Investors in the Thrift Savings Plan (TSP) are having a very good year so far in 2021.

As of August 23, the C Fund has provided investors with a return of 20.36%. The S Fund has the 2nd highest rate of return at 13.50% and the I Fund is at 10.79%. The popular G Fund has returned 0.85% so far.

Among the Lifecycle Funds (L Funds), the L 2055 Fund has the best return for the year at 15.86%. The L Income Fund, a conservative fund investment, has returned 4.15% in 2021. Here is a chart displaying the year-to-date returns for all of the funds in the TSP.

YTD Returns for TSP Funds

| FUND | YTD |

| G Fund | 0.85% |

| F Fund | -0.46% |

| C Fund | 20.36% |

| S Fund | 13.50% |

| I Fund | 10.79% |

| L Income | 4.15% |

| L 2025 | 7.77% |

| L 2030 | 9.79% |

| L 2035 | 10.67% |

| L 2040 | 11.55% |

| L 2045 | 12.30% |

| L 2050 | 13.06% |

| L 2055 | 15.86% |

TSP Is Effectively Nation’s Largest 401(k) Fund

The Thrift Savings Plan now has more than $780 billion under its management. The federal Thrift Savings Plan is effectively the largest 401(k) retirement fund in the United States. It is not technically a 401(k) fund as it is not organized under this section of the IRS code. But, according to Morningstar, “Effectively, though, TSP walks like a 401(k), talks like a 401(k), and quacks like a 401(k), which makes it in my book the world’s largest such plan…”

For comparison purposes, the largest actual 401(k) fund is the Boeing fund which recently had about $50 billion in its plan. For those not paying close attention, $780 billion is a much bigger number.

High Satisfaction Among TSP Investors

In the participant satisfaction survey distributed for the last meeting of the Federal Retirement Thrift Investment Board (FRTIB), 89% of TSP participants are satisfied or extremely satisfied with the Thrift Savings Plan.

In fact, the TSP is on track to surpass the historical high annual participation rates of 93.5% for FERS employees and 71.8% for uniformed services set in 2020.

An organization with more than $780 billion in assets is bound to get attention—and it does. Sometimes those with an economic or political agenda want to change the TSP so some of that money flows into their favorite issues or favored constituents.

More recently, climate change has been an issue that has drawn attention to the TSP, including from the President of the United States and the GAO. The implication was that the TSP was not adequately taking into account the impact of climate change and therefore putting TSP investors at risk.

In other words, according to those seeking these most recent proposed changes, TSP investors should be very afraid and jump on to their bandwagon. Perhaps they are right. Perhaps they are just political opportunists. Accurately predicting the future is a tough proposition.

Satisfaction among TSP investors is very high. Therefore, it is not surprising that in a recent survey of readers, 88% of respondents said they did not intend to invest in ESG funds if or when they become available and 71% thought that adding a mutual fund window would increase the risk to TSP investors.

A View of the TSP From An Industry Analyst

Making significant changes in a massive program as successful as the Thrift Investment Plan involves risk, it may impact the satisfaction of the program by investors, and politics is always lurking in the background with a public plan such as the TSP which controls very large investments.

How has the TSP performed? Has it done well for investors?

Here are observations from Morningstar about the TSP (Morningstar is a respected source of information, analysis, and ratings on funds in individual securities):

One would expect such a gargantuan plan, containing the retirement assets for 6 million federal employees, to be run cautiously. Let smaller organizations attempt to lead the charts. The important thing for TSP is to avoid conspicuous failure. No matter how the markets behave, TSP should always perform at least respectably. The 800-pound gorilla cannot be a turkey.

During TSP’s history (the plan was founded in 1986), the investment markets have been extraordinarily generous. Both stocks and bonds have enjoyed almost continuous bull markets, returning far above the inflation rate. To succeed, all that 401(k) plan sponsors needed to do was provide their plan participants with open, low-cost access to the markets and then get out of the way. TSP’s board did just that.

Role of Lifecycle Funds in the TSP

One criticism of the TSP is the large percentage of assets in the G Fund. The G Fund is the TSP’s equivalent of a money market fund. While the percentage of investor assets in the G Fund is dropping, at the end of July, 26.8% of participant allocation of their investments are in the G Fund.

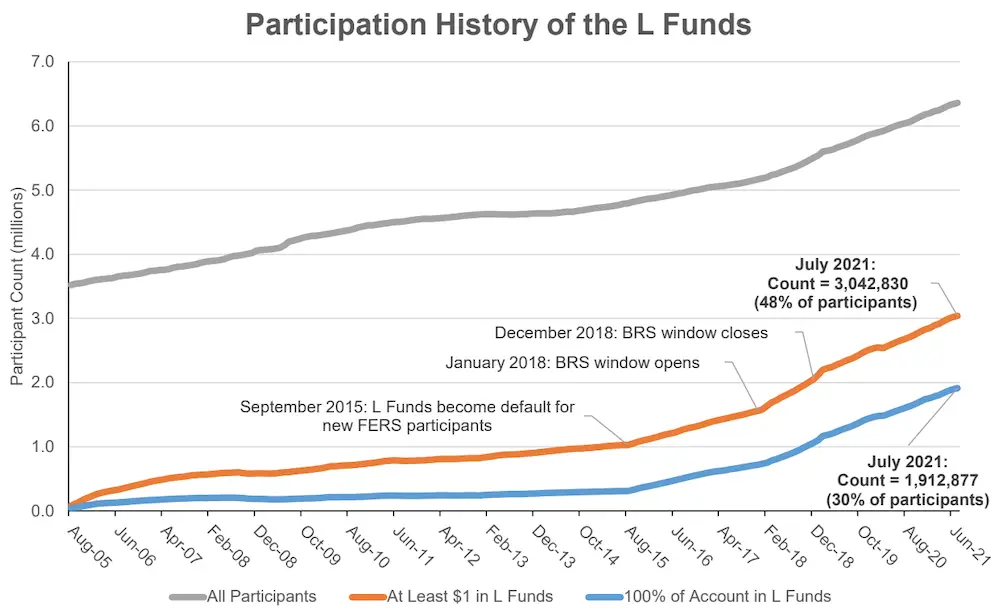

No doubt, the Lifecycle Funds are drawing money away from the G Fund. 22.5% of investor assets were in Lifecycle funds at the end of July. The chart below from the TSP shows how investments in the Lifecycle Funds have grown.

For those investors who moved from the G Fund into the more aggressive funds, including the Lifecycle Funds, their investments have grown larger than they would have by remaining in the G Fund as the stock market has done very well in recent years.

Summary

No doubt, the TSP will continue to evolve as it has since it started in 1986. Changes have been well thought out before they were introduced, investment returns have been very good, the FRTIB has avoided yielding to political pressure despite operating in a political environment, and the program has become the “$780 Billion Gorilla” for retirement assets. TSP investor satisfaction is high and little doubt the TSP has been a big success.

New members of the FRTIB will be coming on board, the president has taken a personal interest in the TSP with the issuance of an Executive Order that will impact the program, and various interest groups with an agenda that aligns with the current administration will bring new challenges to the management of the TSP that the program has not faced in the past.

TSP investors are certainly hoping for the best and the continued success of the program which plays such a large role in their future retirement income. When the program was introduced, the thought of a federal program investing in private securities as a significant part of the federal retirement program was new and, no doubt, viewed with a jaundiced eye. In hindsight, the program has probably exceeded the expectations of both skeptics and knowledgeable investors.

With good management and a stroke of luck, looking back on the TSP 25 or 30 years from now will result in similar accolades for the program. We wish the FRTIB continued success in managing the challenges ahead.