One of the best parts about being a federal employee is your pension, and one of the best parts of your pension is the cost of living adjustments (COLA) that you receive in retirement.

For those that are new to the subject, COLAs allow your pension to increase based on inflation. This is a big deal in helping you maintain your standard of living over time.

But as FERS employees, the problem is that your pension doesn’t always keep up with inflation.

While the 2022 COLA looks like it will be the largest it’s been in 10 years (that’s the good news), it also looks like it will lag behind inflation by the biggest margin in 10 years (that’s the bad news).

2022 FERS Pension COLA

The COLAs are announced in October of every year, so the COLA for 2022 is not determined yet, but if the year continues on its current trend, then inflation (CPI-W) will be about 5%-6%.

This means that next year’s FERS pension checks (assuming you are eligible for COLAs) will probably be 4%-5% higher than they are right now. This is way higher than it has been in recent years with only 2009’s COLA of 4.8% being even comparable.

Here is the last 20 years of FERS COLAs:

| 2020 | 1.6% |

| 2019 | 2.0% |

| 2018 | 2.0% |

| 2017 | 0.3% |

| 2016 | 0% |

| 2015 | 1.7% |

| 2014 | 1.5% |

| 2013 | 1.7% |

| 2012 | 2.6% |

| 2011 | 0% |

| 2010 | 0% |

| 2009 | 4.8% |

| 2008 | 2% |

| 2007 | 2.3% |

| 2006 | 3.1% |

| 2005 | 2.0% |

| 2004 | 2.0% |

| 2003 | 1.4% |

| 2002 | 2.0% |

| 2001 | 2.5% |

| 2000 | 2.0% |

Why a Big COLA is Bad For FERS

Your FERS pension COLA is based on the CPI-W which is an index that is used as a proxy for inflation. Basically, if the CPI-W shows that prices have gone up then FERS pensions will go up as well.

Social Security and CSRS pensions get COLAs based on exactly what the CPI-W grew by but the COLA for FERS pensions isn’t as generous.

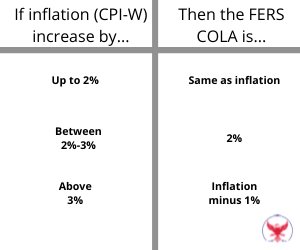

This is how it works.

So basically, if inflation is less than 2% per year, then your FERS pension will keep up 100%, but if inflation rises above 2% then it will lag behind. When inflation is above 3%, then FERS pensions will lag a whole 1% behind inflation every year that occurs.

That is why it is not great for FERS retirees when inflation is high. While your pension will increase the cost of everything you normally buy increases by a larger amount. While 1 year of this might not make a huge difference, it certainly will compounded over multiple years.

So as the law stands today, FERS retirees better hope that above average inflation doesn’t become a norm in the coming years.