FEGLI (Federal Employee Group Life Insurance) can get outrageously expensive as you get older depending on the parts you have, but what most federal employees don’t know is that one type of FEGLI can become basically free once you retire.

However, it only works if you know what to elect on your retirement application.

The Truth Will Set You Free

The truth is that most federal employees don’t understand how FEGLI works at all, but if you are one of the few that does then you can save yourself lots of money.

This article is going to focus only on FEGLI Basic but if you want to know more about the other parts then you’ll want to check out this article.

But just so everyone knows, FEGLI has 4 different parts, all of which have different rules. Here are the 4 parts with a quick summary of what they are about.

- Basic: Provides about the same amount of coverage as your salary.

- A: Provides $10,000 worth of coverage

- B: Provides between 1 and 5 times your salary depending on what you elect

- C: Provides a small amount of coverage for your spouse and children

Note: Part B is the one that has major price hikes as you age!!

The (Potentially) Free One

This article is going to focus on FEGLI Basic as that is the one that can become free into retirement and, in my experience, seems to be the one that most federal employees do take into retirement.

FEGLI Basic does not become free in retirement for everyone, only for those federal employees that make a certain election on their retirement applications.

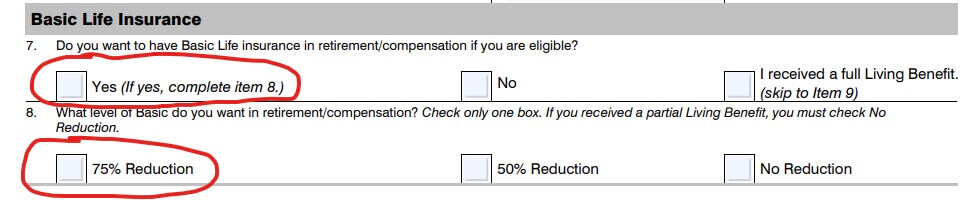

It is called ‘75% Reduction’ as you can see from this snippet I pulled from SF-2818:

What’s The Catch?

But like everything, the devil is in the details.

This is how the ‘75% Reduction’ option actually works.

If you retire at age 65 or later then immediately at retirement you will no longer have to pay premiums for FEGLI Basic, aka it becomes free.

However, the coverage amount does go down by 2% per month until it reaches 25% of your pre-retirement coverage amount.

For example, if your salary was $100k before retirement then your FEGLI basic coverage would start at about $100k in retirement but go down by 2% per month until it reached about $25k.

Once it hits about $25k then there are no more reductions and you’d have $25k worth of coverage for the rest of your life for free. But if you retire before age 65 the reduction doesn’t start until age 65 and you will still need to pay premiums until you hit 65.

For example, if you retire at age 57, then you’ll have $100k coverage (assuming our salary was about $100k) until age 65 and you’ll pay the same premiums you were paying while working.

But at age 65 your premiums go away (it becomes free) and your coverage amount starts getting reduced as explained above.

Is It Worth It?

Let’s go through one more example to see if this option is worth it.

Let’s say you are 60 years old and retiring tomorrow. You have FEGLI Basic and you are trying to decide what to do with it. Your salary is about $100k, so your coverage amount is about $100k and your monthly premiums would be about $35.

Note: Most federal employees pay their FEGLI premiums every two weeks, but in retirement, you’d pay them on a monthly basis.

In this example, if you elected the 75% Reduction option then you’d continue paying the premiums until 65 at which point your premiums would go away and your coverage amount would go to $25k.

So if you continued to pay $35/month for 5 years (the time between age 60 and 65) then you’d pay about $2,100 ($35 x 12 Months x 5 Years) in premiums over that time.

But in exchange for the $2,100, you get $25k worth of coverage for the rest of your life.

You put in $2,100 and get out $25,000.

Not a bad deal at all. This option can often be a no-brainer if you are already 65+ and retiring as the premiums go away immediately.

Note: The numbers I shared in the example above are fairly realistic but your specific numbers will depend on your situation.

Not The Full Picture

But of course, this option does not make sense for everyone.

Some people have no need for more life insurance at all, so the $2,100 spent on premiums would be better used now enjoying their life. Or some people might have gotten rid of FEGLI Basic years ago and have no option to take it into retirement.

You’ll want to understand all your options to make the best decision for you and your family.