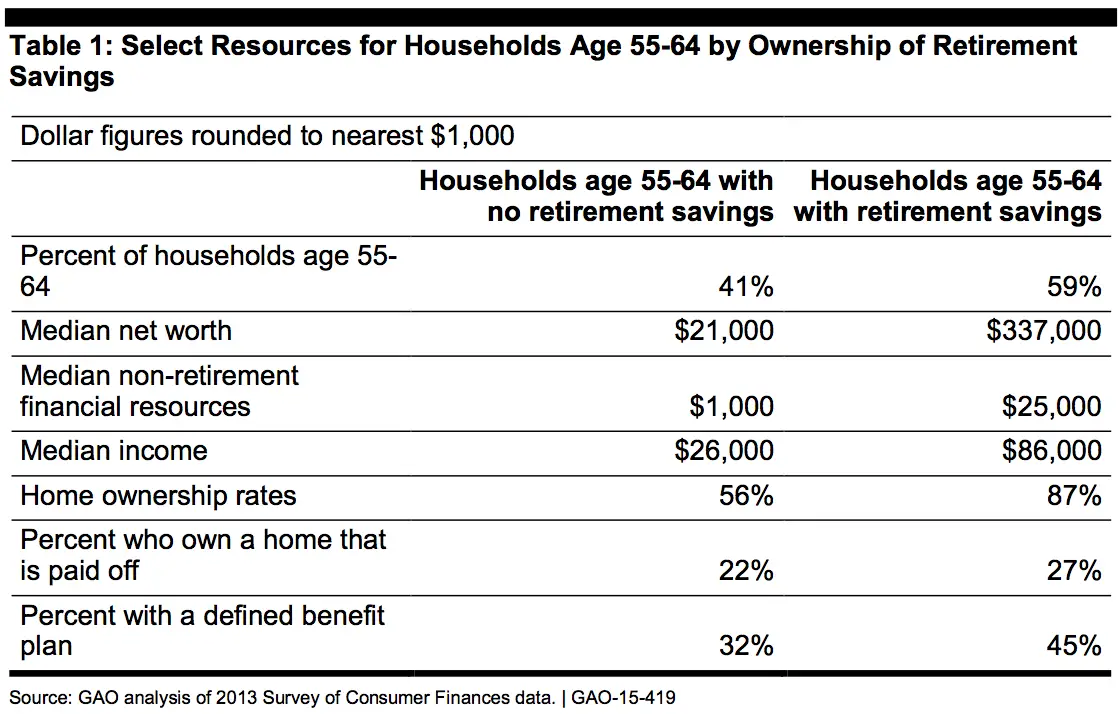

A recent study conducted by the Government Accountability Office found that roughly half of households age 55 and over have no retirement savings, such as a 401(k) or IRA.

Among the 48% of households that do have some form of retirement savings, the amounts saved are generally underwhelming: the median amount is about $104,000 for households age 55-64 and $148,000 for households age 65-74, equivalent to an inflation-protected annuity of $310 and $649 per month.

The study also found that people in the age range of 55-64 are less confident about their financial well-being in retirement than those over 65. Many people over 65 report being able to manage financially. However, poverty rates are higher for people approaching retirement and people who are 75 and older.

The GAO study is just the latest of several studies on Americans’ retirement readiness that confirms the same thing: Americans are, on average, woefully unprepared for retirement and are not saving enough money. For summaries of the other recent studies, see Fed Survey Shows Americans Are Optimistic About Their Finances Despite Generally Lacking Savings and 28% of Workers Have Less Than $1,000 in Savings.

The obvious question to ask about why Americans are so unprepared for their own retirements is, “Why?”

According to Senator Bernie Sanders (I-VT), it’s because Social Security needs to be expanded. Sanders requested that GAO do the study and is using the findings to support his bill, The Social Security Expansion Act.

His legislation would make the wealthiest Americans pay the same share of their income into the retirement program as other wage earners, and Sanders says this change would extend the solvency of Social Security through 2065 and allow Social Security benefits to go up. Sanders also says that the average benefit would increase by $65 a month, cost-of-living adjustments would more accurately measure inflation for seniors and the minimum benefit would be raised to lift millions of seniors out of poverty.

“Social Security is the most successful program in our nation’s history,” said Sanders. “At a time of massive wealth and income inequality, we have got to demand that the richest people in this country pay their fair share.”

Sanders points to the GAO study findings which showed that many of the people with no retirement savings were relying on Social Security for their income in retirement. However, some would disagree with Sanders’ supposition that Social Security has been a success, at least in terms of the program’s financial stability and projected long term health.

FedSmith.com author Brenton Smith, for example, has been vocal about the fragile economic state of Social Security. As he wrote in The Third Rail Is Running Out of Track, “The finances of Social Security are such that most Americans now expect to see benefits cut in their lifetime.” Smith also pointed in the same article to a report from the Social Security Board of Trustees that showed the system should be able to pay benefits until 2033. The Trustees’ report also said that beginning in 2020, the cost of the program is expected to exceed its income. These statements from the Trustrees’ report are not traits one would expect to see in a vibrant economic program, a key point Smith was making in his article.

FedSmith.com users have also expressed their concerns about the future viability of Social Security. In a poll conducted by FedSmith.com, 65% of respondents were either not very or not at all confident about Social Security’s ability to pay them their promised benefits in retirement. The majority of FedSmith.com users are federal employees, and they are lucky in that they have retirement programs provided by the government to help them prepare for retirement that are separate from Social Security. Some retired federal workers are still able to collect Social Security, however, such as employees who retire under FERS.

Is Sanders right about Social Security, or is the program on the path to failure? That is ultimately up for you to decide, but here is a point to ponder: if you invest even a small amount of your income each month throughout your working years, you will have enough money saved by the time you reach retirement to free yourself from having to rely on Social Security (and subsequently free yourself from worrying about whether or not the program will be able to pay you when you get there). If you end up with Social Security income thereafter, so much the better!