A new Government Accountability Office report shows just how bad the financial situation is with the Postal Service Retiree Health Benefits Fund (RHB).

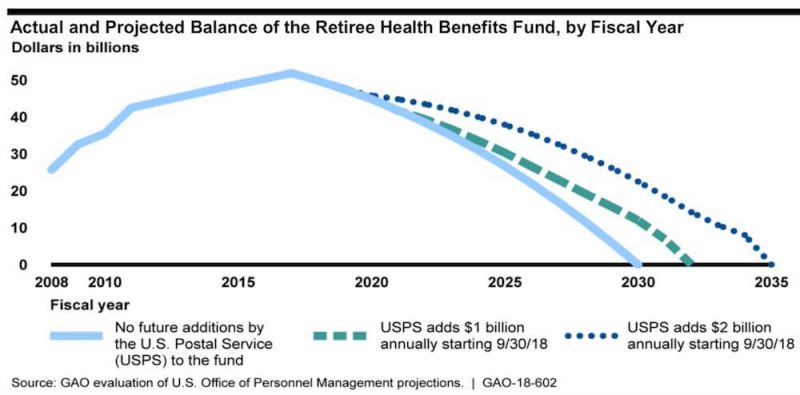

Because of the Postal Service’s poor financial condition (it is now going on 11 straight years of huge financial losses), it has defaulted on $38.2 billion in required payments to the RHB fund through fiscal year 2017. According to the GAO report, the fund will be depleted by 2030 if no other payments are made into the fund.

The Office of Personnel Management (OPM) had to start drawing from the fund to pay the Postal Service’s share of premiums for retiree health benefits in FY 2017. Based on the status quo, OPM projects that future payments will continue to exceed the fund’s income from interest earned on investments.

Currently, there are 500,000 Postal retirees that receive benefits, and OPM expects this number to remain constant through 2035.

GAO’s Recommendations

GAO made a variety of recommendations to address the fund’s financial situation. All of them would require action from Congress. The information that follows describes the possible solutions along with their potential effects and is taken verbatim from GAO’s report.

Approaches that would shift costs to the federal government

Medicare Integration

Various legislative proposals have been made to generally require postal retirees to participate in Medicare, which would increase their level of participation. Increased participation in Medicare would shift primary responsibility for covering certain health care services to Medicare for those who enroll.

Requiring retirees to use Medicare would decrease the U.S. Postal Service’s (USPS) costs but increase Medicare’s costs, according to analyses of past legislation by the Congressional Budget Office. The primary policy decision for Congress to make is whether to increase postal retirees’ use of Medicare.

Supplemental federal appropriations

If the Postal Service Retiree Health Benefits Fund (RHB Fund) is depleted and USPS does not fill the financial gap, appropriations could be provided.

Using federal appropriations could help benefits continue at the same level if Congress so desires. However such an action could increase the federal budget deficit. In addition, supplemental appropriations for postal retiree health benefits would be inconsistent with USPS functioning as a self- financing entity that covers its costs with revenue it generates.

Approaches that would reduce benefits or increase costs to postal retirees and/or employees

Tighten eligibility/reduce or eliminate retiree health benefits

As some companies and state governments have done, eligibility restrictions could be tightened for postal retiree health benefits, such as making new hires ineligible to receive retiree health benefits, or other actions could reduce the level of benefits or even eliminate benefits.

Tightening eligibility would reduce USPS’s liability for postal retiree health benefits, and thus reduce its unfunded liability. Effects on current and/or future retirees would depend on the specific actions taken.

Increase postal retiree and employee premium payments

As some companies and state governments have done, retirees could be required to pay a larger share of premiums, or employees could be required to pay for retiree health benefits before they retire.

Shifting costs to retirees and/or employees would reduce the expenses of the RHB Fund. Depending on how much costs are shifted to retirees, this approach could increase any financial challenges the retirees may face.

Change the federal contribution to a fixed subsidy

As some companies and state governments have done, benefits could be shifted to a defined contribution structure with a fixed amount subsidizing the benefit. This amount could be adjusted over time; any adjustments might or might not keep up with costs.

Using a fixed subsidy could decrease RHB Fund costs and required USPS payments and increase incentives for retirees to make less costly health care decisions. However, it also could result in greater cost exposure for retirees, costs that could lead to difficult decisions regarding health care.

Establish a non-federal voluntary employees’ beneficiary association (VEBA)

As some companies have done to provide retiree health benefits separately from the employer, a VEBA outside the federal government could be established to provide postal retiree health benefits instead of the current federal program. The VEBA would determine what benefits would be provided to its members— which could include retirees and employees—what payments members would make, and how the VEBA’s assets would be invested.

VEBA effects would depend on the VEBA’s governance structure and its determinations of benefit levels, funding sources, level of funding, type of investments, and associated market risks. Such determinations would include the level of initial funding and its sources, such as whether it would come from the RHB Fund and/or the Treasury, as well what funds would be provided to the VEBA going forward.

Approaches that would change how benefits are financed

Reduce the required level of prefunding

Proposed legislation would reduce the prefunding target for the RHB Fund from 100 percent to 80 percent.

Reducing the required funding level would reduce USPS’s required payments to the fund but could increase costs for future postal ratepayers and increase the risk that USPS may not be able to pay for these costs.

Outside investment

Proposed legislation would initially require 25 percent of RHB Fund assets to be invested outside U.S. Treasury securities, with the goal of seeking greater returns.

Allowing outside investment could lead to a higher rate of return on RHB Fund assets and reduce long-term funding needs. However, assets invested in non-Treasury securities may experience losses in a market downturn and would thus reduce assets available for health care.

Recent Proposals to Reform the Postal Service

The GAO report is the latest effort to underscore the severity of the financial problems with the Postal Service, but others have also taken notice.

Legislation Introduced

Legislation was introduced in the current Congress to make reforms to the Postal Service, portions of which were echoed in the GAO report.

The Senate bill would make Medicare mandatory for some Postal retirees by creating a new Postal Service Health Benefits Program (PSHBP) within the Federal Employees Health Benefits Program (FEHB), implemented and administered by OPM, for all postal employees and annuitants, and require all Medicare-eligible postal annuitants and employees enrolled in the PSHBP to also enroll in Medicare, including parts A, B and D.

The House bill took a similar approach, requiring Medicare eligible Postal Service retirees and family members to enroll in Medicare parts A and B and also stipulates that the Postal Service will cover a decreasing portion of the Medicare Part B premium for current retirees transitioned into Medicare as a result of the legislation over a 4-year transition period: 75% in the first year; 50% in the second year; 25% in the third year; and 0% in the fourth year.

Neither bill is likely to advance in the remaining days of the current session of Congress.

White House Task Force

The White House has taken notice of the Postal Service’s financial problems and has suggested that reforms are needed to avoid a “taxpayer-financed bailout” should its current course remain unchanged.

President Trump echoed this concern when he signed an executive order in April directing that a task force be established to make recommendations on administrative and legislative reforms for the Postal Service.

Bottom Line

One concern that has been raised is that any reforms to the Postal Service could drive up the costs of mailing packages. The Package Coalition, for example, was formed to oppose any changes it feels would raise package prices. It’s stated goal is “preserving affordable, reliable postal package delivery services” from the Postal Service.

However, the current financial situation with the Postal Service cannot continue in perpetuity as GAO makes clear in its report; the math makes doing so impossible. It’s likely only a matter of time before changes of some kind have to happen.