When planning your federal retirement, it’s critical to understand how unused sick leave is handled and whether it plays a role in increasing your eligibility age. Many federal employees also wonder if their accumulated sick leave can help them meet age or service requirements for retirement. Let’s dive into this topic and dispel the myths surrounding it.

What Does Unused Sick Leave Get You?

To those who want a short yes/no answer to the title of this article, here it is: No. Unused sick leave does not increase your age in the retirement calculations.

So, what does sick leave do? To answer that, we have to take a look at the FERS (Federal Employee Retirement System) pension.

Your federal pension under FERS is calculated based on three main factors:

- Your high-3 salary (the average of your highest-earning three consecutive years).

- Your years of service, including creditable sick leave.

- Your multiplier, which depends on your retirement age and years of service.

Unused sick leave is added to your total years of service to increase the service time factored into your pension calculation. However, it cannot change your eligibility age for retirement. You can check out this article if you want to know more about your high-3 and multiplier.

Who Can Get Credit For Unused Sick Leave?

You can’t just quit your federal government job and expect a reward for your unused sick leave. To benefit from unused sick leave, you have to retire with one of the following retirements:

- Full (Immediate) Retirement

- Early Out Retirement (VERA)

- MRA + 10 Retirement

- Postponed Retirement

- Deferred Retirement

How Unused Sick Leave Works

Let’s say you want to retire with a full (immediate) retirement. To do that, you have to accomplish one of the following:

- Age 57 with at least 30 years of service

- Age 60 with at least 20 years of service

- Age 62 with at least 5 years of service

Example #1: You are 60 years old with 19 years of service and 1 year of unused sick leave. In this case, you are NOT eligible for a full retirement. But, the 1 year of unused sick leave can increase your pension once you become eligible for retirement.

Example #2: You are 59 years old with 20 years of service and 1 year of unused sick leave. In this case, you are NOT eligible for a full retirement. But, the 1 year of unused sick leave can increase your pension once you become eligible for retirement.

Example #3: You are 60 years old with 20 years of service and 1 year of unused sick leave. In this case, you ARE eligible for a full retirement. The 1 year of unused sick leave will increase your pension at retirement.

The One Exception-ish

The one time, however, that sick leave can help make you eligible for something is if you are going for the 10% pension bonus you’d get at age 62 with 20 years. In this case, if you had 19 years of normal service at 62 but had 1 year worth of unused sick leave, then you would be eligible for the 10% bonus.

This is because at age 62 you are technically already eligible for retirement as all you need is 5 years of service at that age. The extra sick leave then adds in to make you eligible for the 1.1% multiplier (10% bonus).

How to Change Sick Leave Hours to Years of Service

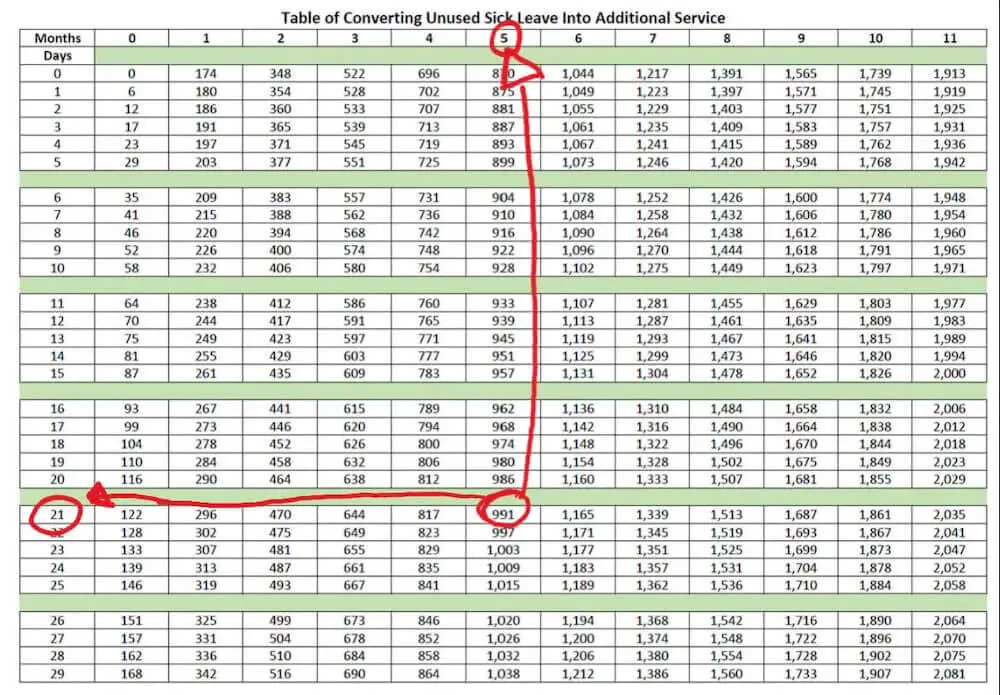

If you have 500 hours of unused sick leave at retirement, how do you know how much service time that is worth? Here is the chart that shows how it works:

| Months | 0 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 |

| Days | ||||||||||||

| 0 | 0 | 174 | 348 | 522 | 696 | 870 | 1,044 | 1,217 | 1,391 | 1,565 | 1,739 | 1,913 |

| 1 | 6 | 180 | 354 | 528 | 702 | 875 | 1,049 | 1,223 | 1,397 | 1,571 | 1,745 | 1,919 |

| 2 | 12 | 186 | 360 | 533 | 707 | 881 | 1,055 | 1,229 | 1,403 | 1,577 | 1,751 | 1,925 |

| 3 | 17 | 191 | 365 | 539 | 713 | 887 | 1,061 | 1,235 | 1,409 | 1,583 | 1,757 | 1,931 |

| 4 | 23 | 197 | 371 | 545 | 719 | 893 | 1,067 | 1,241 | 1,415 | 1,589 | 1,762 | 1,936 |

| 5 | 29 | 203 | 377 | 551 | 725 | 899 | 1,073 | 1,246 | 1,420 | 1,594 | 1,768 | 1,942 |

| 6 | 35 | 209 | 383 | 557 | 731 | 904 | 1,078 | 1,252 | 1,426 | 1,600 | 1,774 | 1,948 |

| 7 | 41 | 215 | 388 | 562 | 736 | 910 | 1,084 | 1,258 | 1,432 | 1,606 | 1,780 | 1,954 |

| 8 | 46 | 220 | 394 | 568 | 742 | 916 | 1,090 | 1,264 | 1,438 | 1,612 | 1,786 | 1,960 |

| 9 | 52 | 226 | 400 | 574 | 748 | 922 | 1,096 | 1,270 | 1,444 | 1,618 | 1,791 | 1,965 |

| 10 | 58 | 232 | 406 | 580 | 754 | 928 | 1,102 | 1,275 | 1,449 | 1,623 | 1,797 | 1,971 |

| 11 | 64 | 238 | 412 | 586 | 760 | 933 | 1,107 | 1,281 | 1,455 | 1,629 | 1,803 | 1,977 |

| 12 | 70 | 244 | 417 | 591 | 765 | 939 | 1,113 | 1,287 | 1,461 | 1,635 | 1,809 | 1,983 |

| 13 | 75 | 249 | 423 | 597 | 771 | 945 | 1,119 | 1,293 | 1,467 | 1,641 | 1,815 | 1,989 |

| 14 | 81 | 255 | 429 | 603 | 777 | 951 | 1,125 | 1,299 | 1,473 | 1,646 | 1,820 | 1,994 |

| 15 | 87 | 261 | 435 | 609 | 783 | 957 | 1,131 | 1,304 | 1,478 | 1,652 | 1,826 | 2,000 |

| 16 | 93 | 267 | 441 | 615 | 789 | 962 | 1,136 | 1,310 | 1,484 | 1,658 | 1,832 | 2,006 |

| 17 | 99 | 273 | 446 | 620 | 794 | 968 | 1,142 | 1,316 | 1,490 | 1,664 | 1,838 | 2,012 |

| 18 | 104 | 278 | 452 | 626 | 800 | 974 | 1,148 | 1,322 | 1,496 | 1,670 | 1,844 | 2,018 |

| 19 | 110 | 284 | 458 | 632 | 806 | 980 | 1,154 | 1,328 | 1,502 | 1,675 | 1,849 | 2,023 |

| 20 | 116 | 290 | 464 | 638 | 812 | 986 | 1,160 | 1,333 | 1,507 | 1,681 | 1,855 | 2,029 |

| 21 | 122 | 296 | 470 | 644 | 817 | 991 | 1,165 | 1,339 | 1,513 | 1,687 | 1,861 | 2,035 |

| 22 | 128 | 302 | 475 | 649 | 823 | 997 | 1,171 | 1,345 | 1,519 | 1,693 | 1,867 | 2,041 |

| 23 | 133 | 307 | 481 | 655 | 829 | 1,003 | 1,177 | 1,351 | 1,525 | 1,699 | 1,873 | 2,047 |

| 24 | 139 | 313 | 487 | 661 | 835 | 1,009 | 1,183 | 1,357 | 1,531 | 1,704 | 1,878 | 2,052 |

| 25 | 146 | 319 | 493 | 667 | 841 | 1,015 | 1,189 | 1,362 | 1,536 | 1,710 | 1,884 | 2,058 |

| 26 | 151 | 325 | 499 | 673 | 846 | 1,020 | 1,194 | 1,368 | 1,542 | 1,716 | 1,890 | 2,064 |

| 27 | 157 | 331 | 504 | 678 | 852 | 1,026 | 1,200 | 1,374 | 1,548 | 1,722 | 1,896 | 2,070 |

| 28 | 162 | 336 | 510 | 684 | 858 | 1,032 | 1,206 | 1,380 | 1,554 | 1,728 | 1,902 | 2,075 |

| 29 | 168 | 342 | 516 | 690 | 864 | 1,038 | 1,212 | 1,386 | 1,560 | 1,733 | 1,907 | 2,081 |

In the body of the chart, find the number that is closest to the amount of sick leave hours you will have at retirement. The column that your number is in will show you how many months that is worth and the row will show you how many days it is worth.

And if your sick leave number falls between two different numbers of the chart, then go with the higher number. For example, if you have 990 hours, then you’d round up to 991, which would equate to 5 months and 21 days of service time.

Extra Days Drop Off!!

But when they calculate your pension, they only use full years and months of service. Any extra days drop off. But this drop off only happens after you add the sick leave time to your normal years of service. For example, if you have 30 years, 4 months, and 18 days of normal service and 3 months and 15 days of sick leave, your pension would be based on 30 years and 8 months as the 3 extra days dropped off.

Note: When doing this math, months are always considered to be 30 days!

Final Note

Knowing how sick leave affects your retirement is key to not losing too many days that will end up just being dropped off your calculation. Because anytime you learn more about your benefits/retirement the more likely you are to not leave any money on the table.