The Internal Revenue Service (IRS) rarely holds federal employees who fail to file and/or pay their taxes accountable and also devotes very little time to doing so despite a significant increase in the number of tax delinquent federal employees in the past several years. This is according to a recent report from the U.S. Treasury Inspector General For Tax Administration (TIGTA).

Failure to file a tax return is a crime that is punishable by a fine of not more than $25,000 ($100,000 in the case of a corporation) or imprisonment of not more than one year. The TIGTA report also notes that federal employees have a heightened responsibility to be compliant with their federal tax obligations.

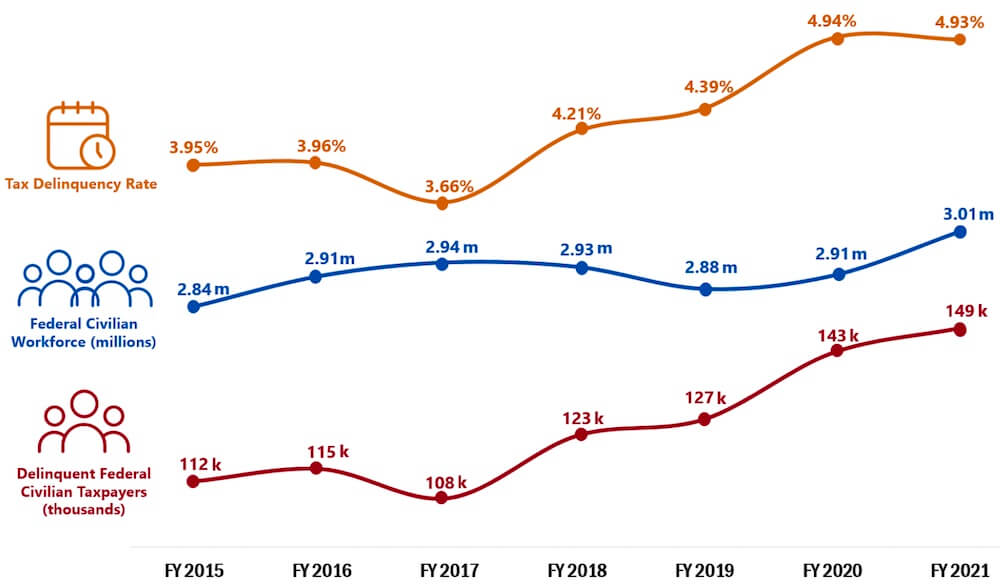

However, despite these facts, there are over 42,000 federal employees that have repeatedly failed to file a tax return for multiple years in the time period analyzed by the report. That number has been growing also as the figure from the TIGTA report below indicates. The size of the federal workforce grew by 6% from fiscal year (FY) 2015 – 2021, but the total tax delinquency rate among federal employees increased 32% during the same time period.

The IRS established the Federal Employee/Retiree Delinquency Initiative (FERDI) program in 1993 to promote Federal tax compliance among current and retired Federal civilian and military employees. A FERDI delinquency is considered to be any unresolved Federal income tax in the form of an unfiled tax return (TDI) and/or a balance owed (TDA).

As of FY 2021, tax delinquent federal employees collectively owed $1.5 billion in unpaid taxes to the federal government. From FY 2015 – 2021, the FERDI civilian federal employee population grew by over 36,000 delinquent federal employees while the balances due grew by over $389 million.

How Many Tax Delinquent Federal Employees Are There?

According to the TIGTA report, there are a total of 42,047 federal employees who repeatedly failed to file a tax return between FY 2016 and 2020. Some of the instances span multiple years (9 or more in some cases).

| Delinquent Tax Years | Number of Employees |

|---|---|

| 2 | 24,734 |

| 3 | 10,242 |

| 4 | 4,182 |

| 5 | 1,829 |

| 6 | 700 |

| 7 | 255 |

| 8 | 86 |

| 9+ | 19 |

| Total | 42,047 |

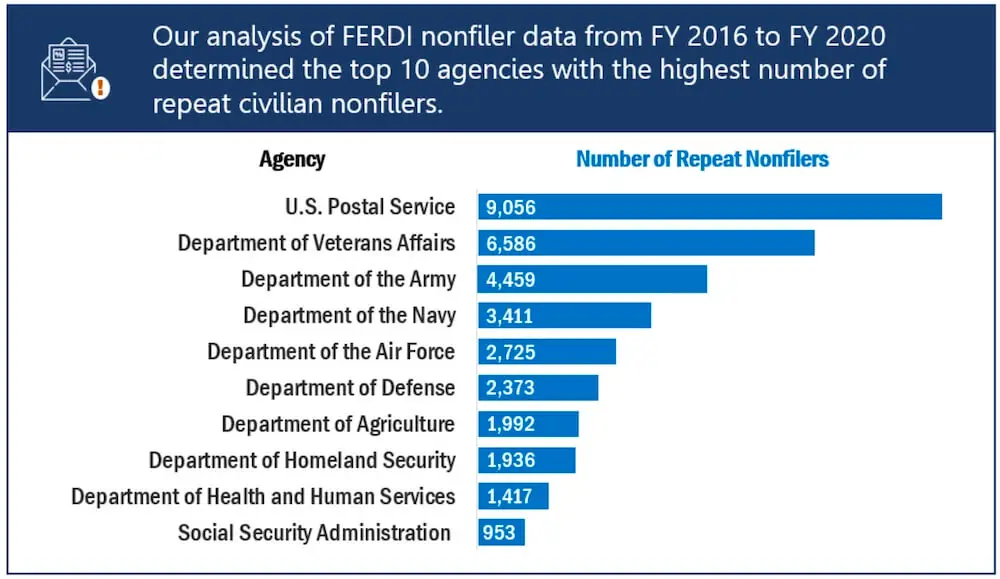

Which Agencies Had the Most Repeat Offenders?

Federal agencies that had the highest numbers of “repeat offenders,” i.e. the federal employees who continued not to file their tax returns in multiple years, included the Postal Service, Department of Veterans Affairs, Army, Navy, Air Force, Department of Defense, and Department of Agriculture.

There Oughta Be a Law…

Interestingly enough, the TIGTA report found that federal employees in the Treasury Department (which includes IRS) are the most tax compliant federal employees. In FY 2021, IRS employees had a 1.35% tax delinquency rate versus 4.93% for civilian workers throughout the federal government. The report said that this is probably because the IRS has the ability to take disciplinary action when its employees have tax delinquencies.

This discrepancy between IRS and the rest of the federal government led TIGTA to state in its report that “legislation should be considered to allow the IRS to share essential delinquent employee return information with other Federal agencies.” The report states:

The IRS has attempted to work with other Federal agencies since the Executive Order was issued to improve the Federal deliquency rate; however, due to statuatory limitations, including the inability to share return or return information with those agencies, no recommendations have been instituted to improve the delinquency rate.

Legislation has been introduced in the past to attempt to crack down on tax delinquent federal employees, something noted by TIGTA, but to date nothing has become law.

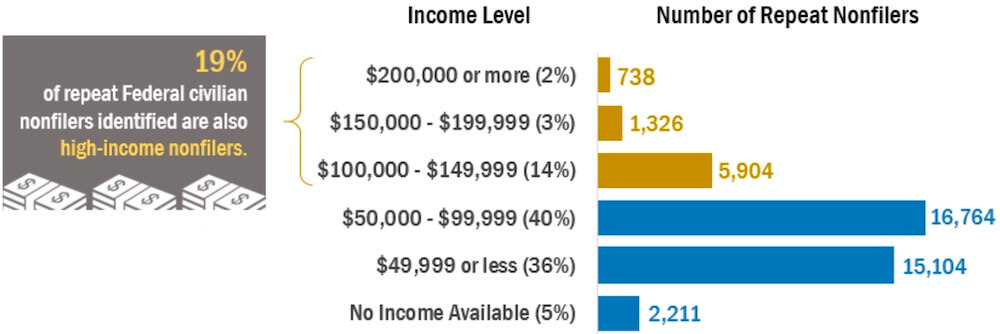

Income Levels of Tax Delinquent Federal Employees

TIGTA also said in its report that most of these federal employees are high income earners. High income earners make $100,000 per year or more as defined by the IRS with respect to non-filers.

TIGTA estimated in its report that 5,904 (14%) of the non-filer federal employees earn between $100,000 and 149,999 per year, 1,326 (3%) earn between $150,000 and 199,999 per year, and 738 (2%) earn $200,000 per year or more.

The grade levels of the tax delinquent federal employees analyzed by the report ranged from GS-05 to GS-14 for employees on the General Schedule. A smaller number were WG-10 (Wage Grade). The largest number were GS-12 (3,623), and 18% were GS-12 to GS-14.

Tax Delinquent Federal Employees Not a Priority for the IRS

Despite the growing numbers of tax delinquent federal employees, the matter apparently isn’t a priority for the IRS. The report states that TIGTA interviewed five managers and five employees and asked them if the FERDI non-filers were being addressed as a priority. All of them stated they not “timely or regularly” in the Automated Collection System.

The report also adds that just one day per quarter was used to work on the cases. This only happened during the course of the review, however, which seems to imply that the IRS only started to look at it since it was under scrutiny by the IG.

TIGTA adds:

The IRS’s lack of prioritization of nonfiler cases is not new. Balances due are generally considered a higher priority for the IRS over unfiled returns. However, an IRS Research Study concluded that the TDI nonfiler program would be the most cost effective activity for the IRS to produce revenue. In the normal course of the collection process, automated processes make addressing balances due easier, especially with the systemic FPLP levy process for Federal employees. Nonfiler cases are a form of brazen noncompliance by taxpayers who are required to file and promptly addressing FERDI nonfiler cases should be a priority. FERDI taxpayers have heightened tax compliance responsibilities, and it is important for the IRS to prioritize unfiled returns wherever they may be in the collection process.

The report added, “As the agency primarily responsible for administering Federal tax law, the IRS must ensure that Federal employees comply with the tax law in order to maintain the public’s confidence.”