The Social Security Administration (SSA) has announced that it expects to finish updating all records for over 3.2 million Social Security recipients impacted by the Social Security Fairness Act by early November.

We have been able to expedite payments using automation. For the many complex cases that cannot be processed automatically, additional time is required to manually update the records and pay both past due benefits and the new benefits amount. We are expediting these cases now. We are releasing past due benefits and sending new monthly benefit amounts as we process each case, with the expectation that all beneficiary records will be updated by early November 2025. (emphasis added)

Understanding the Social Security Fairness Act

The Social Security Fairness Act ends the Windfall Elimination Provision (WEP) and Government Pension Offset (GPO). These provisions reduced or eliminated the Social Security benefits of over 3.2 million people who receive a pension based on work that was not covered by Social Security because they did not pay Social Security taxes.

The WEP and GPO have historically reduced Social Security benefits for certain individuals, including retired federal employees, who receive pensions from non-Social Security-covered employment.

The WEP and GPO no longer apply as of January 2024 under the legislation. Given that the bill was signed into law in January 2025, SSA had to pay many payments to impacted individuals retroactively in addition to adjusting future payments.

What Are the WEP and GPO?

Windfall Elimination Provision (WEP)

The WEP reduces Social Security benefits for retired local, state, and federal government employees who worked in Social Security-covered employment and receive a government annuity from non-covered employment.

It applies to retired federal employees who began before 1984 under the Civil Service Retirement System (CSRS), who don’t pay the 6.2% payroll tax and don’t earn Social Security benefits from their federal work. It doesn’t apply to Federal Employees Retirement System (FERS) employees who pay the tax and earn benefits.

The WEP provision was designed to prevent “double-dipping” but has often been criticized for unfairly penalizing public servants.

Government Pension Offset (GPO)

The GPO affects spousal or survivor benefits for individuals who receive a government pension from non-Social Security-covered employment. It was designed to ensure individuals receiving government pensions from work not covered by Social Security, such as federal employees under CSRS, did not receive spousal or survivor benefits exceeding what they would receive if they had earned a Social Security benefit through covered employment.

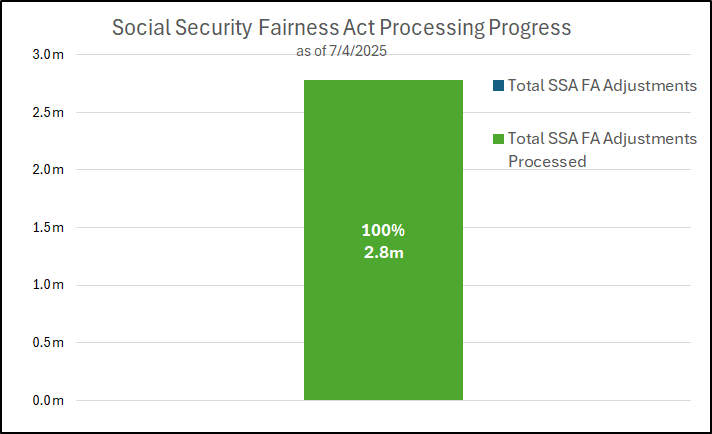

Progress on Benefit Adjustments

Starting February 25, 2025, SSA began adjusting monthly benefit payments for individuals impacted by the WEP and GPO.

While automation has expedited many payments, complex cases require manual updates. SSA is working to process these cases and ensure all beneficiaries receive their adjusted benefits promptly.

Key Dates

- February 2025: SSA initiated adjustments to monthly benefits for affected beneficiaries.

- April 2025: Most beneficiaries began receiving their new monthly benefit amounts, reflecting changes for March 2025.

- November 2025: SSA expects to complete all adjustments, including past due payments and new monthly benefit amounts.

One-Time Payments

Beneficiaries due additional benefits as a result of the Act will receive a one-time payment covering the increase in their benefit amount back to January 2024. This payment will be deposited into the bank account SSA has on file.

According to SSA, the change in monthly Social Security benefits can vary significantly from person to person depending on factors like the type of benefit received and the size of an individual’s pension. While some may see only a modest increase, others could gain more than $1,000 per month.

Notifications to Beneficiaries

Beneficiaries will receive mailed notices explaining their benefit changes. In some cases, individuals may receive two notices: one for the removal of WEP or GPO and another for the adjustment to their monthly benefit amount. Past due payments may be issued before notices are received.

Additional information about implementing the Social Security Fairness Act is available on the SSA website.

Reduced Social Security Payments for Some Americans Starting in July

Starting in July 2025, some Social Security recipients are receiving reduced monthly payments due to the Social Security Administration’s effort to recover past overpayments.

These overpayments—often caused by outdated earnings records, unreported income changes, or administrative miscalculations—resulted in individuals receiving more benefits than they were entitled to.

Individuals who have been overpaid could have their benefits payments cut in half starting in late July.

This effort is to recover overpayments made between 2015 and 2022. SSA estimates that nearly $72 billion worth of improper payments were made during this time period.

SSA made the announcement in April 2025, and it began notifying recipients of the repayment requirements and offering options for appeal or requesting a waiver. Individuals facing financial hardship or who believe the overpayment wasn’t their fault are encouraged to contact the SSA to explore those relief options. For individuals who meet these criteria, there is a form on the SSA website for requesting an overpayment waiver.

According to the April announcement, SSA will “usually provide 90 days for the individual to request a lower rate of withholding, a reconsideration, or waiver. If the individual does not request a lower rate of withholding, reconsideration, or waiver after the approximately 90-day period, we will recover the overpayment by withholding up to 50 percent of their Title II benefit payment (if there is no fraud or similar fault), until we fully recover the overpayment.”