With a large universe of Thrift Savings Plan (TSP) investors, there are multiple reasons a TSP investor may have for moving money from one fund into another. Short term moves are sometimes made seeking a greater return or a smaller loss, depending on how an investor believes the stock market will move in the future.

The TSP stock funds have gone up for several months in a row. In hindsight, being invested in these stock funds was good for investors. But, in April, TSP investors moved money out of the C, S and I funds and poured money into the G, F and L funds.

$491 million was transferred from the C fund and $412 million was moved from the S fund. Another $145 million was moved from the I fund. In the other direction, $617 million was moved into the G fund and $234 million into the F fund. $198 million went into the Lifecycle funds.

The C fund was up 3.63% in 2016 at the end of May and the S fund was up 2.85% for the same time period. When stocks are going up, those who leave money in the stock funds usually have a better rate of return. This year is no exception as those in the G fund have had a return of 0.78% so far in 2016 as of the end of May. Over time, the higher returns from stock funds can make a significant difference in an investor’s TSP balance.

The reality is, many TSP investors follow their returns on a daily or weekly basis. It is hard not to react to short term events and to move money around based on these short term events. For better or worse, that is human nature.

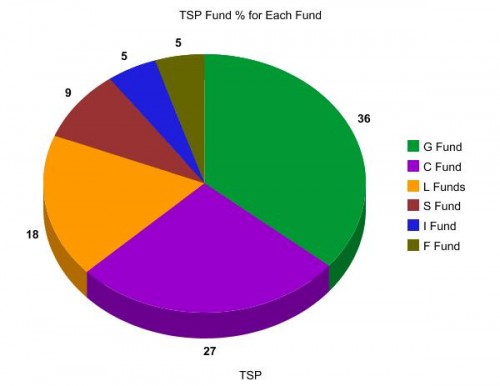

The safety of the G fund is probably the biggest reason that 36% of all TSP funds are invested in the G fund. For comparison, 27% is in the C fund. The percentage of funds in the C fund has gone up and the percentage in the G fund has gone down as the bull market has extended over the past several years.

tely predict future short term movement in the stock market. Moving money around based on the results of the past month or so often results in making a short term move that loses money.

One advantage of the TSP fund is that investors are free, within strict limits, to trade into or out of funds as they see fit.

We wish all TSP investors the best of luck in making their own investment decisions for their future retirement income.