The following information is meant to be an exhaustive explanation of the Federal Employees Retirement System (FERS) pension. The intention is to be a single resource when preparing for a federal retirement. The article is lengthy, so you may want to also review this short summary page on FERS.

Table of Contents

- Three Main Components of FERS

- FERS is Not Created Equally for Everyone

- Confirm Your Retirement Service Computation Date

- How to Retire

- Sick Leave Will Increase FERS Pension

- Calculating Your FERS Pension

- Special Provision Employees

- Alternative Retirement Options

- COLA

- What to Expect After Filing Application for Immediate Retirement

- What are the Best Dates to Retire?

FERS – Three Main Components

Congress created the Federal Employees Retirement System (FERS) in 1986, and it became effective on January 1, 1987.

The Federal Employees Retirement System (FERS) is a retirement plan for federal employees in the United States. It was established in 1987 to replace the older Civil Service Retirement System (CSRS).

FERS is a three-tiered system that includes the following components:

- Basic Benefit Plan (Pension): Similar to the traditional pension plan, federal employees under FERS receive a defined benefit based on their years of service, high-3 salary, and a multiplier formula. This portion provides a guaranteed monthly annuity upon retirement for life.

- Thrift Savings Plan (TSP): The TSP is a defined contribution plan that allows federal employees to contribute to a tax-advantaged retirement account. The Federal Government contributes an automatic 1% and up to 4% of your basic pay depending on contributions made. Employees can choose how to invest their TSP contributions among various investment funds.

- Social Security: FERS employees also participate in the Social Security system, with deductions made from their salary. Social Security benefits are provided based on the individual’s earnings and work history.

FERS aims to provide federal employees with a comprehensive retirement package that includes a guaranteed pension, personal savings through TSP, and Social Security benefits. The combination of these three components is designed to provide a secure income stream for retirees. We will focus on covering the FERS basic benefit plan, also known as the FERS pension.

FERS is Not Created Equally for Everyone

If you entered service after 2014 you are paying 450% MORE into the same system. New FERS employees are paying 4.4% for the same exact pension that at one time only cost 0.8%.

Employees are required to pay into FERS, Social Security and Medicare. The employer also contributes 6.2% for Social Security and 1.45% for Medicare separately.

In total, new FERS employees are having 12.05% deducted from their paychecks right off the top for legacy retirement systems.

FERS (Federal Employees’ Retirement System)

- Entered service between 1/1/1987 – 12/31/2012

- 0.8% to FERS

- 6.2% to Social Security

- 1.45% to Medicare

- Total = 8.45%

FERS-RAE (Revised Annuity Employees)

- Entered service between 1/1/2013 – 12/31/2012

- 3.1% to FERS

- 6.2% to Social Security

- 1.45% to Medicare

- Total = 10.75%

FERS-FRAE (Further Revised Annuity Employees)

- Entered service between 1/1/2014 – Current

- 4.4% to FERS

- 6.2% to Social Security

- 1.45% to Medicare

- Total = 12.05%

Confirm Your Retirement Service Computation Date (RSCD)

RSCD is NOT Leave Service Computation Date (LSCD)

The RSCD is used to calculate your federal years of service for the pension calculation. It is important to not confuse the RSCD with the LSCD date that is on your leave and earnings (LES) statement. Often, the LSCD and RSCD are the same, however, it is better to assume they are not.

Primary reasons for having a different RSCD and LSCD include:

- Breaks in service

- Military time

- Entered service with higher per-pay-period leave

At retirement, the Office of Personnel Management (OPM) will review all of your SF-50s to confirm the RSCD after you file retirement paperwork. You can verify your creditable service time by submitting an SF-3107 – go to page 9 of the form titled, “Certified Summary of Creditable Service.” You can submit it to HR to verify the RSCD. We recommend confirming the RSCD sooner than later to avoid any surprises come retirement.

How to Retire

Eligibility to Retire on Immediate Unreduced Pension

An immediate retirement benefit starts within 30 days from the date you stop working. If you meet one of the following sets of age and service requirements below, you are entitled to an immediate retirement benefit. If you retire at minimum retirement age (MRA) with at least 10 years of service, but less than 30 years of service, your benefit will be reduced by 5% a year for each year you are under 62, unless you have 20 years of service and your benefit starts when you reach age 60 or later.

| Age | Years of Service |

|---|---|

| 62 | 5 |

| 60 | 20 |

| MRA | 30 |

| MRA | 10 |

The early retirement benefit is available in certain involuntary separation cases and cases of voluntary separations (Voluntary Early Retirement Authority – VERA) during a major reorganization or reduction in force (RIF).

Minimum Retirement Age (MRA) is Dependent on Birth Year

| If you were born | Your MRA is |

|---|---|

| Before 1948 | 55 |

| In 1948 | 55 and 2 months |

| In 1949 | 55 and 4 months |

| In 1950 | 55 and 6 months |

| In 1951 | 55 and 8 months |

| In 1952 | 55 and 10 months |

| In 1953-1964 | 56 |

| In 1965 | 56 and 2 months |

| In 1966 | 56 and 4 months |

| In 1967 | 56 and 6 months |

| In 1968 | 56 and 8 mo |

| In 1969 | 56 and 10 mont |

| In 1970 and after | 57 |

High-3 Calculation

The high-3 salary is the average of the highest 36 months of consecutive income. For most people, the last 36 months are used for calculation purposes, but not always the case. Not all income is included in the high-3.

The table below shows what is included and excluded from the high-3 calculation.

| Pay Included in the High-3 | Pay Not Included |

|---|---|

| Regular Pay | Bonuses |

| Locality Pay | Cash Awards |

| Law Enforcement Availablity Pay (LEAP) | Regular Overtime |

| Administrative Uncontrollable Overtime (AUO) | Retention Pay |

| Premium Pay | Overseas COLA |

| Market Pay | Military Pay |

| Environment Pay (for wage grade only) | |

| Night Differential Pay (for wage grade only) |

Creditable Service Calculation

The calculation includes several components:

- Service time from work

- Unused sick leave

- Military time

- Made deposit to count towards civilian service

- Redeposit service

- Refunded pension contribution when leave

- Non-deductible Service (Temp/Intern)

- Federal service before 1/1/1989 but did not contribute to FERS (must buy back)

Special Note for Active & Reserve Military

Retired military receiving pensions can opt to buy their military time back which will increase the total federal civilian creditable service. Often, it makes sense to buy military time if you retired at a low salary (in the military) and have a much higher federal salary. Take the time to run the numbers on buying back military time vs not.

Other special notes:

- Retired reservists can make a military deposit and not lose the military pension

- Combat Time is eligible

- Military Academy is eligible

Do you lose the military pension immediately if you buy back military time?

A common misconception is that you will lose your military pension immediately. This is NOT true. The military pension will stop once you start receiving an immediate pension from FERS.

Sick Leave Will Increase FERS Pension for Life

All unused sick leave is converted into months & days of service using the 2087 Chart.

- The converted time is added to your total service time

- Days over 30 will count toward an additional month of service

- Leftover days are discarded

Sick leave only adds to service time and will not count toward eligibility (does not help you retire earlier).

In the example below, there are 6 months and 27 days of unused sick leave. An important note, the sick leave is added to the creditable service time to then round out at 30 days. Any days left over the 30 days is lost. In this example, 9 days of sick leave is forfeited and does not add to the pension.

| Years | Months | Days | |

|---|---|---|---|

| Creditable Service | 30 | 1 | 12 |

| Unused Sick Leave | 6 | 27 | |

| 30 | 7 | 39 | |

| Total Service Time | 30 | 8 | 9 |

Calculating creditable service with civilian time, military time, and unused sick leave.

| Years | Months | Days | |

|---|---|---|---|

| Creditable Service | 30 | 1 | 12 |

| Unused Sick Leave | 6 | 27 | |

| Military Service | 4 | 0 | 0 |

| 34 | 7 | 39 | |

| Total Service Time | 34 | 8 | 9 |

How to Convert Unused Sick Leave

The 2087 chart is used to convert unused sick leave. Determine the total unused sick leave number and locate it on the chart by rounding down. From there you can find the total months in the column and days by the row.

| Months | 0 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 |

| Days | ||||||||||||

| 0 | 0 | 174 | 348 | 522 | 696 | 870 | 1,044 | 1,217 | 1,391 | 1,565 | 1,739 | 1,913 |

| 1 | 6 | 180 | 354 | 528 | 702 | 875 | 1,049 | 1,223 | 1,397 | 1,571 | 1,745 | 1,919 |

| 2 | 12 | 186 | 360 | 533 | 707 | 881 | 1,055 | 1,229 | 1,403 | 1,577 | 1,751 | 1,925 |

| 3 | 17 | 191 | 365 | 539 | 713 | 887 | 1,061 | 1,235 | 1,409 | 1,583 | 1,757 | 1,931 |

| 4 | 23 | 197 | 371 | 545 | 719 | 893 | 1,067 | 1,241 | 1,415 | 1,589 | 1,762 | 1,936 |

| 5 | 29 | 203 | 377 | 551 | 725 | 899 | 1,073 | 1,246 | 1,420 | 1,594 | 1,768 | 1,942 |

| 6 | 35 | 209 | 383 | 557 | 731 | 904 | 1,078 | 1,252 | 1,426 | 1,600 | 1,774 | 1,948 |

| 7 | 41 | 215 | 388 | 562 | 736 | 910 | 1,084 | 1,258 | 1,432 | 1,606 | 1,780 | 1,954 |

| 8 | 46 | 220 | 394 | 568 | 742 | 916 | 1,090 | 1,264 | 1,438 | 1,612 | 1,786 | 1,960 |

| 9 | 52 | 226 | 400 | 574 | 748 | 922 | 1,096 | 1,270 | 1,444 | 1,618 | 1,791 | 1,965 |

| 10 | 58 | 232 | 406 | 580 | 754 | 928 | 1,102 | 1,275 | 1,449 | 1,623 | 1,797 | 1,971 |

| 11 | 64 | 238 | 412 | 586 | 760 | 933 | 1,107 | 1,281 | 1,455 | 1,629 | 1,803 | 1,977 |

| 12 | 70 | 244 | 417 | 591 | 765 | 939 | 1,113 | 1,287 | 1,461 | 1,635 | 1,809 | 1,983 |

| 13 | 75 | 249 | 423 | 597 | 771 | 945 | 1,119 | 1,293 | 1,467 | 1,641 | 1,815 | 1,989 |

| 14 | 81 | 255 | 429 | 603 | 777 | 951 | 1,125 | 1,299 | 1,473 | 1,646 | 1,820 | 1,994 |

| 15 | 87 | 261 | 435 | 609 | 783 | 957 | 1,131 | 1,304 | 1,478 | 1,652 | 1,826 | 2,000 |

| 16 | 93 | 267 | 441 | 615 | 789 | 962 | 1,136 | 1,310 | 1,484 | 1,658 | 1,832 | 2,006 |

| 17 | 99 | 273 | 446 | 620 | 794 | 968 | 1,142 | 1,316 | 1,490 | 1,664 | 1,838 | 2,012 |

| 18 | 104 | 278 | 452 | 626 | 800 | 974 | 1,148 | 1,322 | 1,496 | 1,670 | 1,844 | 2,018 |

| 19 | 110 | 284 | 458 | 632 | 806 | 980 | 1,154 | 1,328 | 1,502 | 1,675 | 1,849 | 2,023 |

| 20 | 116 | 290 | 464 | 638 | 812 | 986 | 1,160 | 1,333 | 1,507 | 1,681 | 1,855 | 2,029 |

| 21 | 122 | 296 | 470 | 644 | 817 | 991 | 1,165 | 1,339 | 1,513 | 1,687 | 1,861 | 2,035 |

| 22 | 128 | 302 | 475 | 649 | 823 | 997 | 1,171 | 1,345 | 1,519 | 1,693 | 1,867 | 2,041 |

| 23 | 133 | 307 | 481 | 655 | 829 | 1,003 | 1,177 | 1,351 | 1,525 | 1,699 | 1,873 | 2,047 |

| 24 | 139 | 313 | 487 | 661 | 835 | 1,009 | 1,183 | 1,357 | 1,531 | 1,704 | 1,878 | 2,052 |

| 25 | 146 | 319 | 493 | 667 | 841 | 1,015 | 1,189 | 1,362 | 1,536 | 1,710 | 1,884 | 2,058 |

| 26 | 151 | 325 | 499 | 673 | 846 | 1,020 | 1,194 | 1,368 | 1,542 | 1,716 | 1,890 | 2,064 |

| 27 | 157 | 331 | 504 | 678 | 852 | 1,026 | 1,200 | 1,374 | 1,548 | 1,722 | 1,896 | 2,070 |

| 28 | 162 | 336 | 510 | 684 | 858 | 1,032 | 1,206 | 1,380 | 1,554 | 1,728 | 1,902 | 2,075 |

| 29 | 168 | 342 | 516 | 690 | 864 | 1,038 | 1,212 | 1,386 | 1,560 | 1,733 | 1,907 | 2,081 |

Calculating Your FERS Pension Amount

The FERS pension calculation formula is: Hi-3 Salary x Creditable Years of Service x Multiplier = Gross Annual Pension

Basic Calculation

You will use the basic calculation if you fall under one of the following:

- Retiring under age 62 with any number of years of service OR

- Retiring after age 62 with less than 20 years of service

Hi-3 Salary x Creditable Years of Service x 1% = Gross Annual Pension

Bonus Calculation

You will use the basic calculation if you are age 62 or older with at least 20 years of service.

Hi-3 Salary x Creditable Years of Service x 1.1% = Gross Annual Pension

Basic (1%) vs. Bonus Calculation (1.1%) – The 10% Bonus

The decision to retire before age 60 or after 62 can be a game changer for your retirement. In the below example, you can see the increase just by retiring after 62 with the same high-3 and years of service.

Age 60: $120,000 Hi-3 Salary x 20 Years of Service x 1% = $24,000 annual pension/$2,000 monthly

Age 62: $120,000 Hi-3 Salary x 20 Years of Service x 1.1% = $26,400 annual pension/$2,200 monthly

Special Provision Employees

Special Provision Employees have separate rules for their retirement which include a different MRA, years of service, and multiplier.

Special Provision Employees include:

- Law Enforcement Officer (LEO)

- Fire Fighter

- Air Traffic Controller

Eligibility to Retire on Immediate Undreduced Pension

Must have 20 years of service in Special Provision Service. The Mandatory Retirement Age (MRA) is age 57 for LEOs & Fire Firefighters and age 56 for Air Traffic Controllers.

- Age 50 + 20 Years of Service

- Any Age + 25 Years of Service

Calculating Special Provision Employee Pension

- Hi-3 Salary x First 20 Years of Creditable Service x 1.7% = Gross Annual Pension

- Hi-3 Salary x Over 20 Years of Creditable Service x 1.0% = Gross Annual Pension

Example: Age 55 LEO, High 3 $120,000, 23 years of service

- First 20 years: $120,000 Hi-3 Salary x 20 Years of Creditable Service x 1.7% = $40,800 annual

- Years over 20: $120,000 Hi-3 Salary x 3 Years of Creditable Service x 1% = $3,600 annual

- Total pension: $40,800 + $3,600 = $44,400 annual/$3,700 monthly

Alternative Retirement Options

There are ways to retire without meeting previous requirements.

- MRA + 10

- Deferred / Postpone Retirement

- Early Out (VERA) – Relaxed Eligibility

- Disability

MRA + 10

If you retire at MRA with at least 10 years of service, but less than 30 years of service, your benefit will be reduced by 5% a year for each year you are under 62, unless you have 20 years of service and your benefit starts when you reach age 60 or later.

You can retire after you turn MRA with at least 10 years of service, but you will pay a penalty.

- Pension will be reduced by 5% for each year you receive an immediate pension before your eligibility age

- If you have less than 20 years of service, the pension will be reduced by 5% for each year you are younger than 62

- If you have more than 20 years of service, the pension will be reduced by 5% for each year you are younger than 60

- Eligible to keep FEHB & FEGLI in retirement

Example: Employee with 15 Years of service decided to retire at MRA (Age 57) with an average high 3 of $100,000. Full pension would be:

$100,000 Hi-3 Salary x 15 Years of Service x 1% = $15,000 annual/$1,250 monthly

The pension after reduction:

$15,000 Full Pension – (5% x 5 years until 62) = $11,250 annual/$937.50 monthly

Deferred & Postponed Retirement

If you leave federal service before you meet the age and service requirements for an immediate retirement benefit, you may be eligible for deferred retirement benefits. To be eligible, you must have completed at least 5 years of creditable civilian service. You may receive benefits when you reach one of the following ages:

- 62 and 5 years

- 60 and 20 years

- MRA and 30 years

A deferred and postponed retirement will avoid the 5% penalty reduction to your annual pension. Essentially, you would be delaying your pension to a later date in lieu of an immediate pension. Be careful! Deferred vs. postponed are very different in the benefits you get to retain into retirement.

To simplify the difference, a deferred retirement is if you leave service BEFORE MRA and a postponed retirement is if you leave AFTER MRA.

Losing Certain Benefits in Retirement

A deferred retirement is not eligible for a Special Retirement Supplement (SRS), FEHB, and FEGLI. Losing FEHB in retirement is a huge loss. The Federal Government continues to pay ~72 – 75% of the FEHB premium even in retirement.

A postponed retirement allows you to keep FEHB and FEGLI once your pension begins. In the interim, there will be no FEHB or FEGLI coverage. In addition, there is no SRS.

| Benefits | Deferred | Postponed |

|---|---|---|

| Eligible for Pension | Yes | Yes |

| FERS Supplement | No | No |

| FEHB* | No | Yes |

| FEGLI* | No | Yes |

“Early Out” – Voluntary Early Retirement Authority (VERA)

Often, a VERA can be confused with a Voluntary Separation Incentive Payment (VSIP) which is very different. A VERA allows you to retire on a full, immediate pension right away whereas a VSIP is only a one-time payment.

Voluntary Early Retirement Authority (VERA)

- No 5% per year penalty

- Eligible for FERS Supplement after MRA

- Eligible for FEHB and FEGLI

Voluntary Separation Incentive Payments (VSIP)

- One-time payment of less than $25,000

- Repay if hired back within 5 years

- 100% Taxable

Disability Retirement

The Federal Government offers a very generous disability retirement. If disabled, employees will receive a portion of their salary until they reach age 62. At age 62, you will receive a full pension for life. The years you are disabled will count as eligible creditable years of service when calculating your pension computation.

FERS Disability Requirements

- The agency certifies that it’s unable to accommodate the condition

- Requires applying for Social Security Disability (approval is not)

Amount of Disability Check

- First 12 months

- 60% of high 3 – (100% offset Social Security Disability)

- After 12 months

- 40% of high 3 – (60% offset Social Security Disability)

- After Age 62

- Normal FERS calculation but Disability counts toward service

FERS Pension Receives an Automatic Cost-of-Living Adjustment (COLA)

The FERS pension increases every January due to the COLA. The COLA does not begin until you reach age 62 unless you are a Special Provision Employee in which you receive a COLA immediately at retirement. The COLA is adjusted on how the Consumer Price Index (CPI) performs in the prior year.

FERS annuitants do not receive a full COLA with CPI. Below is the formula to calculate the FERS COLA.

| If the CPI is: | Then the COLA is: |

|---|---|

| <= 2% | COLA = CPI increase |

| > 2% and <= 3% | COLA = 2% |

| > 3% | COLA = CPI – 1% |

What to Expect After Filing Application for Immediate Retirement

Plan to file retirement early! There are several factors and decisions to be made that could delay your retirement paperwork such as incorrect RSCD and not being prepared to make elections for survivor benefits, FEGLI, and tax withholdings. Some agency’s HR offices may only process paperwork 1 or 2 months ahead of time.

Expect to receive interim payments until OPM has processed your paperwork. The interim pay is a portion of your estimated annuity payment (approximately 60–80% of your finalized net payment for most people). If not trying to maximize the annual leave payout it may be best to pick a date other than December. OPM has consistently seen an uptick in retirement applications in the month of December. As a result, retired annuitants receive their finalized payment amount much later.

What Are the Best Dates to Retire?

We have heard all sorts of theories on the best dates to retire and believe there really isn’t a perfect month. Unless you want to maximize your annual leave payout, then the end of December would be the best month.

The best day to retire would be the last day of the month. The reason you want to choose the last day of the month is that it prevents a gap in income. If you were to choose the middle of the month, then you would be forgoing 1/2 of a month’s pension check.

Retiring 12/31 – Maximum Annual Leave Payout

Retiring on 12/31 allows you to carry over 240 hours from the previous year plus an additional 208 accrued from the current year for a total of 448 annual leave hours. As a bonus, the annual leave payout will be taxed in the following year when total income may be lower resulting in overall lower taxes paid.

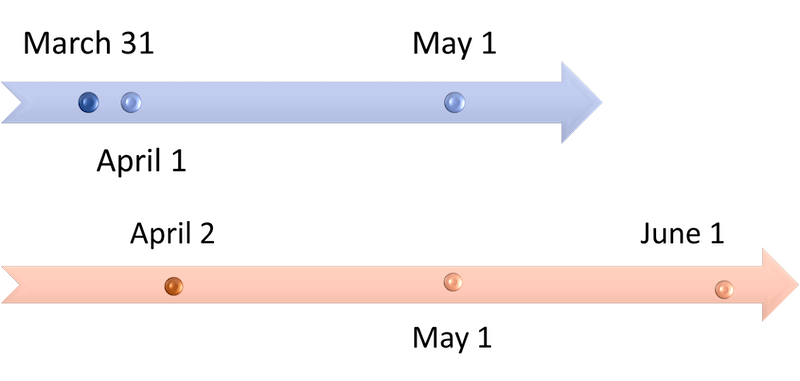

In the example above, you have the choice to retire on March 31st or April 2nd. If you retire on March 31st, the interim annuity check will come the following month in April with no gap in income. If you retire on April 2nd, the interim annuity check will not start until the following month of May. You will have lost a whole month’s income payment.

The content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation. The opinions expressed and material provided are for general information and should not be considered a solicitation for the purchase or sale of any security. Securities and advisory services offered through Osaic Wealth, Inc., member FINRA, SIPC. Osaic Wealth is separately owned and other entities and/or marketing names, products or services referenced here are independent of Osaic Wealth. Representatives may not be registered to provide securities and advisory services in all states. Branch address: 10701 Parkridge Blvd, Ste 130, Reston, VA 20191. Branch phone: 571-543-2783.