If you want to stay out of jail then you have to pay your taxes, but there is no reason to leave a tip, and making mistakes with TSP withdrawals is a great way to leave the government a tip.

So before you take a TSP withdrawal, you are going to want to read this article.

Tax Considerations While Tied to The Desk

Tax planning in retirement is important, but if you are still working, then here are the 3 main things that could affect your taxes now.

If you are already retired, jump to the retired section below.

1. Traditional Vs. Roth TSP

You can decide while you are working to contribute money to either the Roth TSP or the Traditional TSP.

The main difference between the two is when you pay taxes. If you do traditional, then you lower your taxes now but pay the taxes in retirement. With the Roth TSP, you don’t get a tax deduction now but never have to pay taxes on it later.

Some people use a farming example to explain it. The Roth TSP is like giving a portion of your planting seed to the government but you are able to keep 100% of what the remaining seed produces. The Traditional TSP is like using all your seeds to grow crops but then giving the government a cut of what you produce at the end.

Let’s put some numbers in this example. Let’s say you have 100 seeds to plant and you decide to give 10 seeds to Uncle Sam upfront which leaves you with 90 to plant. You plant the 90 and it doubles to produce a total of 180. Since you already paid taxes you can keep the entire 180.

Now let’s say you used the Traditional TSP instead. You were able to plant the entire 100 and it doubles to 200. You pay your 10% tax and you are left with 180.

The Roth option is often the best one for federal employees during their careers, but it ultimately depends on your situation as there are other important factors to consider.

2. HSA/FSA

These accounts can have triple tax savings while paying for things you would pay for anyway.

Health Savings Account (HSA)

While your money is in a health savings account (HSA), you are able to invest it as you do with other accounts like an IRA. This means that no matter how much it grows, as long as you use it for qualified expenses, all of it, including the growth, comes out tax-free.

Because of this, some people choose to pay medical expenses with other funds (not with their HSA) during their working career so that they give their HSA more time to grow. This way they have a tax-free bucket of money to pay for medical expenses in retirement.

The one downside to this strategy is that you would need to have cash to pay for medical expenses now. Because of this, this strategy works best for those with extra cash flow and general financial stability.

An HSA is not right for everyone, but it can be a very useful tool if used correctly, especially if you plan on letting your HSA grow until retirement because the tax benefits really start to compound. You will have to take an honest look at your situation to see if it makes sense for you.

Flexible Spending Account (FSA)

A flexible spending account (FSA) is a type of savings account that provides certain tax advantages. The account allows you to contribute a portion of your regular earnings before tax. Distributions from the account are used to reimburse you for qualified expenses such as medical, dental, or vision care not covered by your other insurance plans.

One of the key benefits of an FSA is that the money you contribute to it is deducted from your earnings before taxes, thereby lowering your taxable income. As a result, regular contributions to an FSA can reduce your annual tax liability.

You do need to budget your planned expenses carefully when using an FSA because if there is any unused money left in the account at the end of the year, not all of it can be rolled over to the following year (unlike an HSA). In 2024, the annual contribution limit to an FSA is $3,200 with a maximum rollover to the following year of $640. A rollover is only an option if you stay enrolled in an FSA into the following year.

This program for federal employees is called the Federal Flexible Spending Account Program (FSAFEDS). You can enroll in an FSA during the annual open season.

There are different options within FSAFEDS. The Health Care FSA (HCFSA) is a pre-tax account used to pay for eligible medical, dental, and vision care expenses that are not covered by your health care plan. The Limited Expense Health Care FSA (LEX HCFSA) works in conjunction with an HSA to help maximize tax savings. The Dependent Care FSA (DCFSA) is a pre-tax account you can use to pay for eligible dependent care services, i.e. preschool, summer day camp, before or after school programs, and child or adult daycare.

3. Charity/Mortgage Interest

People often think they get more tax benefits from these things than they actually do.

To get any tax benefit from giving to charity or your mortgage interest, you would have to have enough deductions to itemize your deductions. In other words, you’d have to have more itemizable deductions than the standard deduction which is not the case for most people.

Tax Considerations While Retired

These are the big things that affect your taxes while you are retired.

TSP Withdrawals

Whenever you take money out of the traditional TSP then you must pay taxes on it.

For example, if you take $20,000 out then $4,000 will often be automatically withheld and sent to the IRS.

Watch Out!!

While working it is difficult to do any one thing that causes a huge tax problem. However, people cause major tax problems in retirement all the time.

This is simply because huge spikes in income are rare while you are working but while retired huge spikes in income can be created when you make a large TSP withdrawal.

The reason this is such a problem is that many people pay tens of thousands in extra/unnecessary taxes to the government because of these spikes.

Here is an example to show my point:

Let’s say you need a large amount of money from your TSP for a large retirement purchase. This could be paying off the mortgage, buying a boat, etc.

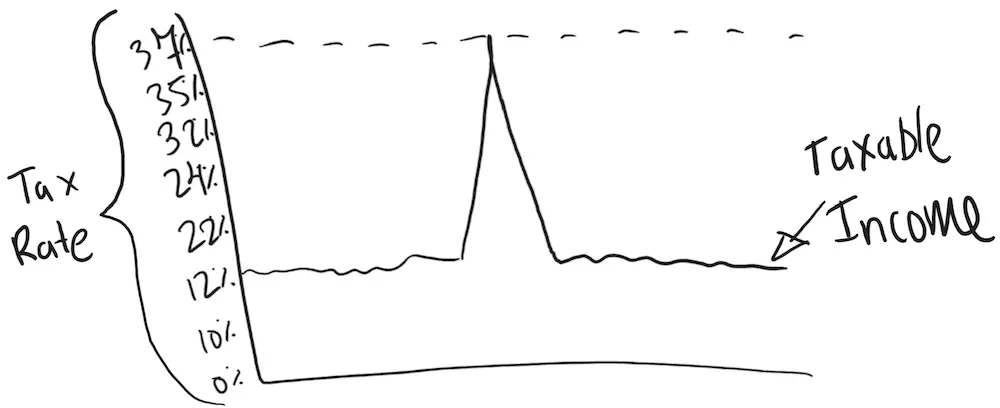

A spike in income may look like this (See picture above).

This person may normally be in the 12% tax bracket but would be shoved into a much higher tax bracket because of the big withdrawal. This means that they’ll have to pay much more than 12% of that big withdrawal to the government.

Even if someone wanted to withdraw the same amount of money it would be much better to spread that withdrawal out over years.

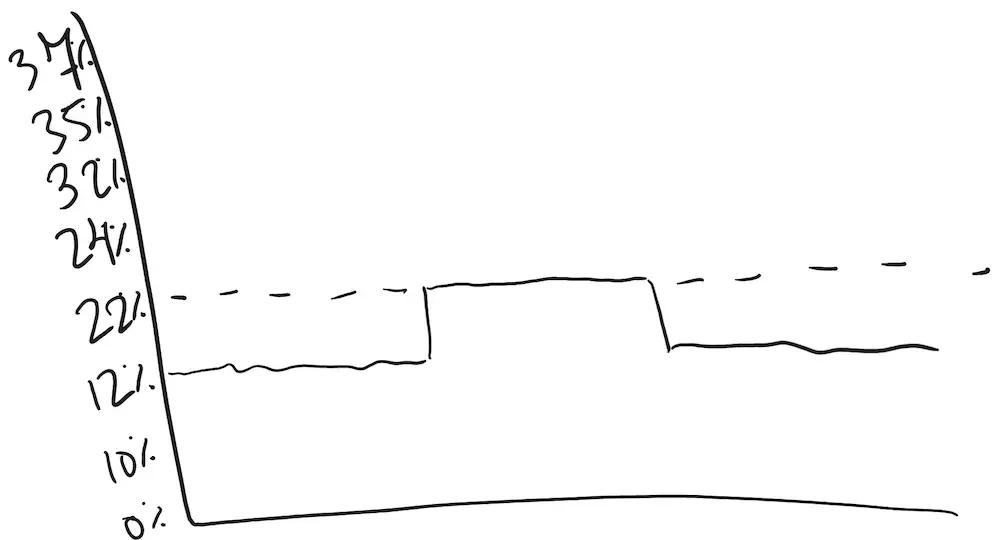

It could look something like this:

In this example (above), their tax bracket does go up but not nearly as much as the withdrawal is spread out over time.

Know your Tax Bracket!

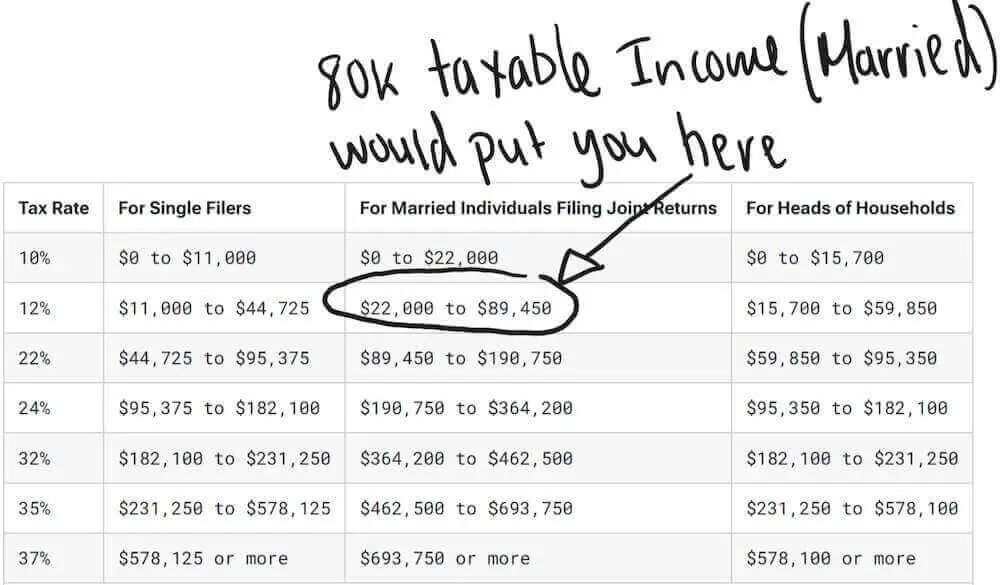

So before you take a withdrawal from your TSP you are going to want to have an idea of what tax bracket you’re in. That way you’ll know what a TSP withdrawal will do to your tax bracket and how much you can withdraw before going into a higher bracket. This becomes even more important as the size of the withdrawal goes up.

For example, if you are married and have $80k in taxable income (in 2023) then you’d be in the 12% tax bracket (See picture below).

But once your taxable income goes over $89,450 then you’d be in the 22% tax bracket! That is a 10% jump in taxes!!

Income Means Taxes

But we have to remember that taxes are not all bad. If you are paying taxes then that means that you have income and we all like income.

The most important thing is to understand at least the basics of how taxes work so you don’t give more money than you have to to the government.