Retirement Factors and Federal Employees

Why does a federal employee decide to retire? The answer is often complex and different for each person.

Is there a link between a COLA increase or a significant pay raise and the number of people who decide to retire? What about election results and policy decisions of an administration that impact the federal workforce?

FedSmith has gone back over the data of retirement applications from 2012 through 2021. Readers will reach their own conclusions about what heavily influences the decision to retire.

At the end of the fiscal year 2021, 94.54% of current civilian federal employees were enrolled in the Federal Employees Retirement System (FERS) which covers employees hired since 1984. 1.30% were in the older Civil Service Retirement System (CSRS).

97.58% of employees worked in the United States. 14.58% of these federal employees worked in the core-based statistical area that includes Washington, DC, and portions of Virginia, Maryland, and West Virginia.

Retirement Applications from 2012-2021

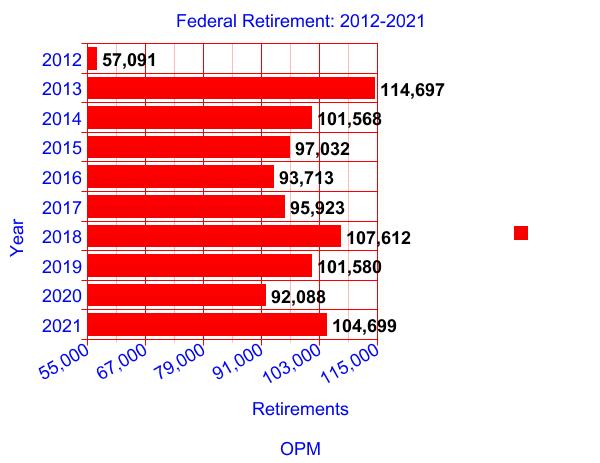

The number of federal employees deciding to enter the retirement phase of life varies from year to year. This chart displays the number of federal employees who retired each year from 2012 through 2021. These data are based on the number of retirement applications filed during these calendar years. The data are from the Office of Personnel Management (OPM).

Big Differences in Number of Retirement Claims

Looking at the bar chart above, there are big differences in the number of retirement claims filed in a given year. What causes the differences? Policy decisions in an administration? A large COLA increase in the coming year? The amount of a pay raise for the coming year? The results of an election?

Obviously, many retirement decisions are very personal. Will I have enough money to be comfortable after retirement? Is this a good time to move to be closer to family members? Are health considerations driving a decision to retire now?

But looking at events that occurred in a year that impact the federal workforce and then looking at the number of retirements in a year may provide some indication as to what may have influenced some retirement decisions.

Impact of a Government Shutdown and No Pay Increase

What happened in 2013 that could have contributed to the increase? The most obvious answer is a government shutdown.

2012 was the lowest point for federal retirement during this time period. 2013 was the year with the largest number of retirement applications being filed. In other words, there was an increase of 100% in retirement applications filed between the calendar years 2012 and 2013. Obviously, many federal employees were unhappy over the implications and impact of a shutdown.

The 16-day-long shutdown in October 2013 was the third-longest government shutdown in U.S. history, after the 35-day 2018–2019 shutdown and the 21-day 1995–96 shutdown. A “funding gap” was created when Congress failed to agree to an appropriations continuing resolution.

This article outlines the results of a lawsuit filed by some federal employees in the Court of Claims as a result of the shutdown.

The government shutdown was probably a factor for many people. Another factor may have been the decision by the political structure to forego any raise for federal employees in 2012 and 2013. And, while current federal employees were not getting a pay raise, there was an increase in annuity payments in each of those two years going to retirees.

Also, a factor may be that after two years of not receiving a pay raise, the following year, in 2014, the annual federal employee raise was 1%. For three years in a row, federal retirees received a larger increase in their annuity payments than current federal employees.

| Year | Retirement Applications | Pay Raise % | COLA Increase % |

| 2021 | 104,699 | 1.0 | 1.3 |

| 2020 | 92,088 | 3.1 | 1.6 |

| 2019 | 101,580 | 1.9 | 2.8 |

| 2018 | 107,612 | 1.9 | 2.0 |

| 2017 | 95,923 | 2.1 | 0.3 |

| 2016 | 93,713 | 1.6 | 0 |

| 2015 | 97,032 | 1.0 | 1.7 |

| 2014 | 101,568 | 1.0 | 1.5 |

| 2013 | 114,697 | 0 | 1.7 |

| 2012 | 57,091 | 0 | 3.6 |

Survey: 65% Of Federal Employees Would Remain in Government in a Trump Administration

The number of federal employees retiring in a year fluctuates. It is not surprising that some predictions turn out wrong.

For example, in 2016, survey results received wide publicity. Here are quotes from the Government Executive article on the survey finding large support for Hillary Clinton and very little support for Donald Trump. The date of the article was October 28, 2016—a few days before the election on November 8th when voters elected Donald Trump as the next president.

[S]urvey found that 14 percent of federal workers say they would definitely consider leaving their jobs if Donald Trump wins the Nov. 8 presidential election. Another 13 percent said they might consider leaving, while 9 percent said they did not know. That leaves just 65 percent of federal workers who say they would stay for a Trump administration.

The animus toward Hillary Clinton is less severe: Nine percent would definitely consider leaving; 7 percent might leave; 5 percent didn’t know. Nearly eight in 10 (79 percent) say they would stay for a Clinton administration.

If that had turned out to be accurate, there would have been a large jump in retirements after the election in which Donald Trump was elected president.

At the end of December 2018, there were 2,081,160 federal employees. 14% would be about 291,362. 35% of the number of federal employees would be 728,406.

There was a jump in the number of retirements in 2018 but still less than in 2013 and considerably less than the number of employees who at least implied they would consider leaving if Donald Trump were to be elected.

On the other hand, this survey of 2,100 people taken just after the FBI announced its intention to open the investigation on emails on a laptop used by Huma Abedin’s estranged husband, we asked readers this question: “If the presidential election were held today, for whom would you vote?” The result of this survey showed a preference for Donald Trump.

Regardless of a person’s political allegiance, the federal salary and benefits are significant, particularly a life-long retirement pension that usually goes up each year. So, while those taking the survey cited above may have preferred Clinton over Trump, most decided to stick around and continue receiving a government paycheck.

There was an uptick in retirements in 2018, but the increase in 2017, after Trump was elected, was minimal.

Retirement Numbers After Biden Election and Vaccine Mandate

President Biden was elected in November 2020 and inaugurated in January 2021. In 2021, there was an increase of 13.6% in retirement applications.

Inflation started soaring again in 2021. The final inflation rate was 7.8% based on the CPI-W index. The COLA increase going into effect in January 2022 was 5.9% and the average annual raise for the federal workforce in January was 2.7%. As noted above, the absence of any raise in 2012 and 2013 and a 1% raise in 2014 may have influenced an increase in retirement applications. Perhaps a similar rise in retirement applications in 2021 was based on these data just as it may have been back in 2013.

Impact of Vaccine Mandate on Retirements

It is certainly possible that policy decisions by the Biden administration are having a significant impact on retirement figures as well.

There is little doubt that we have yet to see the full impact of these economic changes. The retirement backlog at OPM climbed for the last three months of the year. There is normally a flood of retirement claims in the first two months of the new year with many federal employees retiring at the end of a year. We now know that the retirement backlog went up even more at the end of January 2022. The increase in the backlog was not due to an increasing number of federal retirement applications in January compared to previous years.

The vaccine mandate imposed on the federal workforce has not been popular with many federal workers. In a survey taken shortly after the Executive Order with the mandate was issued, a number of readers indicated they may not continue their federal career or were undecided if they would retire. For those employees who are eligible to retire, there is a good chance some of those employees would retire now.