Inflation is up in 2021. The rate of inflation is increasing based on the latest calculations.

The amount of a cost of living adjustment (COLA) in 2021 will impact all Social Security recipients and federal retirees. As a result, the annual COLA calculation impacts millions of Americans, including retirees of the federal government.

We will not know the amount of the 2022 increase until mid-October. The system for calculating the COLA increase is only based on the average of the months of July, August, and September. The calculation uses one specific CPI from the Bureau of Labor Statistics (BLS) to calculate your COLA for the next year.

Calculating Your “Retiree Raise” for Next Year

The CPI-W is the current index used for measuring increases in the prices of consumer goods, including food and beverages, housing, clothing, transportation, medical care, recreation, education, and communication, among others. The annual increase is calculated by the Bureau of Labor Statistics.

Another index has been created that would have advantages for older Americans but is not used. The CPI-E (E stands for “Elderly”) increases the importance of expenses for older Americans in its calculation. The main difference between CPI-W and CPI-E is the proportion allocated to medical-care spending, which for the elderly is about double the medical expenses of the general population. The elderly also spend more on housing than younger Americans.

3% COLA Projected for 2022

Inflation is picking up according to BLS. Anyone who has gassed up a car in the last several months has noticed a significant increase in the cost per gallon.

And, based on the latest calculations from BLS, the cost of gas went up 9.1% in March. This is a 12-month increase of 22%. The cost of food is up 3.5% over the last 12 months.

Overall, using the CPI-W index, through March 2021, the index is 2.2% higher than the average CPI-W for the third quarter of 2020.

In effect, the rate of inflation is increasing. While the current index is up 2.2%, the inflation rate is expected to increase.

Kiplinger’s estimates that the bump in retiree payments will go up 3% in 2022—the largest increase since 2012. However, Kiplinger’s estimate was made in March and the inflation for the most recent month was not included. Based on the latest increase, and expectations that inflation will go higher during the rest of the year, it is likely the 3% estimate will turn out to be too low.

Recent COLA Increases

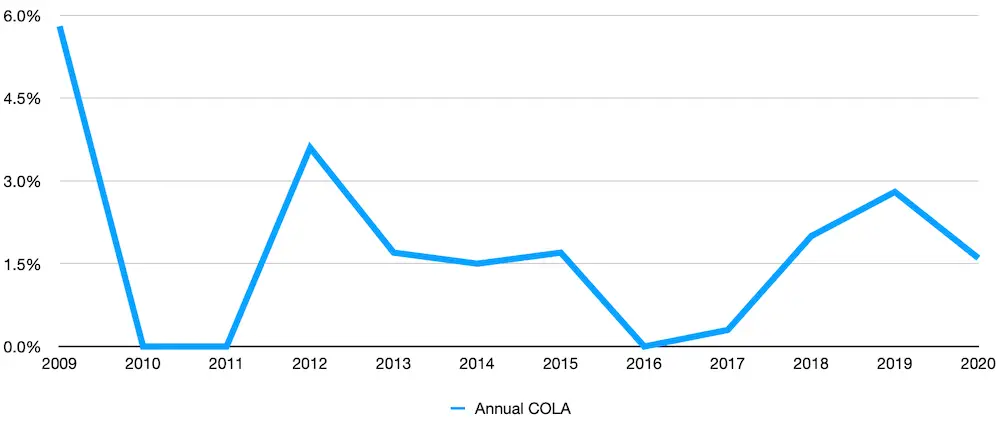

In January 2021, federal retirees received a 1.3% increase for Civil Service Retirement System (CSRS) annuities, Federal Employees Retirement System (FERS) annuities, and Social Security benefits. The 2021 increase was the smallest COLA since 2017. The largest increase in recent years was the 3.6% increase in 2012. There were three years when there was no COLA increase due to low inflation.

Here are the recent COLA increases by year:

- 2021: 1.3%

- 2020: 1.6%

- 2019: 2.8%

- 2018: 2.0%

- 2017: 0.3%

- 2016: 0%

- 2015: 1.7%

- 2014: 1.5%

- 2013: 1.7%

- 2012: 3.6%

- 2011: 0%

- 2010: 0%

- 2009: 5.8%

More Money, Higher Inflation, Less Purchasing Power?

The reason your COLA will be going up more in 2022 than in more recent years is because inflation is going up. Higher inflation means your expenses will increase. For those who are retired, the type of expenses you are likely to have after retiring are likely to be different than when you were working.

Even more importantly, the expenses older Americans are experiencing are often not given as much weight in the relevant index as expenses that are not as important to retirees. This means that while your retirement income may increase, your actual purchasing power will go down.

In other words, you can buy fewer goods and services than in previous years because your money is worth less than it used to be because of inflation. So, while news of a higher COLA rate may give you a short-term emotional high, in the bigger picture your financial security may be going down each month.

Reasons for Inflation

Reasons for a rising inflation rate are complex, and inflation can go up for a number of reasons. As our country is recovering from a pandemic, demand for goods and services is increasing. Manufacturers are having a hard time meeting the demand in some instances and shortages pop up. When this occurs, prices go up.

There is a tremendous amount of money to be spent that has been approved by Congress. Trillions of dollars are or will be inserted into the economy. When the money supply expands, it lowers the value of the dollar. When the dollar declines compared to foreign currencies, the prices of imports rise. That increases prices in our economy.

High inflation can create significant economic problems. Under the Carter administration, for example, inflation went as high as 14.8%. Interest rates went up to as much as 18% from 1977-1981. By 1985-1990, this situation contributed to the failure of Savings and Loan Associations. These institutions had taken on many loans, especially in real estate, which could not be repaid.

Inflation and Federal Government Deficits

President Carter pledged to eliminate federal deficits. Despite this intention, the deficit for fiscal year 1979 was $27.7 billion. In 1980, it was approximately $59 billion. Inflation had been growing since 1965 so the problem with inflation obviously preceded President Carter but it got worse during his administration. And, while the federal budget deficit was thought to be very high under his administration, those figures pale in comparison to recent years.

Federal Spending: Then and Now

Adjusted for inflation, $59,000,000,000 in 1980 is equal to $200,364,615,385 in 2021. Annual inflation over the period from 1980 to 2021 was 3.03%.

The Federal Government’s debt at the end of March 2021 was $22.0 trillion. At the end of March 2020, the debt was $17.7 trillion. The deficit in Fiscal Year 2020, and so far in Fiscal Year 2021, has pushed up the current amount of debt held by the public by 24 percent in one year.

One analysis on inflation, the economy and the federal deficit from the Carter era concluded:

[T]he Carter administration made the basic mistake of believing it could stimulate a faster recovery without reigniting inflation because of high unemployment and surplus industrial capacity. It stepped up federal spending. It encouraged the Fed to follow an easy money policy. The result was a solid recovery—but also accelerated inflation.

Inflation, COLA’s and Federal Spending and Debt

Will the increasing amount of government spending and debt lead to higher inflation? If it does, your COLA will go up. Your actual purchasing power is likely to go down.

America’s leaders disagree on the impact of deficit spending and how much inflation will go up. The sheer amount of spending and debt the government is taking on will certainly test the hypothesis of how much debt a country can absorb and contain the rate of inflation.

We know that the rate of inflation is increasing. We do not know if the inflation rate will continue to increase and certainly do not know how much it will increase.

How Much Debt is Too Much?

Wages for currently employed Americans tend to go up in an inflationary environment. Social Security payments and other payments to retirees of the federal government will also go up. The rate of any COLA increase is based on an automatic calculation formula. It is very unlikely the increase in payments will match the loss of purchasing power. In many cases, retirees fare less well than currently employed workers as employers will increase wages as necessary to keep critical employees.

The result is that all Americans are involved in a vast experiment concerning government spending. Governments tend to take on too much debt because the benefits provided to citizens (and some who are not citizens) can make government leaders popular with voters. In other words, “vote for me and my party, and we will provide more free benefits.”

Increasing the debt load, to a point, also allows government leaders to increase spending without raising taxes which can make more people happy with current leadership.

But here is one analysis of what can happen:

In the long run, public debt that’s too large is like driving with the emergency brake on. Investors drive up interest rates in return for the increased risk of default. That makes the components of economic expansion, such as housing, business growth, and auto loans, more expensive. To avoid this burden, governments need to carefully find that sweet spot of public debt. It must be large enough to drive economic growth but small enough to keep interest rates low.

How much government debt is too much?

America is unique in many ways. We can absorb expenses many countries cannot before going into a “sovereign default” or sovereign debt crisis. Currently, any default seems highly unlikely. An increasing rate of inflation, and an increase in interest rates—including what the government has to spend to finance its huge debt—may create problems similar to what other countries have experienced when deficit spending becomes too large.

In other words, we do not know how much debt the United States can successfully manage. Both Democrats and Republicans appear to be intent on finding the upper limit.