Inflation and Recent COLA Figures

Last month, when the inflation rate for the third quarter of 2023 was released, we learned the 2024 cost of living adjustment (COLA) for federal retirees would be 3.2%. Retired federal employees under FERS receive 2.2% increase in their annuity payments. The Social Security payments for FERS retirees will receive the full increase.

Some retirees are going to be disappointed with the 2024 increase. In 2023, the COLA was 8.7%— the highest in more than 40 years. While the COLA did not go up as much as most prices at the gas pump or for most goods in stores, it was still a significant increase.

The 8.7% increase followed a big increase in 2022—when the COLA was 5.9%—that was the highest in 40 years.

It is probably good news that the 2024 COLA will only be 3.2%—considerably less than it was the previous two years—because the rapidly growing inflation rate hurts everyone because prices are going up higher than the increase in income.

The October inflation data is the start of a new year. We will not know the amount of the 2025 COLA until the inflation data for September is released in October 2024. With the inflation rate decreasing, it is likely the COLA to be announced next October will be less than the 3.2% increase starting in January 2024.

Inflation Figures for October 2023

The October inflation data were released on November 14, 2023. Here is a capsule of the latest data.

Americans spent less on gas and energy last month. That helps keep inflation from increasing as it has in the past couple of years, but underlying price pressures remain. This leaves inflation above the Federal Reserve’s 2% target and a big reason why the Federal Reserve isn’t declaring an end to its historic interest-rate increases.

In October, the Consumer Price Index for All Urban Consumers (CPI-U) was unchanged after increasing 0.4% in September. Over the last 12 months, the all-items index rose 3.2%.

The index with the most significant impact on former federal employees who have retired under a federal retirement program is the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). This is because the CPI-W determines the amount of the next COLA increase to be announced in October 2024.

The CPI-W index increased 3.1% over the last 12 months to an index level of 302.071. For the month, the index decreased 0.1%. The CPI-W figure for September 2023 was 302.257.

Inflation Down But Big Problems Remain

Moody’s Investors Service (a bond credit rating service) dropped a potential shock for investors last week. The Treasury bond markets are in turmoil, with high interest rates hurting the value of older bonds paying a lower interest rate.

Moody’s lowered its view of the American credit rating from “stable” to “negative.” The reasons for the change are economic risks, including high interest rates and the government’s growing debt.

Moody’s has lowered its view of the U.S. credit rating to negative. That’s not a complete downgrade. It conveys to investors that it is less certain about the government’s ability to repay its debts.

According to a senior credit officer at Moody’s, “In the context of higher interest rates, without effective fiscal policy measures to reduce government spending or increase revenues, Moody’s expects that the US’ fiscal deficits will remain very large, significantly weakening debt affordability.”

National Debt of the United States

According to the Treasury Department, the federal debt is now $33.7 trillion. To put this into perspective, this debt level is larger than the combined economies of China, Japan, Germany, India, and Great Britain.

The federal debt level is higher than the country’s annual gross domestic product (GDP), which was $22.7 trillion in 2022.

Regarding interest rates, the Federal Reserve has raised rates from almost zero to about 5.5% since March 2022. That means the government has to pay more when it borrows more money at a higher interest rate.

From December 2008 through 2021, interest rates were between 0% and 2.5%. Once the Federal Reserve decides not to raise interest rates as it tries to reach its goal of a 2% annual inflation rate, interest rates may remain at a rate of about 3.5%.

The federal government’s high debt level poses challenges for the government’s ability to finance its operations, pay interest on its debt, respond to future crises, and assist allies in the ongoing wars in Israel and Ukraine.

The United States has the world’s largest national debt in terms of dollar amount and the world’s largest economy. The American debt-to-GDP ratio is about 128.13%. The federal government’s spending exceeds income most years. The last year in which there was a balanced budget was 2001. In the past 50 years, the federal government budget has reported a surplus five times.

Forecast for 2025 COLA

A lot will happen before the end of September 2024, and the next COLA will be announced in October. Based on what is happening now, federal retirees (or those who plan to retire soon) are likely to receive a lower COLA than in each of the last three years. That is probably a good thing. Most Americans have found their purchasing power has decreased significantly due to inflation.

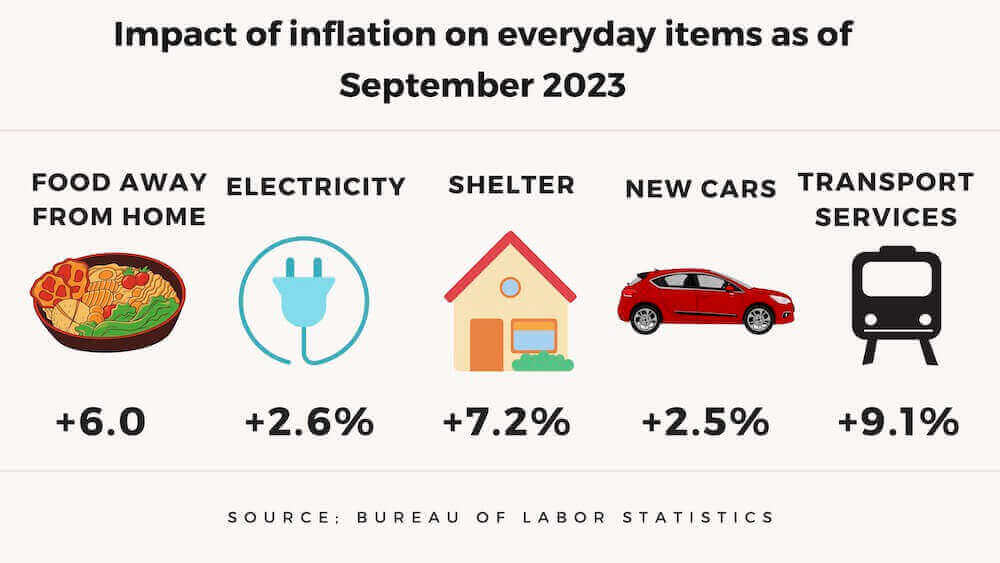

Because of inflation, it has become harder to buy a house, or a car, or pay for groceries. Personal debt is increasing.

Total household debt rose to an average of $17.06 trillion in the second quarter of 2023, with credit card balances alone reaching a high of $1.03 trillion. Credit card debt went up $154 billion year-over-year last quarter, the most significant increase since data began in 1999.

Lower inflation may decrease some financial pressure on American families although reverting to a more typical economic situation will obviously be disruptive and most likely slow down any economic expansion.