The OPM retirement backlog grew again in January, reaching levels not seen since 2012. However, more incoming retirement claims are digital which is having a positive impact on processing times.

January is normally the busiest month of the year in terms of incoming retirement claims at the Office of Personnel Management. Last year, for instance, it grew by just over 16,000 claims in a 68% surge in one month.

To start off 2026, the total inventory of retirement claims grew by 3,452, a 6.8% increase over December 2025. OPM received 18,923 retirement claims during January, 9,394 of which were digital.

The total OPM retirement backlog is now 54,018. Of that, 19,618 claims are digital and 34,400 are paper.

OPM processed 15,571 total claims in January at an average rate of 77 days. On the digital side, 6,465 were processed at an average rate of 48 days, significantly faster than the paper claims which took 97 days on average.

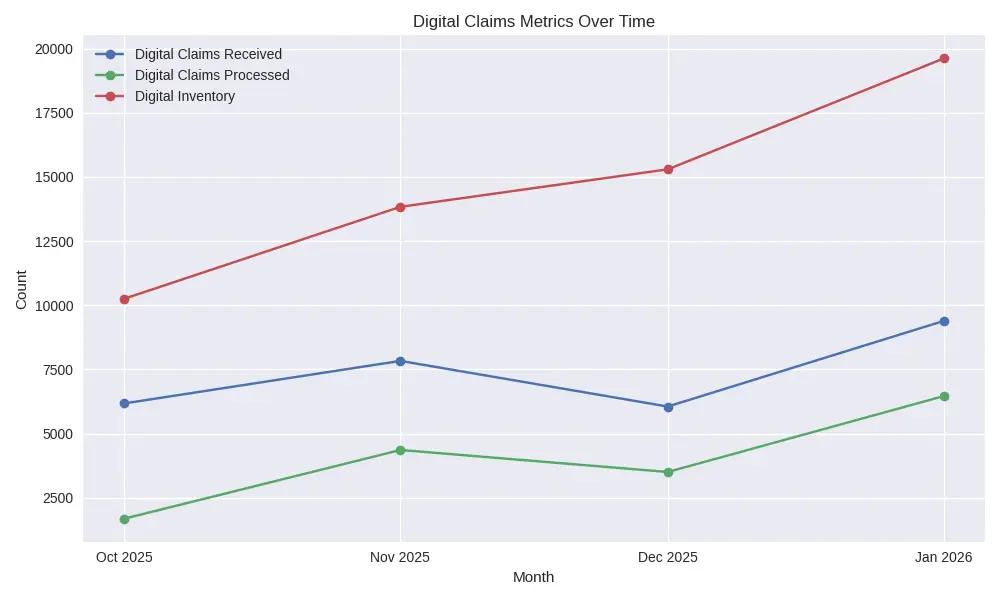

These figures show how the digital processing has grown so far:

| Month | Digital Claims Received | Digital Claims Processed | Digital Inventory |

| October 2025 | 6,176 | 1,686 | 10,252 |

| November 2025 | 7,833 | 4,363 | 13,835 |

| December 2025 | 6,055 | 3,506 | 15,295 |

| January 2026 | 9,394 | 6,465 | 19,618 |

Having more retirement claims in the digital inventory would ultimately be beneficial for federal retirees since OPM processes them in about half the time. The higher number of claims processed this January appears to have helped moderate the overall inventory growth.

The table below shows how the month of January has fared regarding incoming retirement claims. More were received in 2026, but the processing volume also increased significantly, over double the amount processed in some previous years.

| Claims Received | Processed | Inventory | |

|---|---|---|---|

| January 2026 | 18,923 | 15,571 | 54,018 |

| January 2025 | 16,101 | 6,700 | 23,277 |

| January 2024 | 12,997 | 6,467 | 20,822 |

| January 2023 | 12,404 | 9,142 | 24,858 |

| January 2022 | 13,266 | 8,689 | 31,307 |

| January 2021 | 13,850 | 6,569 | 26,968 |

| January 2020 | 17,134 | 10,059 | 23,983 |

Although the data are interesting, 2026 is unique for two reasons: many of the claims are now digital, and the federal workforce reduction efforts throughout 2025, such as the deferred resignation program, led to many more retirement claims than usual over the past several months.

OPM’s Transition to Digital Retirement Processing

OPM is in the process of transitioning to its Online Retirement Application (ORA) system, and during the transitional period it has to contend with processing both types of claims since paper claims will still be coming in for a while.

OPM Director Scott Kupor discussed the new retirement processing system in a January 23 blog post. He said that as of that date, there were 107,000 retirement claims in the ORA system and incoming digital claims now exceed the paper ones.

Kupor explained in his blog post that the new ORA system involves a multi-step process:

- The application is filled out online by the applicant. It takes applicants an average of 14 days to complete the online ORA application.

- ORA then routes it to agency HR departments. It currently takes an average of 60 days to add employment data to the application to complete this step.

- The final routing step sends the application to the agency’s payroll provider. This step currently takes about 51 days for payroll to complete its part of the application.

Consequently, Kupor explains, “OPM does not receive a fully completed application and cannot begin its work – on average – for about 120 days from when the applicant starts the application process.”

Of the 107,000 claims currently in ORA, Kupor said that about half are with OPM, 30% are with payroll providers, 12% with agency human resources teams, and 8% with applicants.

He added that when claims do get to OPM, the agency processes them quickly, issuing interim pay immediately about 75% of the time which means that federal retirees will be getting 80% of their expected final post-adjudication payout within 7 days of OPM receiving the retirement application in ORA.

He said that OPM is completing the digital applications in less than 40 days of receiving them. However, as the data above show, it takes OPM more than double that amount of time to complete its part of processing the paper claims.

Kupor also said that OPM is working to expedite the other parts of the system. He wrote, “We are working with the HR and Payroll providers to help reduce the time it takes for them to complete their ORA work, and we are continuously rolling out new ORA features that expand the types of cases we can handle and will reduce adjudication times further.”

OPM Retirement Processing Statistics as of January 2026

| Month | Digital Claims Received | Total Claims Received | Digital Claims Processed | Total Claims Processed | Digital Processing Time (Days) | Total Avg Processing Time (Days) | FYTD Digital Processing Time (Days) | FYTD Avg Processing Time (Days) | Digital Inventory | Total Inventory |

|---|---|---|---|---|---|---|---|---|---|---|

| Oct-25 | 6,176 | 20,344 | 1,686 | 8,751 | 45 | 79 | 45 | 79 | 10,252 | 34,587 |

| Nov-25 | 7,833 | 23,393 | 4,363 | 8,707 | 38 | 66 | 40 | 73 | 13,835 | 48,396 |

| Dec-25 | 6,055 | 13,174 | 3,506 | 9,428 | 40 | 67 | 40 | 71 | 15,295 | 50,566 |

| Jan-26 | 9,394 | 18,923 | 6,465 | 15,571 | 48 | 77 | 43 | 73 | 19,618 | 54,018 |

Retirement Services (RS) is working towards a fully digital retirement application process; RS is working with agencies and payroll offices to update legacy processes. During this period of transition, RS is still receiving many new retirement claims on paper.

- In January RS Received 18,923 new retirement claims; of these 9,394 were digital and 9,529 were paper

- The processing of digital cases is faster. With systematic checks of data, annuitants experience less delays due to missing information or incomplete packages.

- In January RS processed 15,571 new retirement claims; of these 6,465 were digital and 9,106 were paper.

- In January digital cases were processed in 48 days, and paper claims were processed in 97 days.