has an obligation to ensure all federal employees are current in their filing.

My Recommendation to Treasury Inspector General for Tax Administration (TIGTA)

When I read in the TIGTA report that the IRS will not be pursuing non-Treasury employees other than how they would the average citizen, I said something akin to, “We should, because there are generally two types of federal employees not filing – the poor and those delaying the claim of potentially illicit income, such as from insider trading, kickbacks, or worse.”

The former is being cheated because if they were told that there would be harsh consequences for not filing, they would do it and would likely get a refund. The latter are cheaters, self-dealers, and crooks, the kinds who may think, “Congressmen insider trade; why not me?”

I want to focus on the lower-income employees who are behaving as their own worst enemies, not the dirtbags reasoning their way to claiming that theirs are victimless crimes.

As someone who received the Earned Income Tax Credit for over 10 years, I can personally attest to it being a financial lifeline. As an active-duty marine, those large tax refunds ensured my wife and I weren’t buried in credit card debt; as a stay-at-home dad going to college, refundable credits helped as I reset my career options after the VA determined me to be 60% disabled.

Therefore, my conclusion to TIGTA was that it would be in the best interest of our federal workforce to be more vigilant in enforcing timely tax filing. After all, refunds will flow directly into local communities as these workers often spend everything they make. I did at least.

Why You Should File Your Tax Return Without Being Forced

If you don’t file, an unfavorable return will be filed for you. This happens under an IRS program called Automatic Substitute for Return (ASFR).

The IRS already knows that you made money because your employer reported your W-2 to them. When it’s been 3 or 4 years, or maybe even 9-years-11-months-and-29-days (anything less than 10), their system will churn out a return stating the bare minimum, like that you made money and perhaps owe some taxes. They don’t know if you donated to your church or had a flood, but they do know if you traded stock. If you got a 1099 form from eBay, they’ll just assume it was 100% profit when you might have actually been able to claim a loss which could have increased your tax refund.

And speaking of refunds, I feel morally compelled to repeat that you won’t get one. Anything owed to you from 3 years since the filing deadline is gone. But if you owe, they will now have 10 years from the date of the return being filed to collect from you. This means that if you want your 2022 refund (due 4/18/2023), you’ll have until 4/18/2026 to claim it, but if the IRS files for you today, they have 10 years to collect, starting right now.

If you owe and refuse to get on a payment plan of some kind, the IRS can put a lien against your house or maybe a levy against your Thrift Savings Plan account. Yes, you read that right: The IRS can just go and take the money out of your TSP, and that money will be taxed.

To reiterate, the IRS will withdraw from your TSP, meaning you’ll lose all future growth on that money, and then you will have to pay taxes on it next year unless you fail to file again in which case you’ll still pay that tax plus interest and penalties (as well as interest on the penalties).

You Must File, and Right Now Is the Best Time

If you don’t file, the IRS will file for you. If you owe at the end of the year, it’s best to just get it out of the way. For the rest of us who get a refund at the end of the year, why would you not file?

Christopher Pascale is a federal employee currently serving with the IRS. His writing has been published in The Journal of Accountancy and Marine Corps Gazette. He is currently working on a biography about Vice President Charles Curtis, which is related to his Ph.D studies at SUNY Stony Brook.