Thanks to the slow but steady march of inflation year after year, a million dollars isn’t what it used to be.

Still, it’s a target that few people achieve in their lifetimes, and it can go a long way to a comfortable retirement.

FedSmith regularly keeps track of the number of TSP millionaires, federal employees that have accumulated more than $1 million in their TSP account. The number fluctuates each year, having grown from about 200 in early 2012 to well past 3,000 today, thanks to the eight-year bull market we’ve all enjoyed.

But what does it take to get to that level?

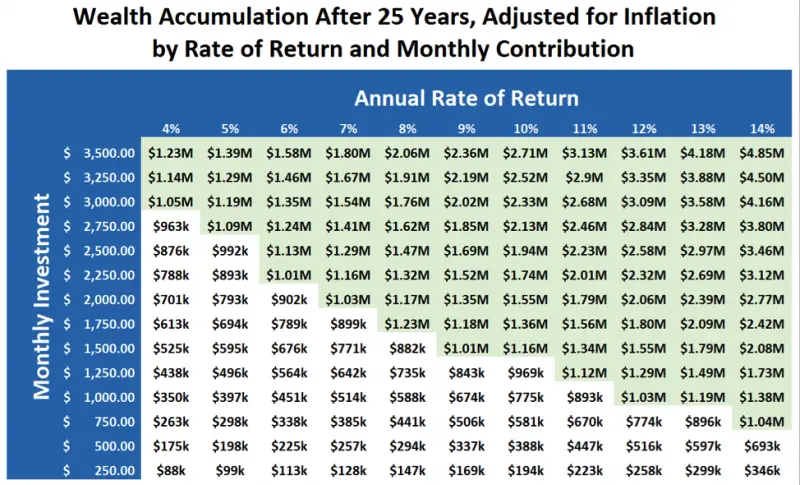

For starters, here’s a chart that shows how much wealth you can build based on your monthly saving amount (vertical axis) and annualized rate of return (horizontal axis) in 25 years:

Levels over $1 million are highlighted in green.

John Bogle, the founder of Vanguard, currently expects about 4% annual returns over the next 10 years from the US stock market, due to the high valuations of the market currently.

A report in 2016 by McKinsey & Company estimates 4-6.5% annual returns for US markets over the next 20 years.

Nobody can know for sure what returns will be going forward, but due to how highly valued the markets are currently (based on metrics like the Shiller PE ratio), the chance of reaching or exceeding the historical 9-10% rate of return is arguably not very likely going forward.

Here are three examples for how a TSP account may grow over a federal career:

Example 1: $500/Month Contributions

If, through a combination of your monthly contribution and your agency matching you contribute only $500/month, adjusted for inflation over time, this is how much inflation-adjusted wealth you can accumulate before retirement based on different average rates of return:

| 4% | 5% | 6% | 7% | 8% | 9% | 10% | |

|---|---|---|---|---|---|---|---|

| 10 Years | $63k | $65k | $68k | $72k | $74.9k | $78k | $82k |

| 20 Years | $135k | $149k | $164k | $182k | $201k | $223k | $248k |

| 30 Years | $219k | $255k | $298k | $351k | $414k | $492k | $586k |

| 40 Years | $315k | $389k | $485k | $610k | $774k | $988k | $1.27M |

This would be the equivalent of someone making $60,000 per year, contributing 5% into the TSP, and receiving 5% agency matching.

At that level, reaching $1 million in terms of today’s purchasing power is unlikely, but reaching half a million is possible. Combined with a FERS pension, social security, and a mortgage-free home, that’s a solid place to be.

If their salary increases over time and they’re able to contribute more, they can bump their final total up quite a bit.

Example 2: $1,000/Month Contributions

Now, assuming an employee makes $100,000 per year, contributes 7% of their gross salary to the TSP, and receives 5% agency matching, here’s how his or her TSP wealth would grow based on different rates of return:

| 4% | 5% | 6% | 7% | 8% | 9% | 10% | |

|---|---|---|---|---|---|---|---|

| 10 Years | $125k | $131k | $137k | $143k | $150k | $157k | $164k |

| 20 Years | $270k | $297k | $328k | $363k | $402k | $447k | $497k |

| 30 Years | $437k | $509k | $596k | $701k | $829k | $983k | $1.17M |

| 40 Years | $630k | $779k | $971k | $1.22M | $1.55M | $1.97M | $2.54M |

At this rate, hitting a million dollars in today’s purchasing power is just within reach. A 7% annual return compounded over decades from a balanced portfolio focused primarily on equities is possible, but not guaranteed.

Many engineers, scientists, lawyers, and other highly-paid occupations in the federal government can achieve a six-figure salary quite early in their careers, potentially allowing for decades of savings at this rate or higher.

Example 3: $2,000/Month Contributions

If an employee makes $120,000 per year, contributes the maximum $18,000 per year, and receives 5% agency matching, it comes to $2,000 per month in combined contributions.

And here’s how his or her inflation-adjusted TSP wealth could grow:

| 4% | 5% | 6% | 7% | 8% | 9% | 10% | |

|---|---|---|---|---|---|---|---|

| 10 Years | $250k | $262k | $274k | $286k | $300k | $314k | $328k |

| 20 Years | $539k | $594k | $656k | $726k | $805k | $894k | $994k |

| 30 Years | $87k | $1.02M | $1.19M | $1.40M | $1.66M | $1.97M | $2.34M |

| 40 Years | $1.26M | $1.56M | $1.94M | $2.44M | $3.09M | $3.95M | $5.07M |

At this rate, hitting a million dollars is not just within reach; it’s likely.

Admittedly, this example is less realistic than the other two, because nobody starts at $120,000 per year.

However, if an employee starts at $60k or more in a highly-paid profession, lives frugally and contributes a large portion of his or her salary to the TSP, and quickly works up to a salary of $100k, and then reaches $130k or possibly far more at the apex of her career, all while maxing out her TSP contributions, it begins to approximate this level of contribution.

The highest TSP balance in the federal government is over $4 million.

Final Words

A large TSP balance before retirement is within reach for everyone, regardless of their salary, as long as equity markets continue to perform adequately. Unlike some 401(k) plans that charge high fees, the TSP is among the lowest cost investment platforms in the world, and is a great way to build wealth.

Naturally, a higher salary makes it easier to accumulate more, because you’ll have more disposable income to contribute and can earn higher agency matching, but even at a lower salary it’s possible to create a very comfortable portfolio.

Over any long investing career, there will be recessions and sharp market declines, but the historical performance of the US stock market has been remarkable through all of that for investors patient and disciplined enough to let it work its magic.