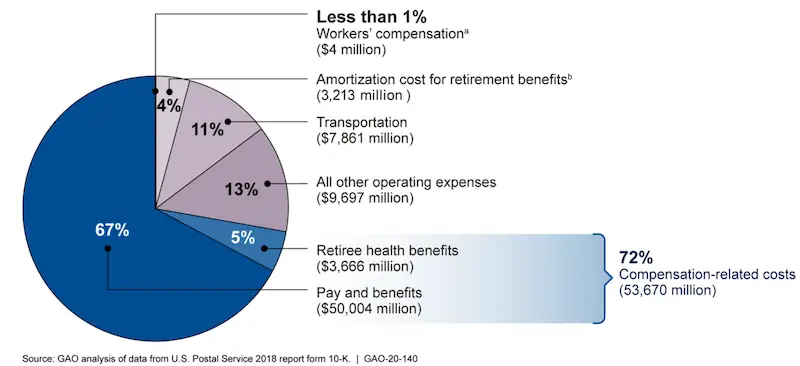

A recent report from the Government Accountability Office illustrates how much employee compensation costs are weighing on the Postal Service.

Collectively, employee compensation related costs comprise 72% of the Postal Service’s total costs. 67% of that is pay and benefits and 5% is retiree health benefits.

But That’s Not the Real Story…

So USPS has cut some labor costs for its current workers. For an agency struggling as much as it is financially, that’s good news.

But that’s not really the big story in this GAO report. A figure that really jumps out is how far behind the Postal Service is in paying for retirement benefits.

All told, the Postal Service is $110 billion in the hole on funding retiree health benefits and pension payments, and it’s probably worse than that, because the figures GAO cited in its report were as of September 30, 2018.

The Postal Service cannot afford these payments, so it has been continually defaulting on them. What is going to happen if this continues? Apparently, nobody really knows.

GAO issued a report in 2018 that looked at the severity of the situation at that time. It wrote:

If the [Postal Service Retiree Health Benefits] fund becomes depleted, USPS would be required by law to make the payments necessary to cover its share of health benefits premiums for current postal retirees. Current law does not address what would happen if the fund becomes depleted and USPS does not make payments to cover those premiums. Depletion of the fund could affect postal retirees as well as USPS, customers, and other stakeholders, including the federal government. About 500,000 postal retirees receive health benefits and OPM expects that number to remain about the same through 2035. (emphasis added)

In other words, there is no contingency plan for the fund going bankrupt under current law. Any retirees who are planning on relying on the Postal Service for their retirement down the road might want to think about having some backup plans in place. Barring a course correction, the fund is on track to be depleted by 2030.

Improvement is Unlikely

GAO also said in its latest report that there are “implementation challenges” to the Postal Service overcoming its dire financial situation which is a nice way of saying things aren’t terribly likely to change.

GAO said that if legislation were enacted that allowed the agency to cut retirement benefits, it would need to negotiate the changes with its unions, and they are not likely to be wild about cuts.

The same goes for making pay cuts. GAO said, “If USPS was provided authority to determine pay rates for its employees without going through collective bargaining, it could reduce employee compensation costs through pay cuts.”

But this is not so simple. GAO also said, “All of the union officials we spoke with said that they would not support the removal of collective bargaining rights over pay.”

And, collective bargaining issues aside, GAO also said that there could be negative consequences to reducing pay such as morale problems or losing some employees.

But the bottom line is that the math says something has to eventually give. GAO is sounding alarms in its reports about the course correction needed for the Postal Service, and its mounting losses paint a grim picture. Whether Congress, the Post Office and its unions will work to take action or just keep ignoring the problem remains to be seen.