I am a big proponent of the Roth IRA and the Roth TSP. Ed Slott says: “By having your money in an IRA to a Roth IRA you go from forever taxed to never taxed.”

Would You Rather Pay Tax on the Seed or Harvest?

Autumn is the season when farmers all over harvest their crops. How rewarding it must be for them to start from a small seed to water, feed, and watch it grow, and then to reap the bounties that their hard work has produced.

The same can be said for us as we plan for retirement… We start with a seed, watch it grow over time, and then as we enter retirement with the intent to reap the bounties of our growth – only to find out that the IRS has a right to a part of it! And how much? They can decide every year.

It is not uncommon for our clients to tell us that they are planning to wait until they are forced to take their Required Minimum Distribution (RMD) from TSP until they reach their RMD age based on the year in which one was born, anywhere from age 70 ½ to age 75.

When we uncover what this looks like in their financial plan, very often they are shocked by how much they will need to withdraw. This not only leads to higher taxes but also higher Medicare Part B premiums. Now, if this were in a Roth TSP or in a Roth IRA, there would be no forced distributions and any distributions would be tax-free, assuming you had had the Roth established for five years and you have attained age 59 ½.

I am a big proponent of the Roth TSP, Roth IRA, and Roth Conversions. Before choosing to recommend any type of Roth to our clients, we go through a Roth Analysis to see if it is favorable even if taxes were somehow not going up in the future. Most of the time it is favorable, and we want to avoid any unpleasant consequences.

Although there are more than five reasons to consider going Roth, I am going to share what I think are the most important.

1. Uncertain Tax Laws

Do you believe taxes are going up? Most people I ask this question say yes.

The “Tax Cuts & Jobs Act” of 2017 (TCJA) went into effect on January 1, 2018. This was the largest of changes to the Revenue Code of 1986, signed into law by President Trump in 2017.

Below are the tax brackets for 2017 and 2023. In 2025, the TCJA will sunset, and without Congress changing this in 2026, taxes will go back to what they were in 2017. I imagine the income will be adjusted for inflation.

Comparison of Tax Brackets

Taxable Income Brackets for 2023 – Ordinary Income Tax Rates

| Marginal Tax Rate | Married Filing Jointly | Single |

|---|---|---|

| 10% | $0 – $22,000 | $0 – $11,000 |

| 12% | $22,001 – $89,450 | $11,001 – $44,725 |

| 22% | $89,451 – $190,750 | $44,726 – $95,375 |

| 24% | $190,751 – $364,200 | $95,376 – $182,100 |

| 32% | $364,201 – $462,500 | $182,101 – $231,250 |

| 35% | $462,501 – $693,750 | $231,251 – $578,125 |

| 37% | Over $693,750 | Over $578,125 |

Taxable Income Brackets for 2017 – Ordinary Income Tax Rates

| Marginal Tax Rate | Married Filing Jointly | Single |

|---|---|---|

| 10% | $0 – $18,650 | $0 – $9,325 |

| 15% | $18,651 – $75,900 | $9,326 -$37,950 |

| 25% | $75,901 – $153,100 | $37,951 – $91,900 |

| 28% | $153,101 – $233,350 | $91,901 – $191,650 |

| 33% | $233,351 – $416,700 | $191,651 – $416,700 |

| 35% | $416,701 – $470,700 | $416,701 – $418,400 |

| 39.6% | Over $470,700 | Over $418,400 |

We have been doing many Roth Conversion analyses for clients. Some like to do as much as possible to stay in their same tax bracket. We call this bracket bumping. Others who are in the 22% tax bracket choose to go up to the 24% tax bracket. Converting to a Roth IRA will result in no future income taxes for you and your heirs.

2. The State of Our Economy

Our US debt is over 33 trillion dollars (about $100,000 per person in the US). Our unfunded liabilities are $193 trillion with Medicare leading the pack followed by Social Security. What concerns me is that our government does not seem to be taking this seriously.

3. “Congress’s Single Best Gift”

“Congress’s Single Best Gift,” according to seasoned IRA pro Ed Slott (see Chapter Seven in his book The New Retirement Time Bomb), is that the Roth IRA works the opposite from the traditional IRA and other tax-deferred accounts such as the TSP and a 401(k). While a current tax deduction will save you money now, withdrawals on earnings from a deductible IRA are eventually subject to tax.

When we do financial planning with clients, most want to maintain the same income as they did when working and often more. Most people are in a higher tax bracket in retirement given the combination of pensions, Social Security RMDs (Required Minimum Distributions), and investment income A Roth IRA can save even more money over the long run because withdrawals are tax-free and will remain tax-free for your beneficiaries, provided that you have established a Roth IRA for at least five years, and you are age 59 ½ or older.

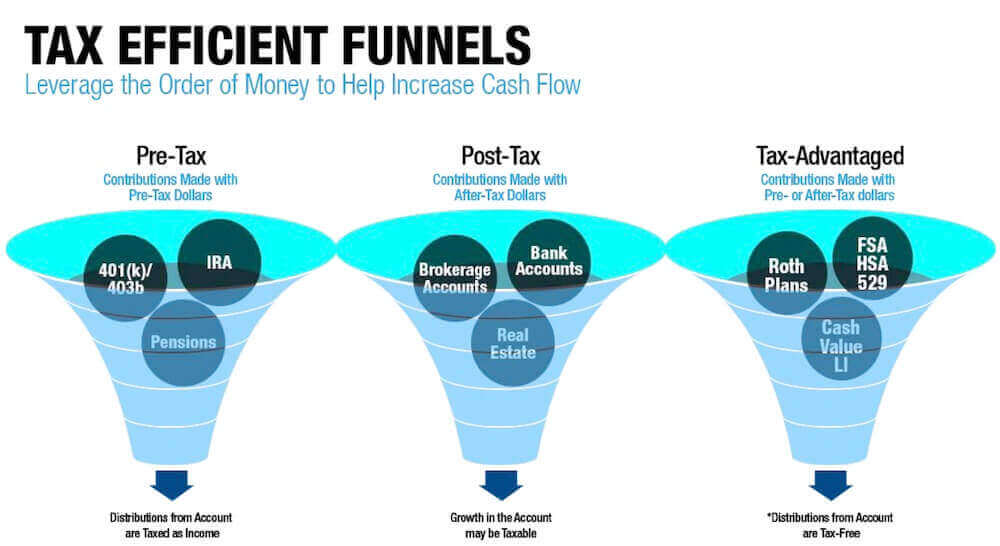

4. Tax-Efficient Funnels

Leverage the order of money to help increase cash flow. In the first funnel, examples of contributions made with pre-tax dollars include TSP, 401(k)/403(b), IRA, and a pension. The second funnel contains contributions made with after-tax dollars such as bank accounts, brokerage accounts, and real estate. The third funnel is contributions made with post-tax dollars such as Roth accounts, FSA, HSA, 529 plans, and cash value life insurance.

People often think it is best to take funds from their second funnel first and delay taking money out of their first funnel. This is usually a mistake. A non-spouse beneficiary in most cases must deplete the account within 10 years following the death of the owner. The second funnel will pass to your heirs with a step-up in basis.

Example: Joanne purchased Amazon stock back in the 90s when it was trading around $40.00. She owns 200 shares valued at $8,000. Today Amazon is trading at $143.00 and valued at $28,600. Joanne has one daughter who will inherit it and will not have to pay tax on the $20,600 gain.

Of course, funnel three should be the last funnel from which to take withdrawals in order to let that turn into a big harvest of tax-free funds for you and your heirs.

5. Avoid an Unintended Outcome

This last one is extremely important for a married couple where one of them is a federal employee and the other is not.

I like to use the names of Christopher and Angelica. Christopher is a federal employee and Angelica was a teacher and is now a stay-at-home mom. Christopher takes care of the finances and investing and is very prudent and disciplined when it comes to investing. He has always contributed the maximum amount to TSP and kept it in the appropriate Lifecycle Funds for his retirement. Angelica has her hands full with their two children Harry and Judy.

Christopher has always suggested to Angelica that if he were to predecease her to leave the money in TSP and keep it invested in the L Income fund. Christopher retired with an account balance of 1.2 million dollars at age 65 along with his FERS pension and Social Security.

Fast forward to age 85, Angelica is age 84 and sadly Christopher passes. He had $1.6 million in TSP.

Angelica did what Christopher told her and put his TSP account into her name, naming Harry and Judy as beneficiaries. Angelica took Harry, Judy, and their families on a Disney Cruise when she was 85. She then just took her minimum distributions from TSP each year. At 88, Angelica passed, and Harry and Judy inherited the TSP account balance of $1.5 million.

What Christopher had not planned for was that his children would each have to pay taxes on $750,000. Christopher is rolling around in his grave knowing that his children and Uncle Sam were splitting his hard-earned life savings. If this were in the Roth TSP, Harry and Judy would get to keep the $750,000 for themselves and their families.

Financial Planning and Advisory Services are offered through Prosperity Capital Advisors (“PCA”), an SEC registered investment adviser. Registration as an investment adviser does not imply a certain level of skill or training. Franklin Planning and PCA are separate, non- affiliated entities. PCA does not provide tax or legal advice.