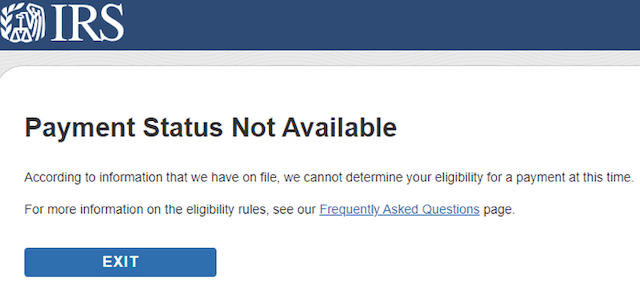

Many people have reported that they encounter a message like the one above that reads “Payment Status Not Available” when they use the Get My Payment application that was set up by the IRS to check one’s coronavirus stimulus payment status. Several FedSmith users have told us that they encountered the same message when using the online application.

The IRS has issued a statement explaining why this is the case.

According to the agency, the application will respond with “Status Not Available” for the following reasons:

- If you are not eligible for a payment (see IRS.gov on who is eligible and who is not eligible)

- If you are required to file a tax return and have not filed in tax year 2018 or 2019.

- If you recently filed your return or provided information through Non-Filers: Enter Your Payment Info on IRS.gov. Your payment status will be updated when processing is completed.

- If you are a SSA or RRB Form 1099 recipient, SSI or VA benefit recipient – the IRS is working with your agency to issue your payment; your information is not available in this app yet.

The IRS also said that you can check the application again later to see if there has been an update to your information, but advised that the Get My Payment application is only updated once per day, so there’s no need to check more often than that.

The IRS has also provided a list of frequently asked questions about the Get My Payment application on its website.

The agency said it plans to send letters to payment recipients after the payments are made:

For security reasons, the IRS plans to mail a letter about the economic impact payment to the taxpayer’s last known address within 15 days after the payment is paid. The letter will provide information on how the payment was made and how to report any failure to receive the payment. If a taxpayer is unsure they’re receiving a legitimate letter, the IRS urges taxpayers to visit IRS.gov first to protect against scam artists.

Tax Refund Anticipation Loans

The Treasury Department also says that a glitch with some tax preparation services is causing some people to not get their stimulus payments.

If taxpayers filed through tax-prep services such as H&R Block or TurboTax and received tax refund anticipation loans, this could be the culprit. This is because the IRS doesn’t have direct deposit information for these taxpayers.

In these cases, the Treasury Department says that these taxpayers should use the Get My Payment application to submit their bank account information to have the stimulus payments direct deposited into their accounts.

IRS Says All is Well

The IRS also responded to reports that were critical of its application and said that the Get My Payment application is “operating smoothly and effectively.”

The agency said in a statement, “As of mid-day today [April 15], more than 6.2 million taxpayers have successfully received their payment status and almost 1.1 million taxpayers have successfully provided banking information, ensuring a direct deposit will be quickly sent. IRS is actively monitoring site volume; if site volume gets too high, users are sent to an online ‘waiting room’ for a brief wait until space becomes available, much like private sector online sites. Media reports saying the tool ‘crashed’ are inaccurate.”

The #IRS Get My Payment tool is operating at record volumes. So far, 9.8M people got an Economic Impact Payment status and 1.6M provided direct deposit info. In some situations, the app responds: Status Not Available. Learn what this means at https://t.co/z4wFEL6Sb2 pic.twitter.com/3BvNibfZ69

— IRS (@IRSnews) April 15, 2020