Since inception, the F Fund has benefited from a multi-decade supercycle of high interest rates that gradually decreased to very low levels.

That period of time benefited bond investors greatly, but created high expectations for long-term bond returns that might not be replicated over the next several years or decades.

This article looks at how the F Fund may be affected in the current environment of low-and-rising interest rates going forward.

An Overview of Past Performance

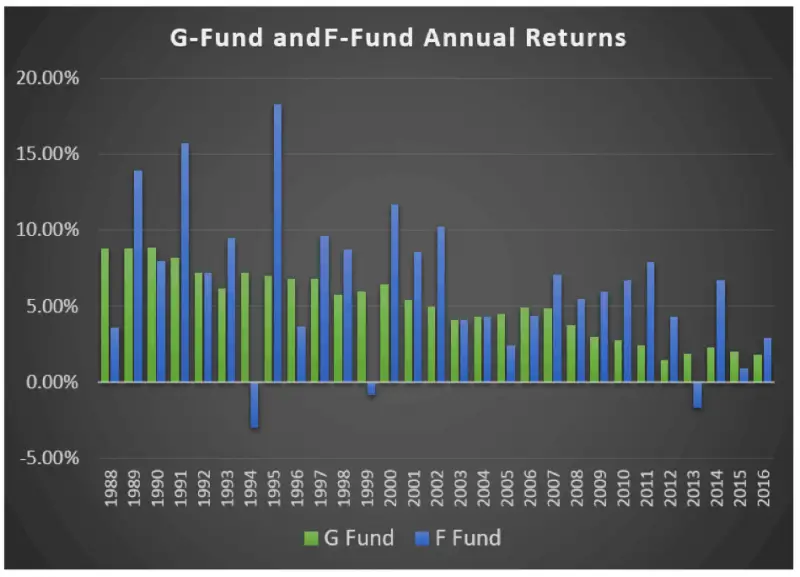

Here’s a chart of the annual returns of the G Fund and F Fund since their inception, based on information from or all types of fixed-income investments.

The F Fund, on the other hand, was more volatile. It lost money in 1994, 1999, and 2013, but in exchange for this added risk the annual returns over time averaged about 1% higher than the G Fund.

The catalyst behind two of those annual losses was an increase in the federal funds rate by the US Federal Reserve.

Here’s a chart by the St. Louis Fed, showing the US federal funds rate over time.

The three rate increases during the lifetime of the F Fund are circled in red.

The rate increases of 1995 and 1999 were responsible for the negative F Fund returns in those years. The rate increase in 2005 noticeably reduced the returns of the F Fund that year compared to neighboring years in 2004 and 2006, but did not manage to pull it into negative territory.

(The negative return of the F Fund in 2013 was caused by quantitative easing rather than changes in the federal funds rate.)

Why the Federal Funds Rate affects the G Fund and F Fund Differently

The longer a bond takes to mature, the more it is affected by changes in interest rates during its existence, and the higher its rate of return should be to offset that risk.

The F Fund has an average bond duration of about 5 years. To quantify how that affects sensitivity to changing interest rates, the TSP says in their F-Fund PDF information sheet:

“The average duration (a measure of interest rate risk) of the U.S. Aggregate Index was 5.31 years, which means that a 1% increase (decrease) in interest rates could be expected to result in a 5.31% decrease (increase) in the price of a security.”

In practice, it’s usually not as impactful as that, because the federal funds rate is generally increased or decreased gradually over the course of a year or more. The TSP information sheet is correct, but assumes an instantaneous change in rates.

For a deeper look at why rising interest rates negatively affect the prices of existing bonds, here’s a tutorial on discounted cash flow analysis as it pertains to bonds.

In contrast to the F Fund, the G Fund is a unique investment that blends the higher rate of return of 10-year US treasuries with the lower risk of only 3-month treasuries. Because the duration of the individual treasures is so short, the fund is nearly immune to the effects of fluctuating interest rates. A full 1% increase or decrease in interest rates would only be expected to alter the price of these treasuries by a fraction of a percent. Most investors in the world outside of the TSP don’t have access to an investment of that type.

Although the G Fund is safeguarded against volatility due to interest rate fluctuations that the F Fund is exposed to, it is still susceptible to long-term changes in the interest rates just like the F Fund. As interest rates have fallen from their peak in the early 1980’s to near zero over the last several years, this has dramatically reduced the rate of return that both the G Fund and F Fund can produce.

The Current Situation and Risks

The Federal Reserve has two mandates: maximize employment and maintain price stability.

In other words, they want to get the unemployment rate as low as possible and target an annual inflation rate of about 2%.

When the economy contracts, they typically reduce interest rates to entice businesses to borrow money for investing in and expanding their business, including their workforce. When the economy picks up steam and they fear that inflation may exceed 2%, they typically raise interest rates to keep inflation at bay.

Over the majority of the last decade, we’ve been in a period of historically low interest rates as the Fed has attempted to spur business investment. In December of 2015 they raised the federal funds rate by 0.25%, which was the first increase in a decade. Recently in December of 2016 they raised rates by another 0.25%, and signaled that if the economy remains stable they could perform multiple small increases in 2017.

In the current environment of very low interest rates that may be gradually rising in the future, neither the G Fund or the F fund will be able to reproduce the rate of return that they provided long ago. If interest rates remain low, their returns will continue to be subpar; barely staying ahead of the inflation rate. On the other hand, if interest rates rise, it will benefit them in the long-term but may hurt the F Fund in the short-term. However, the G Fund will be protected from the possibility of rising interest rates.

In this type of environment going forward, where interest rates are very low and may rise over the near-term, the G Fund is slightly more attractive on a risk/reward standpoint than the F Fund. Neither of them can be expected to grow much due to low existing rates, but the G fund is protected from rate sensitivity.

If we reach a point where the federal funds rate has risen to a few full percentage points, the F fund may regain its status as a comparable investment in terms of its risk/reward ratio.