So far in 2021, returns for investors in the Thrift Savings Plan have been positive. Through February 19, 2021, most of the TSP core funds are ahead for the year. The C Fund is up 4.23%, the S Fund is up 13.07% and the I Fund is up 4.05%. For the bond funds, the G Fund is up 0.13%.

As of February 19th, the F Fund is showing a loss for the year-to-date of -1.77%.

At the end of January 2021, the FERS participation rate in the Thrift Savings Plan (TSP) was 94.1%. This is an all-time high water mark for participation. The Uniformed Services active duty participation rate is now at 76.7%.

Update on TSP Performance in 2021

With the core TSP Funds off to a strong start, all of the Lifecycle Funds are also doing well. Five of the L Funds have a return of more than 4% so far in 2021. These funds are the L 2045 (4.06%), L 2050 (4.35%), L 2055 (5.44%), L 2060 (5.44%) and L 2065 (5.44%). These are the more aggressive TSP Lifecycle Funds as their percentage of stocks in each fund is higher.

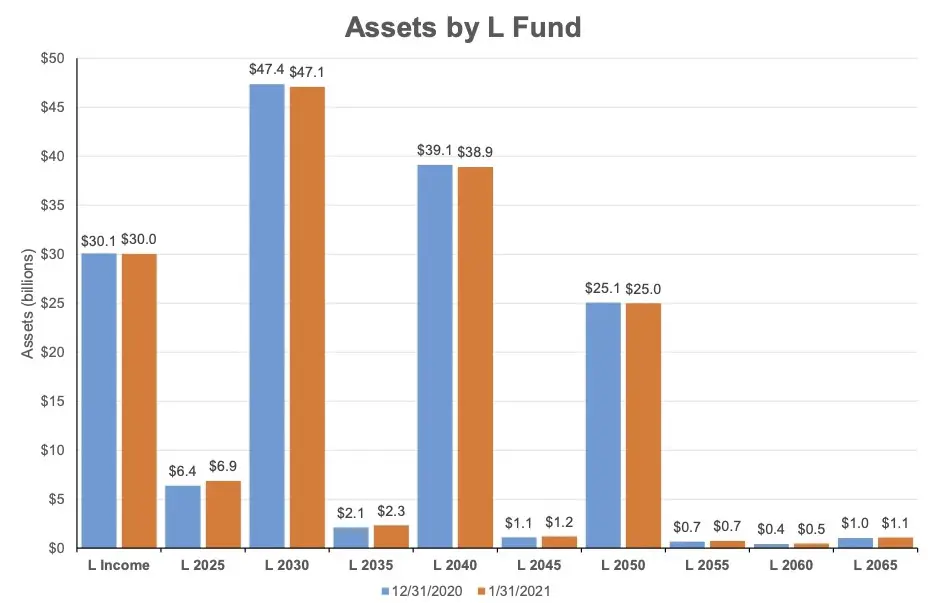

This chart shows the assets in each of the Lifecycle Funds as of the end of January 2021.

Overall, here is how TSP participants have allocated their investments in the TSP:

| Fund | Share of Total Assets |

| G | 30.7% |

| F | 4.1% |

| C | 28.2% |

| S | 11.6% |

| I | 3.7% |

| L Funds | 21.7% |

Call Center Delays

The recent harsh weather throughout Texas effectively cut off one of the TSP call centers with over 150 agents impacted. Losing this many agents to handle calls from TSP participants created some delays in answering calls. Shifting calls to other centers would not compensate for the loss of that many people to answer questions. Service is being restored as the severe weather returns to a more normal pattern.

The call center performance is improving but still below the optimal service levels in answering queries.

Adding New Investment Manager

State Street Global Advisors (SSGA) is now under contract with The Federal Retirement Thrift Investment Board (FRTIB) as the TSP’s second investment manager. The Board is in the process of establishing SSGA’s ability to serve as an investment manager for the TSP and orchestrating the transfers of assets to move portions of the F, C, S, and I Funds from BlackRock (the other investment manager) to SSGA.

About 10% of the assets in the C Fund will be transferred to SSGA in April. 20% of the S Fund assets will be transferred to SSGA in May. 20% of the I Fund assets will be transferred to SSGA at a later date.

To quickly find daily, monthly and annual results for all funds in the Thrift Savings Plan, check out the newly redesigned TSPDataCenter.com. FedSmith will provide an update on TSP performance on March 1, 2021.