The Office of Inspector General for the Social Security Administration said in a recent report that employees at the agency collectively owed $21.8 million in delinquent taxes as of FY 2013. That amount is owed by 2,452 employees which represents 3.92% of the SSA workforce.

The IRS considers an employee delinquent if he/she has unresolved Federal income tax in the form of a balance owed and/or an unfiled tax return. The IRS excludes employees who have installment agreements.

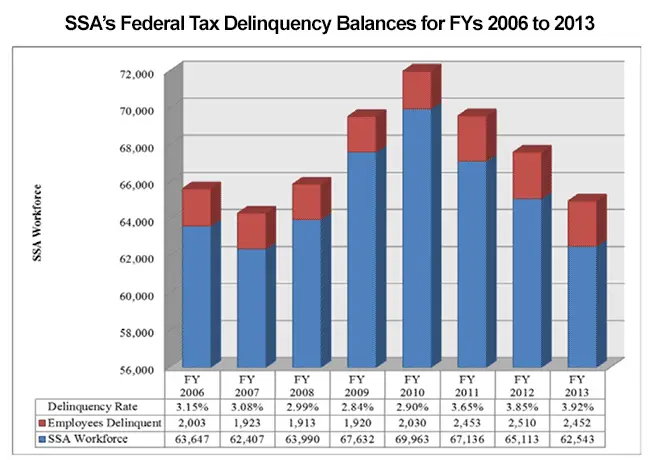

The chart below shows the delinquency rate among SSA employees from FY 2006 to FY 2013. The rate showed a slight overall increase over that time period.

The table below breaks the delinquent rates out by grade level. GS-08 employees had the most delinquencies, however, GS-07 employees had the highest percentage of delinquencies among their pay grade level.

FY 2013 SSA Federal Tax Delinquency Count by Grade Level

| Pay Plan | Grade | Total Workforce | Number of Delinquent Accounts | Delinquency Rate |

|---|---|---|---|---|

| Federal Wage System | 223 | 15 | 6.7% | |

| GS | GS-01 to GS-04 | 268 | 13 | 4.9% |

| GS-05 | 1,383 | 56 | 4.1% | |

| GS-06 | 1,437 | 72 | 5.0% | |

| GS-07 | 1,710 | 138 | 8.1% | |

| GS-08 | 11,039 | 609 | 5.5% | |

| GS-09 | 5,049 | 290 | 5.7% | |

| GS-10 | 431 | 30 | 7.0% | |

| GS-11 | 16,833 | 558 | 3.3% | |

| GS-12 | 11,842 | 383 | 3.2% | |

| GS-13 | 7,051 | 181 | 2.6% | |

| GS-14 | 2,801 | 64 | 2.3% | |

| GS-15 | 748 | 14 | 1.9% | |

| Administrative Law Judge | 1,485 | 26 | 1.8% | |

| Other Pay Plans (Senior Executive Service and other administrative positions) | 243 | 3 | 1.2% | |

| Total | 62,543 | 2,452 | 3.9% | |

The IRS issued a report earlier this year showing that as of FY 2013, current federal civilian employees collectively owed just over $1 billion in back taxes. This amount was comprised of 116,169 employees, so the SSA figures for the same fiscal year account for about .02% of the total.

The complete report is included below.

Tax Compliance for Social Security Administration Employees