When planning your retirement, it’s no longer just about growing your investments. What’s allowed you to be successful until now is not going to get you through the next 20 or 30 years.

You need to think about how you’ll remain financially independent. How are you going to generate your retirement income so that it continues for your lifetime(s)? How will you make sure your taxes are minimized along the way so you can keep the most of what you earn? What allocation strategy is going to help support these objectives and help you get the most out of your retirement instead of simply just meeting your needs?

These are questions we help our clients with every day, and a tool that helps them achieve their success is the use of Roth and tax-aware withdrawals. This column will cover a few reasons why you might want to consider these strategies in your retirement plan.

The Roth is a powerful tool if used correctly. If you still have doubts, I think you may change your mind when you see a real example from one of our clients.

But just because something works for one family doesn’t mean it will be the best thing for you. To close this piece, you’ll also learn when it may be good to avoid using the Roth TSP in your plan.

Market Volatility is Your Friend

If the market drops and your plan allows you to remain invested, then you may recover the losses over time if invested properly. Let’s say this happens in your Traditional (pre-tax) retirement account.

Recovering markets does mean that you could be back to even again but consider if you had converted some of your account to Roth, and now this split amount grows back to its original value with two different tax statuses.

For example, if your $1M TSP reduced to $750K but then recovered back to $1M over the next few years—you’d be happy that you recovered your losses. However, if you had converted $250K of your reduced $750K account to Roth and allowed your accounts to regrow back to $1M, your $1M balance might be comprised of $400K in Roth with only $600K in Traditional.

This is a much more valuable position to be in than before, effectively saving you $100,000 in estimated taxes if in the 25% effective rate. Not to mention the additional future tax-free growth that you get, all with this one single tactic. This is oversimplified to give you an idea of how the strategy works.

Riding the markets back up with future growth inside the Roth effectively moves your tax-deferred assets into the tax-free category at greatly reduced tax costs to you. This is one you need to be ready to effectuate if market volatility comes around, which is why you must have your financial plan in order ahead of time.

Tax Rates and Brackets Are Historically Low

If you’ve seen any of my content over the last few years, then you’ve seen me proclaim the importance of tax planning. The current Tax Cuts and Jobs Act (“TCJA”) has a built-in sunset provision, which means the law expires and reverts to the old rules. This is set to occur in 2026. Here’s what you can expect:

| TCJA Rates | Previous Rates | % Change |

| 12% | 15% | +3% |

| 22% | 25% | +3% |

| 24% | 28% | +4% |

| 32% | 33% | +1% |

| 37% | 39.6% | +2.6% |

We’re looking at a 3-4% increase in taxes for most rates, but the key here is not only are the rates changing, but the brackets are too. What does this mean? Larger portions of your income will be taxed at the new 15%, 25%, 28%, etc. rates.

So while it might seem like only a few points of extra tax, consider that it’s for more than one bracket (remember how taxes work) and bigger swaths of your income are taxed at these new rates which translates to a much higher overall percentage in tax increase. This is a great reminder to focus on the other elements of financial planning beyond just what you’re invested in.

Avoiding the Child’s Penalty

If you’re not familiar with what I’m talking about, this has to do with the SECURE Act. Recent law changes require beneficiaries to distribute inherited IRAs within 10 years. Why is this a problem for you?

Think about the age at which people typically inherit assets. It is usually when they are in their late 50s or early 60s. This also coincides with when people are typically in their highest earning years.

What do you think happens to their marginal tax rate (tax rate paid on the highest dollar earned) if they inherit a $500K or $1M TSP or other pre-tax retirement and they have to take out 1/10th of the account every year? Large distributions could push them into the highest tax brackets, meaning that huge parts of their legacy will be lost to taxes.

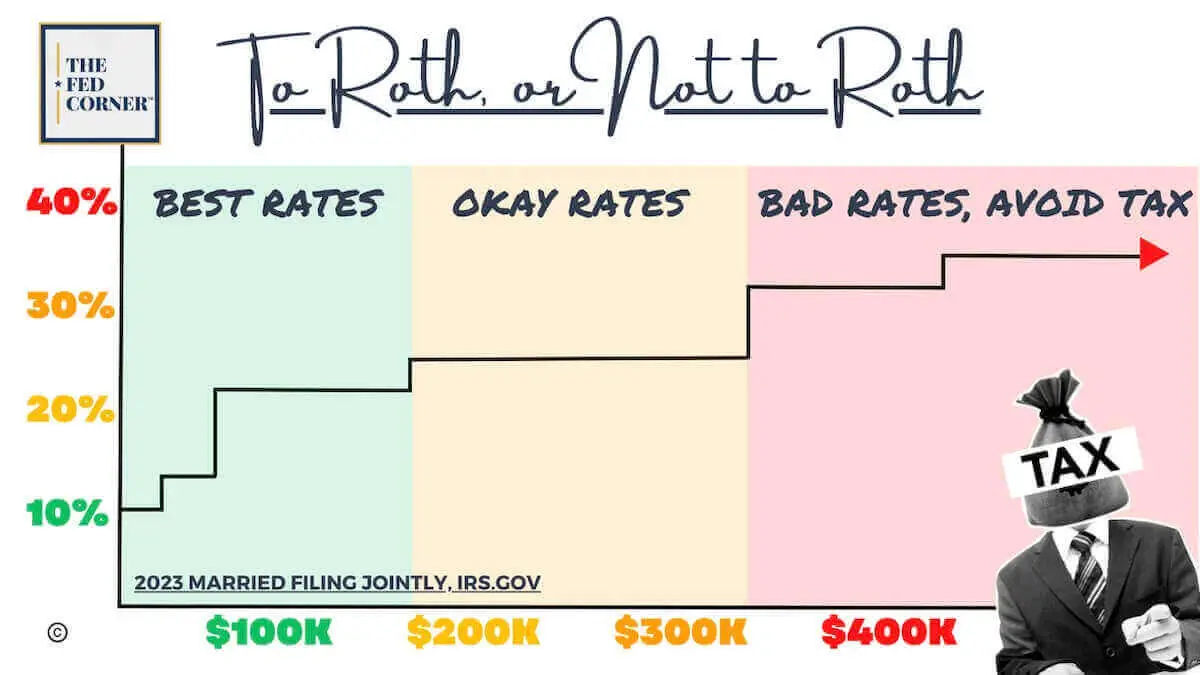

Many of our clients are projected to leave seven figures to their heirs (remember, consider the impact of inflation on account values), and $100K+ annual withdrawals will put their kids in the highest tax brackets for a full decade. Think about how much of the family legacy vaporizes to taxes. Use the graphic below to visualize the brackets and help you plan ahead.

Other Benefits

Here are a few other benefits that may be present for those utilizing these strategies:

- Roth accounts have no RMDs until a non-spouse inherits them. This helps both you and your heirs pay less taxes over time.

- Roth distributions don’t negatively affect your Modified Adjusted Gross Income (MAGI). This is an important tax planning item because it impacts other elements of your plan, like net investment income tax, Medicare, capital gains, and others.

- Increase familial wealth tremendously by paying taxes on conversions from non-retirement accounts, like brokerage or savings. That means a full converted amount can grow tax-free.

- Roth accounts are the best kind of legacy you can leave behind, even better than life insurance premiums in my opinion. Life insurance proceeds are generally tax-free but once invested are subject to taxation. Inherited Roth accounts, while they do have RMDs, get to grow tax-free during that time, then reinvest in non-Roth status.

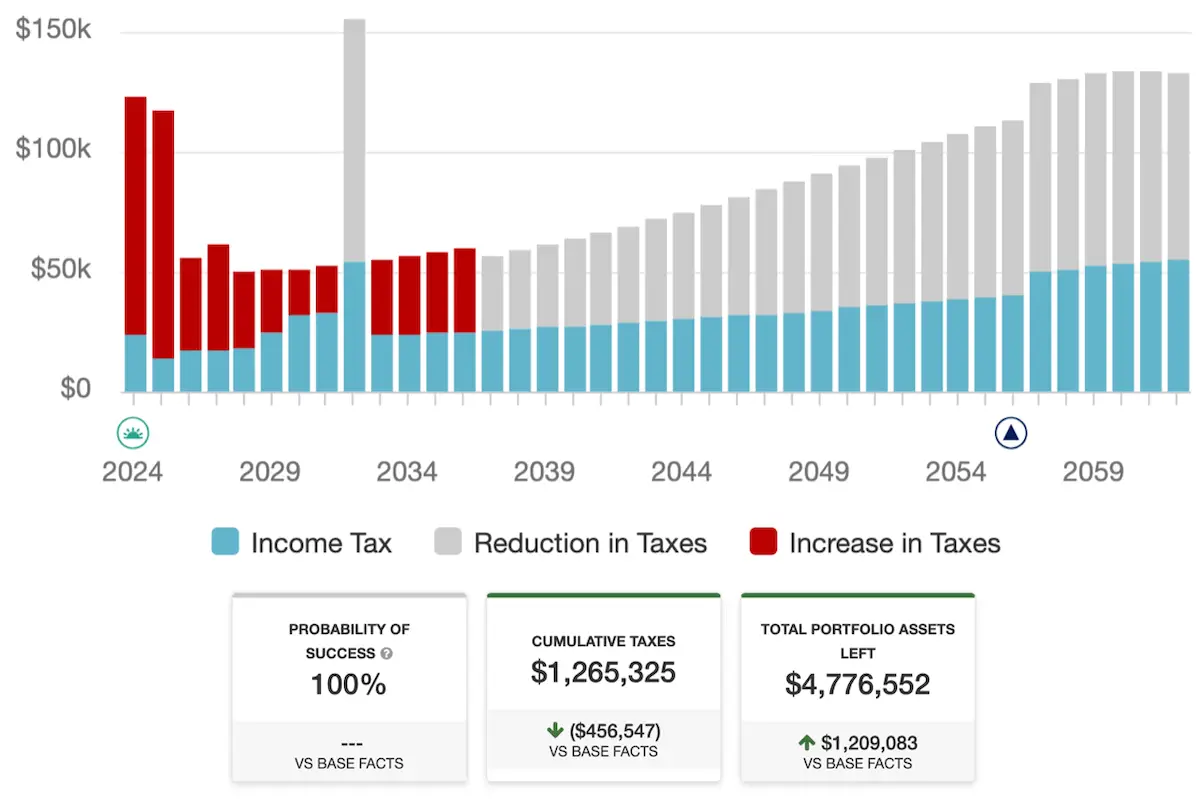

Need more convincing? Here’s a screenshot of one of our clients who was projected to reduce their taxes by $400K, while also increasing their liquid assets by $1M throughout retirement. Please don’t neglect this kind of planning.

Yes, it did mean paying more in taxes over the next couple of years, but only a small increase in future years based on accelerated distributions this family planned on doing anyway.

As much as our clients can benefit from these strategies, there are also times when you want to avoid the Roth as it may be detrimental to your financial well-being. Read more on when you should stay away from the Roth here.