Retirement planning is smart planning and ten years out from your target is a good time to look at some key items.

Here are ten things to consider.

1. Write Down Your Vision

Many people don’t picture what retirement is going to look like until they get there. While the future is unknown, spending some time thinking about it and creating a vision can help guide your decisions.

Try answering the following questions:

- If you didn’t have to work anymore, what would you do with your time? How do you think your spouse might answer?

- What does retirement look and feel like to you?

- When do you want to be done working?

- Where do you want to live, how do you want to spend your time, and who do you want to spend your time with?

- Consider your purpose: Will you work at all? Do you desire to be active in business or support the community? Pursue hobbies or passions, learn new skills, travel, spend time with family?

- Are there any major purchase goals? House, autos, boats, education are common.

- Legacy or gifting – do you want to create a gifting strategy to pass along assets to heirs or charitable organizations?

Creating a clear vision can also help you answer the question – “are we on track?”

2. Enroll or Stay in FEHB

If you plan to continue your federal health benefits in retirement, you must be entitled to retire on an immediate annuity and:

- be enrolled for the 5 years immediately before retiring

- or, during all your federal employment since your first opportunity to enroll if less than 5 years.

Coverage under FEHB, Tricare, or the Civilian Health and Medical Program of Uniformed Services (CHAMPUS) all count toward the 5 year requirement.

3. Max Out TSP Contributions

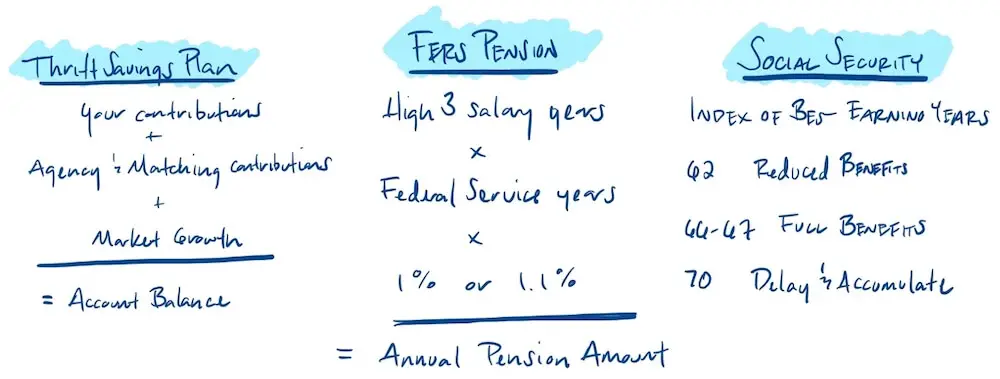

A healthy TSP account can be a key player in creating retirement income.

Your TSP account grows through agency and employee contributions and potential market returns that can provide compound interest on your investment over time.

Maxing out your contributions gives you a chance to accelerate your account’s growth, and a larger account balance may be able to support greater income or other financial goals in the future.

Why do contributions matter? Working with larger numbers makes a big difference and maxing out contributions can help get you there faster.

For example:

- 8% annual return on $250,000 = $20,000.

- 8% annual return on $500,000 = $40,000.

Combining max contributions each year with potential investment returns may lead to significant account balance increases each year.

Put another way: You do the heavy lifting of contributing and compound interest picks up the slack and works harder as the account grows larger.

The maximum annual contribution in FY 2022 is $20,500. There is a $6,500 catch-up contribution if you’re over 50 making the limit $27,000.

4. Maximize Cash Flow

A great cash flow plan maximizes your current income and resources and directs funds to the right places.

We don’t favor strict spending rules in favor of socking money away for the future, but prefer an approach based on making choices that allows us to enjoy today and plan for the future at the same time.

Directing cash flow is often a balancing act between needs and wants as well as how much to allocate to savings, retirement plans, taxable investment accounts, real estate investments and other goals.

Plan to save at least 20% of your gross income and direct it between various account types – TSP, IRA’s, taxable investment accounts, and other investments.

5. Check in on Your Hi-3 Salary and FERS Pension Estimates

Requesting your total compensation statement will provide you with details surrounding all your federal benefits including the FERS pension.

You can review an estimate of monthly retirement benefits at various time periods based on a projected high-3 salary.

Creating your own estimates is also smart. You can play out any expected salary increases or promotions that have the potential to move your Hi-3 significantly.

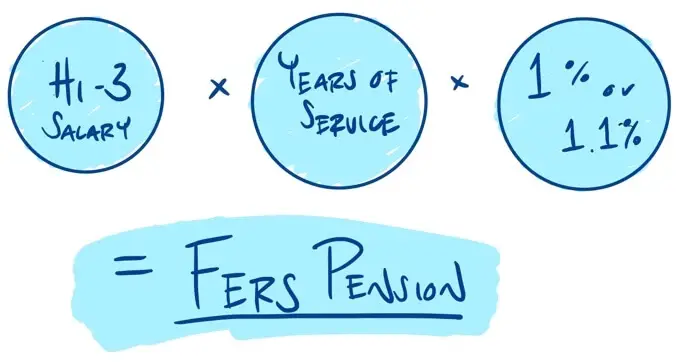

The formula:

Under age 62 or age 62 with less than 20 years = 1% x average high-3 salary x years of service

Age 62 or older with 20 or more years = 1.1% x average high-3 salary x years of service

6. Request Social Security Estimates

Social security is a nice compliment to your FERS pension. Benefits are typically calculated using “average indexed monthly earnings” – this average summarizes up to 35 years of earnings. SSA then applies a formula to come up with your primary insurance amount (PIA) which is the basis for your benefits.

Creating an account at SSA.gov allows you to view earnings records and benefit estimates. They have an estimator online that also allows you to look at various scenarios.

Deciding when to claim benefits can be tough and should be made in context with the rest of your plan. Will you take benefits at the earliest age 62, defer until age 70 or claim somewhere in between?

7. Put Together a Retirement Income Estimate

Take what you’ve learned from your FERS pension estimates, social security estimates, and TSP growth projections to create an estimate of how much income you’ll have available at various targeted retirement dates.

Be sure to Include any other investments or assets that will be able to generate income such as investment accounts or income producing real estate.

8. Rebalance Accounts and Create a Glide Path

Rebalancing is periodically buying and selling positions within your investment accounts to get back to a desired asset allocation mix.

Investment positions in your account appreciate or lose value at different rates, changing the overall portfolio allocation between them. In time, your account can look a lot different than when you started and might not reflect an optimal mix, the amount of risk you intend, or your goals. Rebalancing simply moves things back to the target.

Creating a glide path may also be useful. This is a strategy used to adjust the mix of your investments over time with the goal of reducing risk as you get older, closer to retirement age or a certain goal. The right mix should reflect your unique goals and intentions for your money.

9. Lay the Groundwork on Relocation Plans

Does your vision include relocating or living part of the year in another location?

Start advanced scouting for ideal locations and spend time there to get a feel for what life might be like.

Run the numbers on the local real estate market – smaller markets can provide better value and quality of life. Making the numbers work is important but quality of life factors big as well.

Beginning this process early can give you more choice and flexibility.

10. Consider Insurance

How much and what type of insurance will you need in retirement? Most folks will consider life and long-term care coverage, and both FEGLI and FLTCIP are portable into retirement but there are many other options in the private market.

Analyze your needs and then outline the options for cost and benefits to see what makes the most sense for your situation.

Putting it All Together

No doubt there are more things to consider in planning for retirement, but this list can give you a solid foundation moving forward with plans for a smooth transition into non-working years.

The content is developed from sources believed to be providing accurate information. This material was created for educational and informational purposes only and is not intended as ERISA, tax, legal or investment advice. If you are seeking investment advice specific to your needs, such advice services must be obtained on your own separate from this educational material.