The number of millionaires in the Thrift Savings Plan (TSP) dropped to 100,364 as of March 31, 2022 (the end of the first quarter in 2022). As of December 31, 2021, there were 112,880 TSP millionaires, so the drop in Q1 2022 represents a decline of 11% over Q4 2021.

That is not a big surprise. The first quarter of the stock market ended on March 31st. It is the worst-performing quarter for stocks in the past two years. When the stock market goes down, that impacts the overall average in the TSP accounts of investors.

Q1 2022 Performance for Core TSP Funds

How did TSP Funds perform over the first quarter of the new year? Here is a summary of the core TSP funds’ performance in the first quarter of 2022:

- C Fund: -4.59%

- S Fund: -9.24%

- I Fund: -6.77%

- G Fund: 0.44%

- F Fund: -5.79%

Obviously, the G Fund had the best return. A return of 0.44% is not a high return, but, as those seeking safety know, a small gain is better than a loss.

How Does the TSP Make a Federal Employee a Millionaire?

For the first quarter of 2022, TSP investors with the most conservative investments had a better rate of return in the first quarter of the year. On the other hand, an investor who has a million dollars or more in the TSP is not putting much money in the G Fund. One does not become a TSP millionaire by investing in the G Fund.

Here is why. These are the returns for the TSP core funds over the last several years:

| Fund | 2021 | 2020 | 2019 |

| G Fund | 1.38% | 0.97% | 2.24% |

| F Fund | -1.46% | 7.50% | 8.68% |

| C Fund | 28.68% | 18.31% | 31.45% |

| S Fund | 12.45% | 31.85% | 27.97% |

| I Fund | 11.45% | 8.17% | 22.47% |

Obviously, the G Fund is the “safest” fund but it has the lowest rate of growth. To accumulate at least one million dollars in a TSP account, an investor will have to invest in the core stock funds and ride the “up and down” trends of the market.

Over the past ten years, the C Fund has had an average return of 14.65% and the S Fund has had an average return of 12.42%. The G Fund has had an average return of 1.94% for the same period of time. An investor relying on the G Fund will have a very difficult time accumulating at least one million dollars with the low average return of the G Fund.

How Much Did the Highest TSP Millionaire Account Drop in 1st Quarter of 2022?

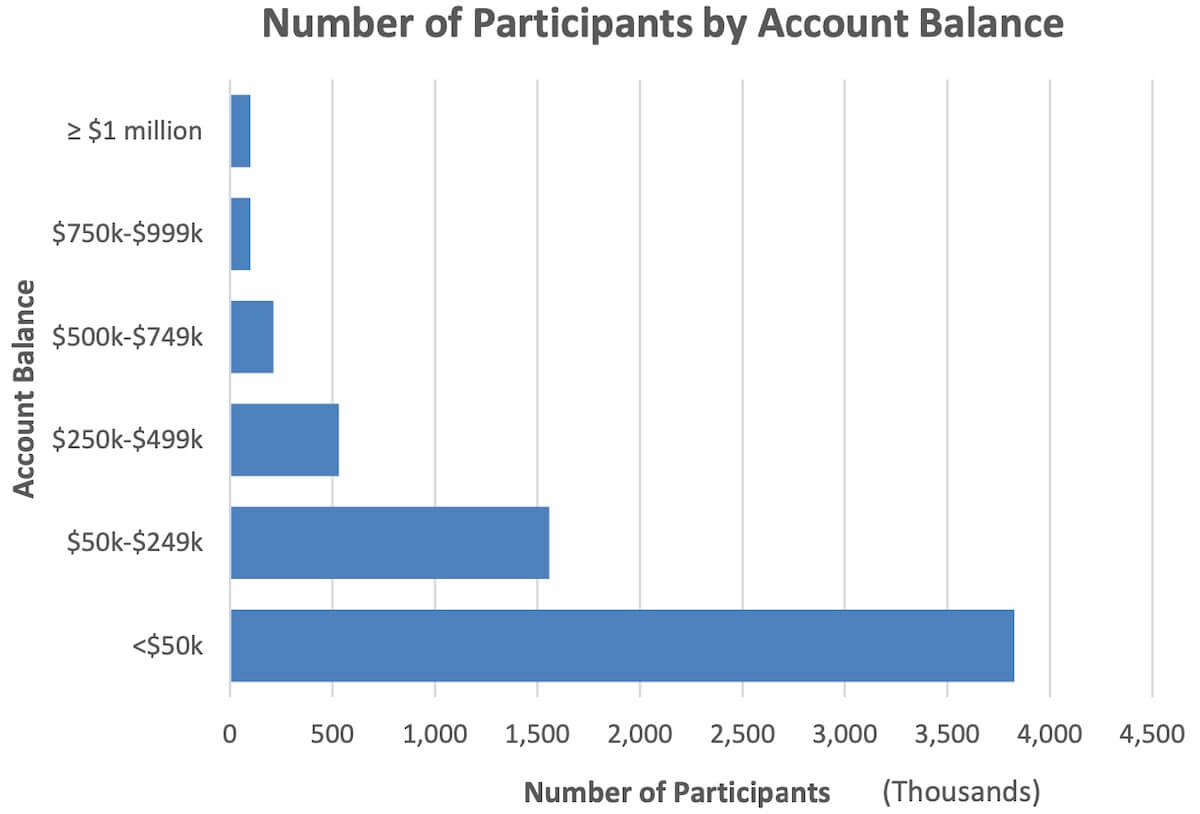

The number of TSP millionaires is a relatively small number out of the total number of participants in the program. As one might expect, the largest number of TSP investors are in the “under $50,000” category of investors. On the other hand, one TSP investor now has $8,400,765.23 in a TSP account.

While some TSP investors may be concerned about an overall drop in the value of their TSP investments in the first quarter of the year, here is a different perspective.

The largest amount in a TSP account at the end of December 2021 was $10,975,527. The largest TSP investor as of March 31, 2022, had $2,574,762 less than was in the largest TSP account just three months ago. This decrease is roughly the amount that the C Fund dropped in value over the past quarter.

Of course, we do not know that this is the same investor or, even if it is the same investor, what investment actions he or she may have taken during the quarter. We can assume this is a savvy investor to have accumulated more than $10 million. Perhaps this investor transferred several million dollars out of the TSP and put it into gold stocks. The value of gold went up 8% in the first quarter of the year so, for all we know, this savvy investor may have a total net worth that has gone up substantially but the extra amount is now outside of the Thrift Savings Plan.

We do not know the identity or background of the investor with more than $8 million in an account. It is possible this investor rolled over money from another qualified plan into the TSP when leaving the private sector and going into government service. While we sometimes see comments from readers that a career federal employee can never accumulate more than $1 million, the data indicate that is not the case.

The average TSP millionaire had more than 28 years of contributions to the TSP as of March 31, 2022.

Here is the breakdown of how many TSP investors are in each investment category as listed:

| Account Balance | Number of Participants | Average Years of Contributions |

| <$50k | 3,826,835 | 5.80 |

| $50k-$249k | 1,557,047 | 15.12 |

| $250k-$499k | 530,781 | 20.51 |

| $500k-$749k | 211,747 | 23.35 |

| $750k-$999k | 99,399 | 25.53 |

| ≥ $1 million | 100,364 | 28.64 |

| Total | 6,326,173 | 10.63 |

How the Number of TSP Millionaires Has Changed

There has been a large increase in the number of TSP millionaires over time.

The first year FedSmith tallied the number of TSP millionaires was in January 2012. There were 208 TSP millionaires at that time. In about 10 years, the number TSP millionaires has grown to over 100,000 from the 208 TSP millionaires in 2012.

Stock investing has historically rewarded patient investors. That has certainly been the case with the TSP.

Despite investing in what is inherently a political institution, the Federal Retirement Thrift Investment Board (FRTIB) has largely avoided becoming involved in whatever the current political investment fad has been and stuck with index investing with a system that is easy to understand, has provided very good rates of return for investors, and is inexpensive for investors.

With the new TSP mutual fund window coming into existence very soon, the rate structure will be changing. Expenses will go up, at least for some investors, investment opportunities will expand, and the complexity of the TSP system will increase.

And, as always, politics is always lurking in the background for TSP investors. There is always a new threat of political preferences encroaching on how the TSP invests the money for the more than six million TSP investors.

The current political concern appears to be climate change and expanding diversity in various ways. As usual, there are those in Congress and elsewhere (including the White House) who would like to mix these issues in with how investment decisions will be made for TSP investors.

With any luck, in another 10 years, the number of TSP millionaires will continue to grow as much as it has over the last 10 years ensuring a better retirement future for TSP investors.