Having $1M in liquid assets is a great achievement to shoot for, whether in your own TSP account or combined with your spouse and other accounts. The number of TSP millionaires has increased significantly this year and many federal employees have started considering retirement more seriously.

But simply achieving this goal doesn’t guarantee that you’re ready to retire just yet. In this column, we’ll show you a very real scenario that we frequently encounter. We’ll review a retirement plan from an actual family that came to us wondering if they were ready to retire.

We took them through an exercise of modeling out their financial life and exploring just that: can you retire right now, and if not, what are some solutions to help you do so?

My hope is this will provide you with a framework and spark ideas on how you can be thinking about your own retirement plans.

Setting the Facts

We’ll start by reviewing the data set for this specific family. They were an average married couple, 59 and 60 years old, who were still working but wondered if they could retire. One is a federal employee and the other works in the private sector. Their net worth totaled to around $1.4M, with their liquid assets representing around $1M as outlined below.

- Checking/Savings: $10,300

- Joint Brokerage: $41,000

- 401(k): $310,000

- TSP: $625,000

- Roth IRA: $25,000

- Real Estate: $505,000

- Liabilities

- Mortgage: $100,000

- Total: $1,416,300

As “millionaires next door”, their lifestyle was comfortable but not lavish for a typical family here in the DC metropolitan area.

During our meeting, they told me that they wanted to accomplish the following:

- Retire confidently and sustain their financial independence

- Travel more frequently in retirement

- Reduce and keep their taxes lower

- Make sure they’re invested properly throughout retirement

- They’d like to have about $7k/mo to support their retirement lifestyle

These are the base facts of their plan and goals that will need to be met from a combination of their Social Security, FERS pension, and savings.

We begin by modeling out what would it look like if they retired today, and we start with a 5-year cash flow report.

5-Year Cash Flow – Base Facts in First Year (2023)

The 5-year cash flow report illustrates your income, savings, expenses, and resulting net cash flow on an annual basis.

| YEARS (AGES) | 2023 (60/59) | 2024 (61/60) | 2025 (62/61) | 2026 (63/62) | 2027 (64/63) |

| CASH INFLOWS | |||||

| Deferred Income | |||||

| FERS | $27,200 | $27,200 | $27,200 | $0 | $0 |

| FERS w/ COLA | $0 | $0 | $0 | $27,880 | $28,583 |

| Other Income Flows | |||||

| FERS Supplement | $13,052 | $13,052 | $13,052 | $0 | $0 |

| Total Cash Inflows | $40,252 | $40,252 | $40,252 | $27,880 | $28,583 |

| CASH OUTFLOWS | |||||

| Living Expenses | $84,000 | $86,117 | $88,287 | $90,512 | $92,793 |

| Liabilities | $21,554 | $21,554 | $21,554 | $21,554 | $21,554 |

| Insurance Premiums | $8,290 | $8,394 | $8,499 | $8,605 | $8,713 |

| Taxes | $6,888 | $18,190 | $18,422 | $21,801 | $21,487 |

| Total Cash Outflows | $120,732 | $134,255 | $136,762 | $142,472 | $144,547 |

| Net Cash Flow | ($80,480) | ($94,003) | ($96,510) | ($114,592) | ($115,964) |

Very simply, this shows us what income they have coming in, known as Cash Inflows, and what expenses they have going out, called Cash Outflows. All figures adjust slightly annually for inflation.

Initial observations and points to highlight:

- If they retire now, they have very little income coming in, because Social Security wouldn’t start until they’re older. This results in a high negative net cash flow.

- They have a FERS pension that starts but without COLAs until 63, and of course, we have the survivor benefit pension (SBP) cost built in so that the non-fed spouse can keep the pension (and FEHB) if the federal employee dies first.

- This family is almost done paying off their mortgage so that’s still under liabilities for another few years, and then they will have insurance and taxes owed on things like the FERS pension and portfolio activity.

- In order to maintain their lifestyle for the year if they stop working, it looks like they’re going to initially need about $80,000 to $90,000 from their portfolio because they don’t have Social Security until later in retirement.

Those are substantial portfolio withdrawals, and while Social Security is available at age 62, there is a permanent reduction for taking it that early, known as the actuarial reduction. Having Social Security available to you doesn’t always mean that you should immediately take it. You should calculate the long-term impact of taking it early.

If retiring on an immediate and unreduced pension under FERS, you may also be eligible for the FERS supplement until age 62 to help bridge this gap in income.

Retirement Projections

Now that we understand how much this family needs from their savings in the early retirement years, we can begin to project what their current retirement will look like. The key question is how sustainable will these withdrawals be.

We do assume some growth on their portfolio because it does need to be invested, but we also have to factor in those monthly withdrawals that they’re going to need for expenses. Here’s how much will need to come out of their portfolio for the next five years:

Detailed Withdrawals – Base Facts in First Year (2023)

The detailed withdrawals report provides a breakdown of your planned and supplemental withdrawals and the percentage of your total portfolio assets that these withdrawals represent.

| YEARS (AGES) | 2023 (60/59) | 2024 (61/60) | 2025 (62/61) | 2026 (63/62) | 2027 (64/63) |

| SUPPLEMENTAL WITHDRAWALS | |||||

| 401(k) | $27,225 | $94,002 | $96,510 | $114,592 | $33,085 |

| Checking/Savings | $10,300 | $0 | $0 | $0 | $0 |

| Client One and Client Two Sample – Core Cash Account | $0 | $1 | $0 | $0 | $0 |

| Joint Brokerage | $42,956 | $0 | $0 | $0 | $0 |

| TSP | $0 | $0 | $0 | $0 | $82,880 |

| Total Supplemental Withdrawals | $80,481 | $94,003 | $96,510 | $114,592 | $115,965 |

| Total Withdrawals | $80,481 | $94,003 | $96,510 | $114,592 | $115,965 |

| Total Portfolio Assets | $1,011,300 | $980,925 | $935,991 | $885,818 | $814,530 |

| Withdrawal Percentage | 7.96% | 9.58% | 10.31% | 12.94% | 14.24% |

We can see that we need to start taking withdrawals from their various accounts to meet their needs, and it looks like from a percentage standpoint the withdrawals make up about 8% of their portfolio in the first year.

At this stage, we started to look at how this impacts their overall retirement plan over time. We notice that their withdrawal percentage is increasing, and not because they’re increasing their expenses, but because the amount they withdraw makes up bigger portions of their portfolio as time goes on.

Now, if we project five additional years into the future to 2028, we can see that their withdrawal needs are significantly reduced once their Social Security benefits begin.

Detailed Withdrawals – Base Facts in 2028

| YEARS (AGES) | 2028 (65/64) | 2029 (66/65) | 2030 (67/66) | 2031 (68/67) | 2032 (69/68) |

| SUPPLEMENTAL WITHDRAWALS | |||||

| Client One and Client Two Sample – Core Cash Account | $0 | $1,848 | $255 | $3 | $0 |

| TSP | $91,067 | $60,622 | $19,103 | $20,814 | $22,234 |

| Total Supplemental Withdrawals | $91,067 | $62,470 | $19,358 | $20,817 | $22,234 |

| Total Withdrawals | $91,067 | $62,470 | $19,358 | $20,817 | $22,234 |

| Total Portfolio Assets | $737,658 | $683,883 | $653,934 | $665,756 | $676,695 |

| Withdrawal Percentage | 12.35% | 9.13% | 2.96% | 3.13% | 3.29% |

5-Year Cash Flow – Base Facts in 2028

The 5-year cash flow report illustrates your income, savings, expenses, and resulting net cash flow on an annual basis.

| YEARS (AGES) | 2028 (65/64) | 2029 (66/65) | 2030 (67/66) | 2031 (68/67) | 2032 (69/68) |

| CASH INFLOWS | |||||

| Social Security | $0 | $23,093 | $63,326 | $64,276 | $65,240 |

| Deferred Income | |||||

| FERS w/ COLA | $29,303 | $30,041 | $30,798 | $31,574 | $32,370 |

| Total Cash Inflows | $29,303 | $53,134 | $94,124 | $95,850 | $97,610 |

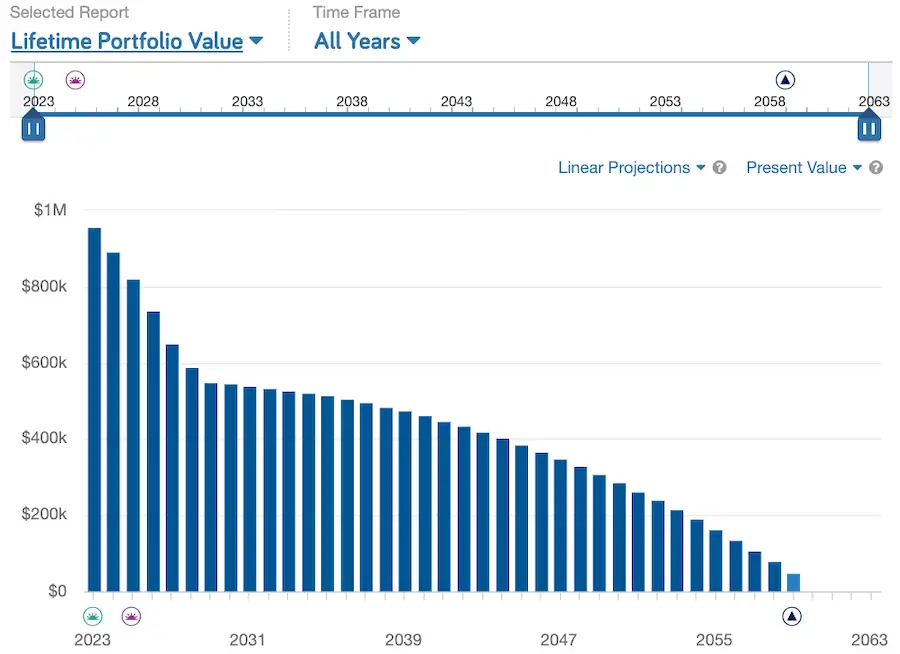

But as a retirement planner, I’m immediately concerned about the higher levels of withdrawals in early retirement. When we look at a projection of their portfolio assets, we can see that things don’t look too good. Bad market returns in those early years would be financially crippling.

It looks like they can enjoy the first several years of their retirement, but because their outflows are much greater than their inflows in early retirement, they take a pretty big hit to their portfolio in those years.

By the time Social Security starts, they’re down to a little over half of their wealth left, and now have to make this last for the rest of their lives. A few years of expensive healthcare could mean that their assets run out too soon, and when we factor in volatility, they only had about a 46% probability of success. Not good.

Implementing the Right Retirement Systems

When we looked at these numbers together, this couple started to feel pretty hopeless. They thought that maybe retirement was still years away or that they would have to make drastic changes to their lives.

But that’s not the case. As you’ll see shortly, sometimes small, and incremental changes can be applied that, when combined with the right retirement systems, can have a huge impact on the sustainability of a retirement in the long run. Let’s explore what some of these changes to their plan looked like.

During our conversation, they shared with me that they didn’t dislike their jobs, they just didn’t want work to consume their lives or get in the way of being able to travel and care for their grandkids. We talked about how a lot of financially independent families don’t simply retire and never do anything again.

The reality is that many young retirees still want to spend their time contributing to something, but they just don’t want to have to rely on a full-time job anymore.

We have clients who consult a few days a week, or maybe they do some teaching or sit on a board, and often they can earn a bit of income for doing so. They still get to contribute something but create a lot more time and flexibility in their schedules to focus on things that matter most to them.

This couple indicated that this sounded exactly like them. They like volunteering and would enjoy consulting here and there. So, we talked about what that might look like and determined they would earn about $30K in extra income for four years.

Unfortunately, it still wasn’t quite enough to get them to a place with which I (and they) could feel comfortable. The probability of success is still calculated to be only 58%.

Then I made another suggestion: if we were to implement a different investment plan, and if we could adjust their retirement income strategy so that they’re reducing their taxes along the way, that could have a big impact on their plan in the long run.

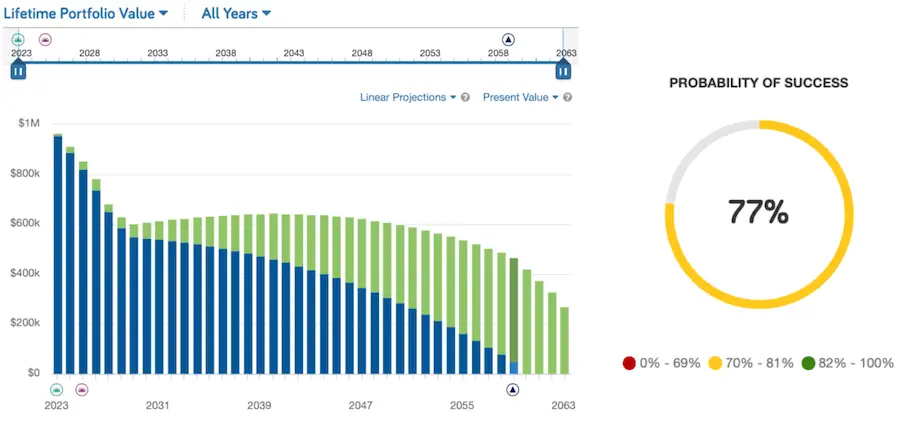

We showed them what implementing proper investment and retirement income systems look like combined with their incremental changes, and there was a significant difference, moving them from a 46% probability of success to 98%.

This family started this process by feeling concerned about their retirement and how it would all come together, to now feeling confident about their future and having conversations about what it might mean to possibly leave a legacy to the kids.

No single factor is what was allowing this couple to meet their needs and wants, but rather the culmination of variables that were engineered specifically for them and their objectives. The lesson here is that your choices are rarely binary, such as retire or don’t. Creating a retirement plan is neither black and white nor linear and often requires finesse to get to a place of ongoing confidence.

From Good to Great

If you’ve read any number of my columns before then you know that I unequivocally stand by the concept of “retiring to” and not “retiring from”. Your wealth is meant to be enjoyed, to do good, and to take care of those you love. We don’t call them the “golden years” for nothing.

If the only goal you accomplish in retirement is to “not run out of money”, then I’d argue you have some more planning to do. While that’s a critical piece, it’s not the only thing that makes a retirement plan successful.

At this point in my meeting with this family, I mentioned that I had heard them both say that traveling more in retirement was important to them.

And I asked: if you could go out and spend an extra $20,000/year on traveling and making memories together for the first five years of your retirement, what would that mean to you? Could we make that happen? Here’s what the projection showed:

There is obviously a big impact from the scenario before, but they were still fully on track to meet all their needs in retirement. This is the benefit of implementing the right retirement systems.

You may start with little confidence and inability to retire, not being certain how everything will come together, or having a low probability of success, to being able to meet all your needs and more with the right systems in place.

The Devil is in the Details

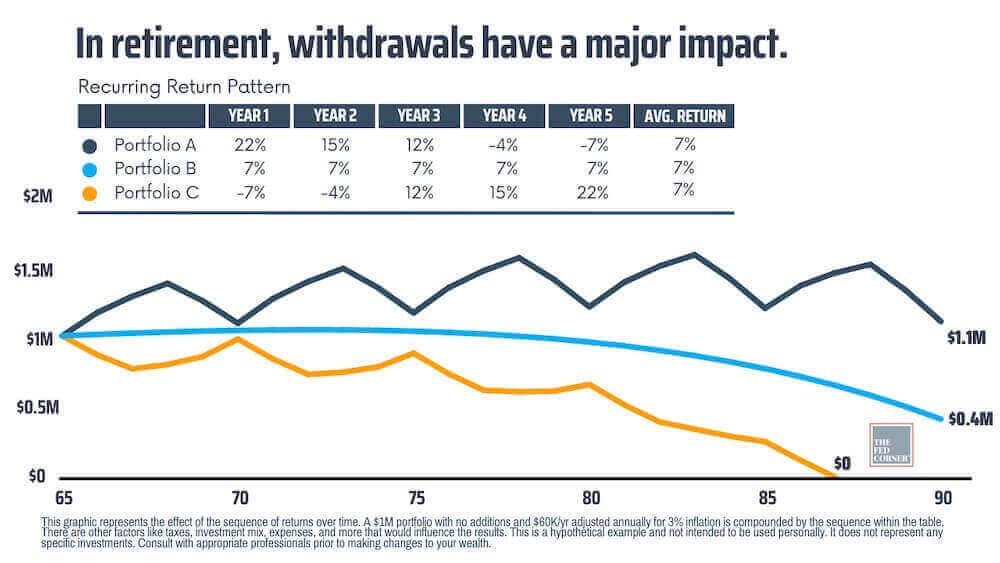

As exciting as all this can be, just doing this modeling is not quite enough. A retirement plan is worthless if implemented improperly. When we look at probabilities of success in quantitative and financial modeling, these are often assuming a single annualized return on your investments.

The reality is that the markets are not going to give you the same growth rate every single year. Some years will be up, other years will be down. A 77% probability of success as shown above may not be as high as someone is comfortable with, but this figure will be inherently different the very next day once your account values have changed again.

This is why retirement planning is a process, not an event. You have to make sure that your plan is always still on the right trajectory to continue meeting your goals. Variables in your life and the world around us will cause your retirement plan to require course-correcting along the way.

To illustrate, below is an example containing three portfolios that all have the same annualized return: seven percent. The only difference was the sequence of returns.

Only one retirement plan was sustainable. The other was in trouble, especially if faced with high health expenses, and one failed altogether.

Your investment returns are not the only thing that makes a retirement successful. Your investments are important of course, but they’re not important enough if you get all the other parts of a retirement plan wrong.

Your retirement income strategy and what you’re doing to keep your taxes lower are just two examples of the kinds of things that can help a retirement plan stay on the right track.

We’ve reviewed countless retirement plans and scenarios, and I can tell you that there is no single formula that works for everyone, but there are proven methods to address a retirement plan that can help you live your dream retirement.

Your own retirement plan will undoubtedly look different, so don’t take these changes to mean they belong in your own plan; you must always check with your appropriate professionals.

There are plenty of levers that we can pull to help make sure that you’re making meaningful progress from where you are today to where you want to be—whether that’s more traveling, spending time with your grandkids, or maybe even retiring sooner than you thought—because it’s not just your money, it’s your future.