With the markets reaching all-time highs this year, there’s no question as to whether we’re in a bull market.

I thought it would be important to share some characteristics about bull markets as you think about your own portfolio and investment strategy for the rest of this year.

1 – What counts as a bull market?

A bull market is a period of upward-trending market prices after having risen at least 20% off the most recent bottom. Notably, you’ll recognize that the only way to know we’re in a bull market is after it’s already happened, but more on that later.

In general, optimism is high, and investors feel confident which pushes company earnings and stock prices higher. This momentum often fuels the bull market to newer highs until it recognizes that a correction is needed.

2 – Markets versus Economy

Although they’re related and are often correlated, you must recognize that the markets and the economy are two separate things. I often refer to the markets as the economy’s temperamental younger sibling.

What’s important to know is that the markets are forward-looking, which means they reflect prices according to future expectations. On the other hand, economic data is generally considered a lagging indicator. This means the data looks backward to what’s already happened.

This is often why markets react to economic news, particularly if anticipatory market prices were wrong about overall data and trends, like if growth wasn’t as good as they expected. This typically results in volatility.

3 – Bulls and Bears are Normal

Both bull markets and bear markets are completely normal and common. In fact, the S&P 500 Index has experienced 27 of each since 1928. Here are some data points:

- There have been 27 bull markets since 1928

- Average length: 992 days or 2.7 years

- Average gain: 114.9%

- Longest bull: 1987–2000 (582% gain); second longest; 2009–2020 (400% gain)

- The first half of a bull has outperformed the second half 74% of the time (20 out of 27 bulls) by an average of 9%

- The average gain during the first month of a new bull market: 13.6%

- During the first 3 months: 25.3%

- During the first 6 months: 27.4%

(Source: Ned Davis Research, 3/24)

The length of time for each isn’t always the same, but on average bull markets do last longer than bear markets, but bear markets are still one of the biggest risks to a retiree and can easily destroy a retirement plan.

That’s why it’s important to have your investment portfolio set up in a way that is fitting for your goals in both kinds of markets. In retirement, you don’t have the time that you did mid-career to simply allow the markets to recover without touching your wealth.

You can’t control the markets, so if you’re only invested in a way that relates to bull markets, how will you be able to continue with your plans if you weren’t prepared for a bear?

4 – Time, not timing, is most important

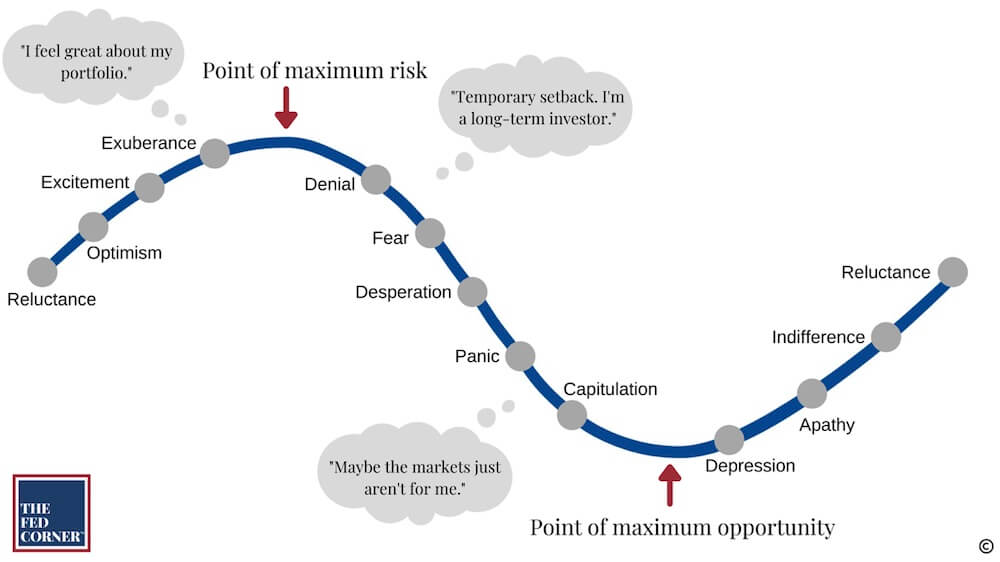

How can we know that we’re in a bull market? It’s only after markets have moved +20% off their lows that it becomes official. It could take weeks or months, and if we were to wait until the markets have risen high enough to feel comfortable enough with investing in it, then we’ve missed a large part of the growth already. The graphic below showcases investor emotions during the ups and downs of the markets.

5 – Bulls are strongest out of the gates

Since the 1920s, the first half of a bull market has outperformed the second half almost 75% of the time. This means that if you were waiting for a stronger sign in the markets, you might have missed out on the majority of the growth for that bull market. In fact, if you miss only 10 of the best days in the markets in a year, you’ll have missed out on most of the growth available in that year.

6 – It’s easy to miss the boat

According to Morningstar, the first month of a new bull market gained an average of 13.6% historically. How about in the first three months? New bull markets have typically risen 25.3% on average in that time. This gives you a sense of how traumatic it can be to a portfolio if you miss out on these huge returns after sustaining losses from years prior.

7 – Bulls come in all shapes and sizes

One of the most challenging parts of bull markets may be the fact that they can look completely different from one another. In fact, the longest bull lasted more than 12 years from the late 80s to 2000, while the shortest lasted only 25 days in the 30s.

8 – Bulls are getting stronger

Overall, the S&P 500 Index has tended to gain an average of 114% during bull markets. But ever since the 1970s, they have gotten stronger and longer. Does this mean we can expect to see this going forward? You’ve seen the line: past performance is not a guarantee of future results.

That said, there’s certainly evidence that the markets are much more mature today, and information is much more readily available which drives investor and consumer sentiment.

9 – Greed and fear are what drive markets

It’s incredibly exciting to see your portfolios skyrocket like they have recently, but if you have not been fully invested, you might feel like you’ve been missing out on the growth. We call this investor-FOMO.

Refer to the emotions graphic above. People often only have that feeling after missing out on a lot of growth, which may be the point where it has become riskier to get back into the markets.

On the other hand, staying fearful might mean that you miss out on another huge growth part of the market. The best thing you can do to your investment portfolio is to remove the emotions out of it. Much easier said than done. This is where having a financial plan is incredibly helpful. If you can develop your strategy ahead of time, you can know how you should be invested regardless of what’s happening in the markets.

10 – How can you make the most out of bull?

By being invested. The only way you can participate in the growth is by having your investments in those asset classes. I suggest that you don’t “wing” your allocation strategy if you’re sub-five-ish years until retirement. Time is no longer on your side, which means you quite literally can’t afford to get it wrong.

The markets are a tool to help you achieve your goals. If you misuse a tool, then there is potential for harm, just like with many other tools. Make this the year you focus on your planning, because it’s not just your money, it’s your future.