In January, Federal retirees and Social Security recipients will receive their largest cost-of-living adjustment in six years.

The 2% increase is due, in part, to the timing and severity of the storms that affected Texas, Florida, and other southern states in August and September, which caused a spike in gasoline prices that accounted for about 25% of the 2018 COLA.

An analysis of inflation data shows that without higher gasoline prices, the COLA would have been closer to 1.5%, resulting in a smaller increase for beneficiaries and significant savings to the Federal budget and the Social Security trust funds.

Role of storms

Hurricanes Harvey and Irma made landfall in the U.S. during two of the three months used to determine the annual COLA, which is calculated using the average of the Bureau of Labor Statistics Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) All Items index for July, August, and September.

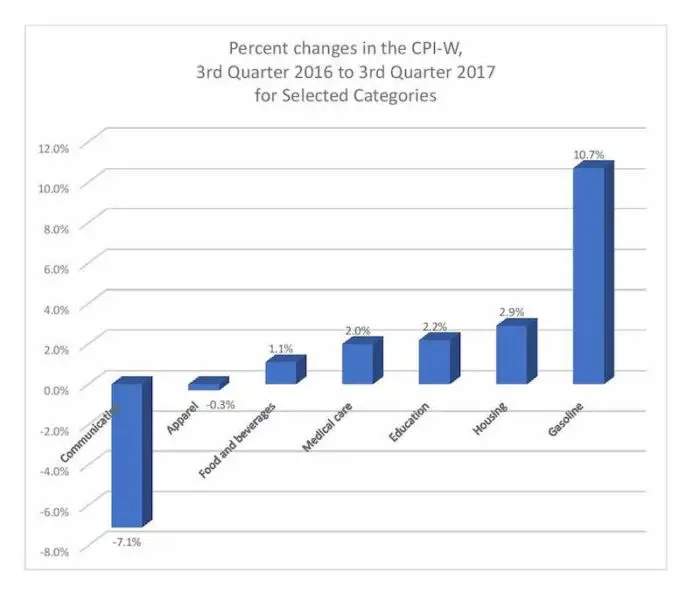

In July, gas prices actually declined 2.3% from the previous month, but the two storms impacted gas prices during August and September and caused the index for gasoline to rise 10.7% in third quarter compared to the same time period in 2016.

The effect of the storms on the CPI during the third quarter would have been quite different if the storms had appeared earlier in the year, or if Hurricane Harvey had not struck the important petroleum refining region in Texas.

Hurricane Harvey caused disruptions to refineries along the coast as well as disrupting the flow of petroleum products by ship and pipeline, resulting in higher gas prices.

Hurricane Irma caused a second spike in gas prices as large numbers of people evacuated by car and bus to safer locations creating increased demand on the already depleted gasoline stocks. Fear of shortages and higher prices also caused drivers outside the affected areas to fill their tanks, thus further increasing overall demand and keeping prices high for the remainder of the September pricing period.

Other factors affecting the 2018 COLA calculation

While higher gas prices boosted the COLA, other factors also influenced the final calculation. Housing prices increased 2.9% over the period with higher costs for both rent (3.8%) and home ownership (3.2%) pushing up the housing index.

Higher costs in some categories were partially offset by a 12.6% decline in the cost of wireless telephone service and a 2% decline in the prices for new and used motor vehicle prices.

Medicare care costs had a small effect on the COLA this year, with the index rising a moderate 2% compared with prior years.

Continued calls to change the COLA formula

Despite this year’s higher COLA, there continues to be calls for a change in the formula used to calculate the annual COLA.

Richard Thissen, president of the National Active and Retired Federal Employees Association (NARFE), issued the following statement in response to this year’s announcement:

Following two years of no and low cost-of-living adjustments (COLAs), today’s announcement was eagerly awaited by millions of Americans who rely on the increase to keep up with the rising prices for food, housing, gas and medical care. Unfortunately, the 2.0 percent COLA provides only partial relief and serves as a reminder that our method for calculating the increasing cost of goods and services is out of sync with the reality faced by federal annuitants, Social Security recipients and military retirees. Our nation’s seniors spend more than twice as much on medical care than the population measured by the current formula to calculate COLAs, the CPI-W. Congress must act to implement a new formula that adequately measures costs incurred by seniors.

This year if the COLA had been changed to another formula, such as the Bureau of Labor Statistics CPI-E to better reflect the purchasing patterns of seniors, most likely the 2018 COLA would be less than 2%.

The calculation of the Consumer Price Index is based on spending patterns. Seniors tend to use less gasoline because most no longer regularly commute long distances to work, so the higher gas prices would have a smaller impact on the COLA formula, while the CPI index measuring medical care costs is now rising more slowly resulting in a smaller impact on inflation.

This year’s new base sets a high base for next year

Next year, a COLA effective for December 2018 will be equal to the percentage increase (if any) in the CPI-W from the average for the third quarter of 2017 using the new base of 239.668. If there is no increase, or if the rounded increase is zero, there is no COLA for the year.

The last time the annual COLA exceeded 2% was in 2011, when after two years of no increases, the CPI rose sufficiently to give retirees a 3.6% increase in January 2012.

As noted at the start of this article, this year’s COLA was boosted by the presence of two hurricanes during the pricing period. If a similar occurrence, or some other unexpected event, does not repeat itself in 2018, then only a sustained pick-up in the level of inflation over the next year will move the index to a level that matches this year’s CPI.