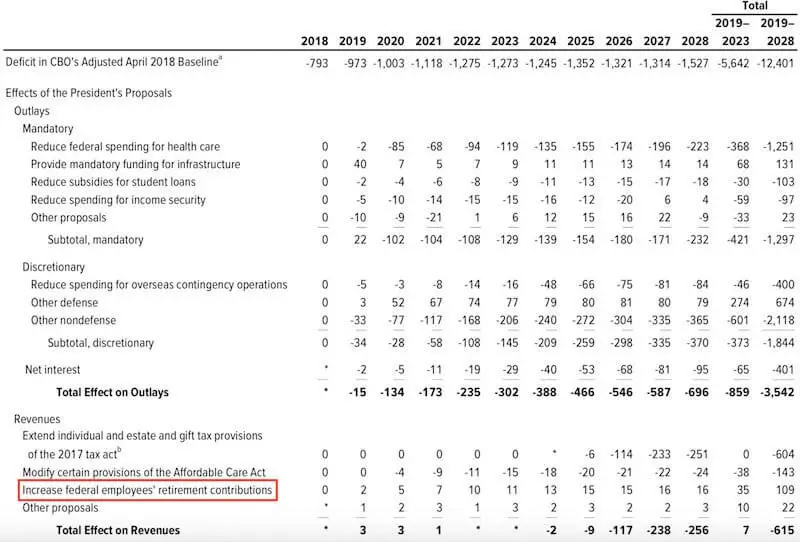

A recent Congressional Budget Office analysis of the White House’s 2019 budget blueprint found that the proposal to increase federal employees’ share of contributions to their retirement would result in significant savings.

CBO’s said in its analysis:

Increase Federal Employee Retirement Contributions

The President proposes to increase federal employees’ contributions to the defined benefit pension plan provided through the Federal Employees Retirement System. The proposal would boost those employees’ contributions by 1 percentage point per year until most employees contribute a total of about 7 percent of their before-tax pay (assuming that the actuarial valu- ation underlying the program remained unchanged). Currently, federal employees contribute between 0.8 and 4.9 percent of their before-tax pay. In CBO’s estimation, implementing that proposal would increase federal revenues by $109 billion over the 2019–2028 period.

The portion of the budget proposal CBO was referring to would raise the employee share of contributions to the Federal Employees Retirement System (FERS) to 50% of cost, but phase it in over several years to mitigate the impact.

For certain categories of federal employees, such as law enforcement and firefighting, employee contributions would increase, but the government would continue to pay a higher share of the normal cost.

For details, see Substantial Cuts to Federal Employee Benefits Proposed in FY 2019 Budget.