Roth IRA, Roth TSP, and Roth 401(k) accounts offer unique advantages for retirement savings, primarily their tax-free growth and withdrawals in retirement. However, to reap these benefits fully, it’s crucial to understand the 5-year rules that govern withdrawals from these accounts.

This article aims to shed light on the often-misunderstood 5-year rules for both Roth IRA and Roth 401(k) accounts, empowering you to make informed decisions about your retirement savings.

The Significance of the 5-Year Rules

The 5-year rules are designed to prevent individuals from using Roth accounts as short-term tax shelters. They stipulate a waiting period before you can withdraw earnings from your contributions or conversions without incurring taxes and penalties. While the concept might seem straightforward, nuances and intricacies are depending on whether you’re dealing with contributions, conversions, or 401(k) accounts.

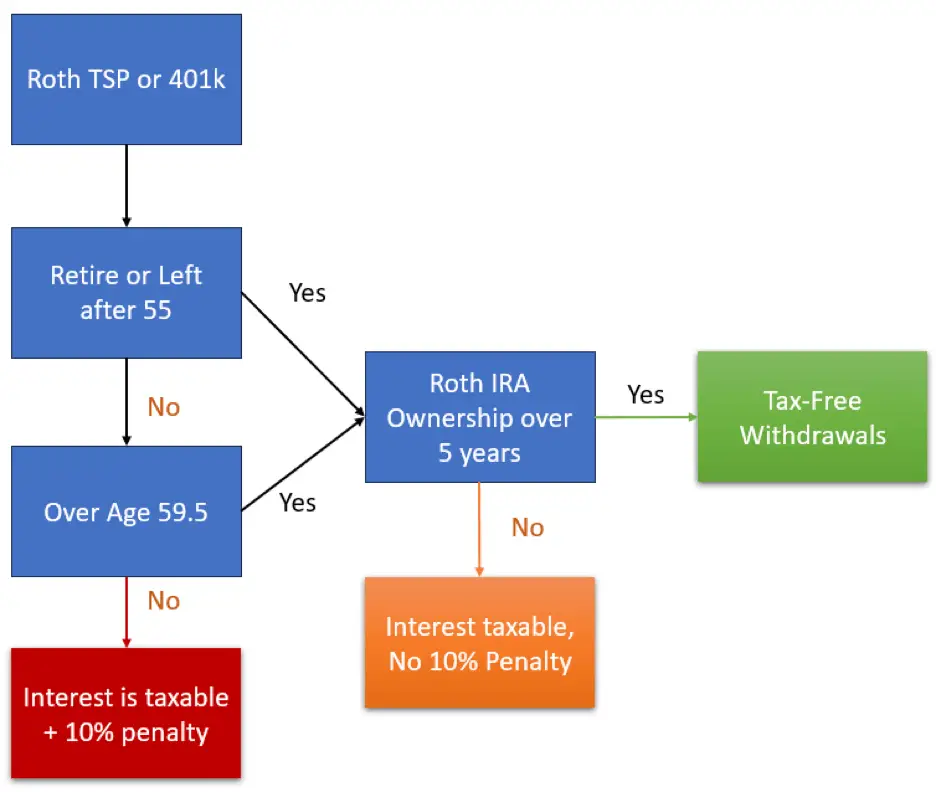

The Five-Year Rule on Roth TSP & Roth 401k

Because employer-sponsored Roth plans are treated separately, you must meet the five-year rule for each plan. If you have multiple Roth 401ks or Roth TSPs, the five-year rule applies to each one separately.

Typically, you must be age 59.5 and have a Roth account for over 5 years to enjoy tax-free Roth IRA withdrawals. However, if you retire or quit from an employer after age 55, you can take Roth distributions as long as you have satisfied the 5-year requirement.

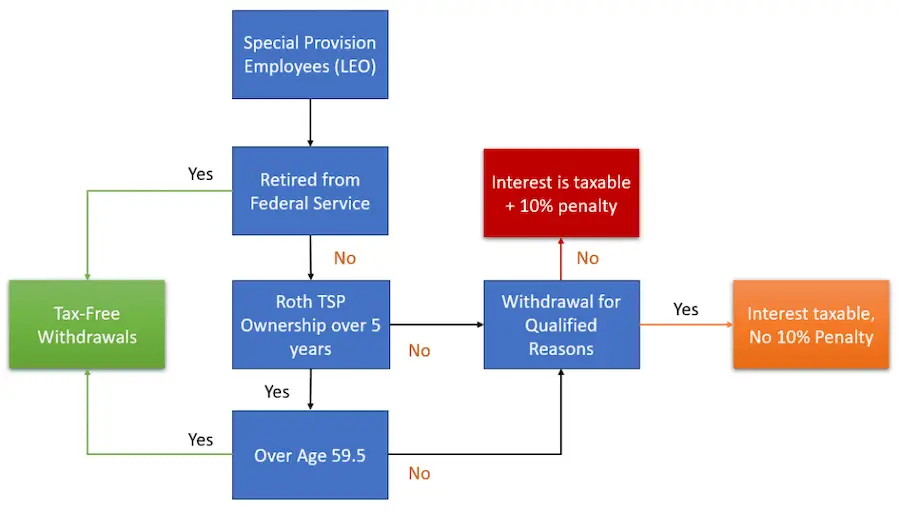

Special note for Federal Special Provision Employees, such as Law Enforcement Officers, Fire Fighters, Air Traffic Controllers, etc. You could withdraw from the Roth TSP when you retire as long as you have satisfied the five-year rule for Roth TSP.

Roth TSP Five-Year Rule

Special Provision Employee Roth TSP Rule Chart

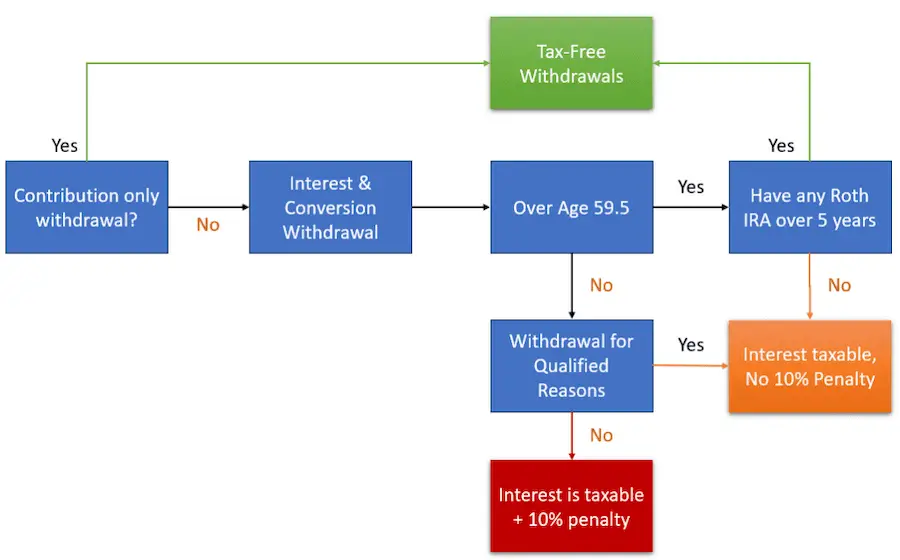

Roth IRA 5-Year Rule

There are multiple Roth IRA five-year rules. The first rule for Roth IRA accounts is how long the IRA has been open. You have to have a Roth IRA open for 5 years before you can take withdrawals tax free. However, due to the IRS’s account aggregation rules, as long as 1 Roth IRA has satisfied this requirement, all Roth IRAs are done.

For Example: You have 2 Roth IRAs. One you opened 10 years ago, and the second one was open 1 year ago. You are age 60 so you have satisfied the age requirement and decided to take a distribution from your Roth IRA. Both accounts will be tax free since the first IRA has satisfied the 5-year rule.

The second rule applies to conversions from a Traditional IRA to a Roth IRA. We will expand on more below.

Withdrawal of Contributions to a Roth IRA

The 5-year clock for Roth IRA contributions starts ticking on January 1st of the tax year you make your first contribution. For example, if your first contribution was made in 2023, your 5-year period began on January 1, 2023, and will end on December 31, 2027. You can only contribute to a Roth IRA when you meet the annual income requirements.

Within this 5-year period, you can withdraw your contributions without taxes or penalties. However, withdrawals of Roth IRA earnings are subject to different rules. If you withdraw earnings before the 5-year period ends and before reaching age 59 ½, they are considered non-qualified distributions and may be subject to taxes and a 10% early withdrawal penalty.

There are a few exceptions to this rule. You can withdraw earnings without penalties if you use the funds for a first-time home purchase (up to $10,000), due to disability, or upon your death.

The Roth IRA Distribution Flow Chart

The 5-Year Rule for Roth Conversions

Roth IRA conversions, where you convert traditional IRA funds to a Roth IRA, have their own 5-year rule. Each conversion has a separate 5-year period, which starts on January 1st of the year you made the conversion.

The ordering rule for withdrawals is crucial here. When you withdraw funds from a Roth IRA, the IRS considers your contributions to have been withdrawn first, followed by conversion funds, and lastly earnings. So, if you withdraw converted funds before the 5-year period ends and before age 59 ½, you might incur taxes and a 10% penalty. However, if you’ve already withdrawn all your contributions and are withdrawing conversion funds after 5 years, you’ll only pay taxes on the earnings portion.

It’s also important to note that if you’ve reached age 59 ½, the 10% penalty doesn’t apply to withdrawals, regardless of the 5-year rule.

Strategies for Managing the 5-Year Rules

To navigate the 5-year rules effectively, consider the following strategies:

- Track your contributions and conversions: Keep meticulous records of when you made contributions and conversions to easily track your 5-year periods.

- Plan withdrawals strategically: If possible, delay withdrawals of earnings until you’ve met the 5-year rule and reached age 59 ½ to avoid unnecessary taxes and penalties.

- Utilize rollovers: Rolling over funds from a Roth 401(k) to a Roth IRA can help consolidate your accounts and simplify tracking your 5-year periods.

- Consult a financial advisor: For personalized advice on managing the 5-year rules and optimizing your retirement strategy, seek guidance from a qualified financial advisor.

Understanding the Roth 5-year rules is essential for anyone with a Roth IRA or Roth 401(k) account. By being aware of the rules and planning your withdrawals strategically, you can maximize the tax advantages of these accounts and ensure a comfortable retirement.

Remember, the rules and regulations around retirement accounts can be complex and are subject to change. Always stay informed and consult a financial advisor to tailor your strategy to your circumstances and goals.

The content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation. The opinions expressed and material provided are for general information and should not be considered a solicitation for the purchase or sale of any security. Securities and advisory services offered through Osaic Wealth, Inc., member FINRA, SIPC. Osaic Wealth is separately owned and other entities and/or marketing names, products or services referenced here are independent of Osaic Wealth. Representatives may not be registered to provide securities and advisory services in all states. Branch address: 10701 Parkridge Blvd, Ste 130, Reston, VA 20191. Branch phone: 571-543-2783.