Thrift Savings Plan (TSP) investors that pay close attention to their investment balance in the TSP may recall the headline for the month of September: Worst Drop in Core Stock Funds Since March 2020. A headline like this understandably will make some investors uncomfortable.

More importantly, how have your TSP investments performed so far this month?

Core TSP Fund Results in October

Here are the results for the TSP core funds for October and for the year-to-date as of the close of markets on October 26, 2021.

| Name of Fund | + or – % | YTD |

| G Fund | 0.1% | 1.10% |

| F Fund | -0.3% | -1.70% |

| C Fund | 6.27% | 23.17% |

| S Fund | 5.60% | 17.93% |

| I Fund | 2.93% | 11.74% |

The good news: While the C, S, and I Funds all went down in September, these funds are positive so far in October. The core funds have not gained back as much as they lost in September, but the gains listed in the chart above are healthy gains nevertheless.

TSP Roth Investors Continue to Increase in Number

The Thrift Savings Plan (TSP) is highlighting that there are now nearly two million investors in Roth accounts. This is 31% of the total number of TSP participants.

37% of TSP participants are uniformed services members but about 60% of Roth TSP accounts are held by this group.

The number of beneficiary participants is also continuing to go up and there were 34,746 beneficiary TSP participants as of September 2021.

| Total Number of Participants | Average Balance | Number of Roth Participants | Average Roth Balance | |

| FERS | 3,739,036 | $174,136 | 774,178 | $21,585 |

| CSRS | 277,536 | $187,693 | 10,126 | $30,305 |

| Uniformed Services | 1,357,272 | $38,062 | 614,427 | $16,629 |

| BRS Participants | 1,027,446 | $10,055 | 584,305 | $9,108 |

| Bene Participants | 34,746 | $137,097 | 1,968 | $13,744 |

| Total | 6,436,036 | $120,288 | 1,985,004 | $16,401 |

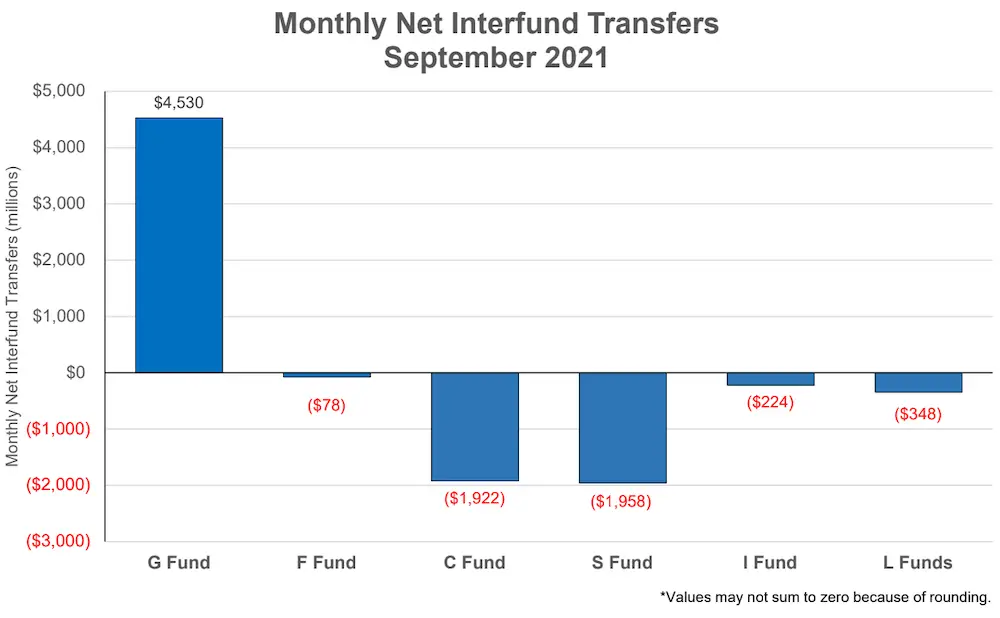

Interfund Transfers in September

Perhaps as a result of the stock market declining in September, TSP investors transferred about $4.5 billion into the G Fund during that month. At the same time, they transferred $1.9 billion out of the C Fund, $1.9 billion out of the S Fund, $224 million out of the I Fund, and $348 million out of the Lifecycle Funds.

While these transfers involve large amounts of money, most TSP investors are not prolific traders. They tend to be long-term investors. So, while the number of dollars transferred are big numbers, put this into perspective. At the end of September, there is more than $774 billion in assets in the TSP.

C Fund Still Largest Core Fund

As of September 30, 31% of participant allocation of their investments are in the C Fund. 27.7% of funds are in the G Fund and 11.6% are in the S Fund. The I Fund has 3.8% of funds and the F Fund has 3.3%.

Assets in the Lifecycle Funds

As of September 30, the Lifecycle Fund with the largest amount invested is the L 2030 Fund with $51.6 billion in assets. Here is how much is in each Lifecycle Fund.

| Fund | Assets (in Billions) |

| L Income | $30.5 |

| L 2025 | $9.5 |

| L 2030 | $51.6 |

| L 2035 | $4.0 |

| L 2040 | $43.6 |

| L 2045 | $2.1 |

| L 2050 | $29.6 |

| L 2055 | $1.5 |

| L 2060 | $1.0 |

| L 2065 | $1.9 |

In looking at these amounts for each fund, keep in mind that new Lifecycle Funds were introduced on July 1, 2020. The funds with the lowest amounts are the new funds that have been available since that date. (See New L Funds Launching July 1)

Inflation and the Stock Market

Inflation has been in the news recently, particularly with regard to the amount of the annual cost-of-living adjustment (COLA) for Social Security and federal employee retirees.

Administration officials and others have stated on various occasions that the rising inflation rate is “transitory” meaning the underlying reasons for inflation will change and there is no reason for concern about inflation being a big factor for more than a few months.

That reassurance is not holding up. As one billionaire investor stated recently: “I think to me the No. 1 issue facing Main Street investors is inflation, and it’s pretty clear to me that inflation is not transitory…It’s probably the single biggest threat to certainly financial markets and I think to society just in general.”

Rapidly rising inflation is not good for the stock market. Stock prices are valued largely on corporate profits. Higher interest rates cut into profits. If the underlying reason for higher rates is inflation, rising prices and wages also increase a company’s costs. These factors also have a negative impact on stock prices.

In short, rapidly rising inflation is not good for stock prices if it continues for a longer time period.

With regard to “transitory” inflation, here is a quote on the reliability of predictions from governments and central bankers about “transitory” inflation:

[T]he official line of both central banks, and that of the ECB (European Central Bank), is that inflation pressures are transitory. That stretches credulity. Supply chain disruptions, including those that are pushing up shipping costs, are likely to persist longer than policymakers anticipated; energy prices paid by households are soaring, and wages are rising and could pick up further.

https://www.reuters.com/breakingviews/transitory-inflation-is-fig-leaf-thats-slipping-2021-09-23/

In short, no one will watch over your retirement investments like an individual investor. Politicians and other officials have a vested interest in making people feel good and will often downplay the negative impact government policies may have on the stock market.

Inflation is a concern for investors. Large government programs for adding more money into the economy can also impact stock prices—sometimes in a positive way and in a negative way at other times. Adding more trillions into the money supply on top of the “emergency” spending from the COVID pandemic could result in inflation lasting longer and rising more rapidly than anticipated.

In other words, pay attention to financial and market news and do not take casual reassurance from top-level officials about why their policies will lead to positive results. For stock market investors, including those in the TSP, there are may be more good reasons for being cautious in making investment decisions.