If you’ve followed the news lately, you’ve learned that inflation has been the highest in 40 years, and that the Federal Reserve (“Fed”) has begun to hike interest rates. But what are the reason behind this, and how does this impact federal employees?

When an economy begins to accelerate too fast, we start to see inflation increase. Our economy has seen significant recovery from the pandemic, despite the lingering pockets of issues.

An economy is impacted by monetary policy, which is impacted by the Fed, and their job is like trying to balance a plate on a finger. Keeping the plate still with your finger requires immense precession. A move too aggressive in any direction, can cause the plate to begin to wobble. They are less concerned with wobble, though. The end game is not to drop the plate.

Interest rates have been rising to help cool off an economy that’s too hot. Rates have been near zero to support the economy during the pandemic. Rate hikes are meant to curb inflation but may also have a direct impact to your overall economic wellbeing. The Fed sets monetary policy to try to keep the economy humming along with full employment and stable prices. One of their tools in doing this is to adjust the federal funds rate, which is the rate that banks borrow money from each other.

Higher interest rates can benefit savers and equity investors but can create challenges for borrowers and fixed-income investors. For our purposes, let’s consider Social Security and your FERS pension as “fixed income”.

In this column we’ll discuss the intricacies of inflation, the most common questions we receive from clients on inflation, and how inflation may impact you.

Inflation 101

Inflation, for our purposes, is simply a rise in prices of goods or services during a fall in purchasing power of the USD. It erodes the purchasing power of money and is one of the main reasons that we invest the money we earn. Investments may allow you to outpace inflation and grow your money faster than the costs around you.

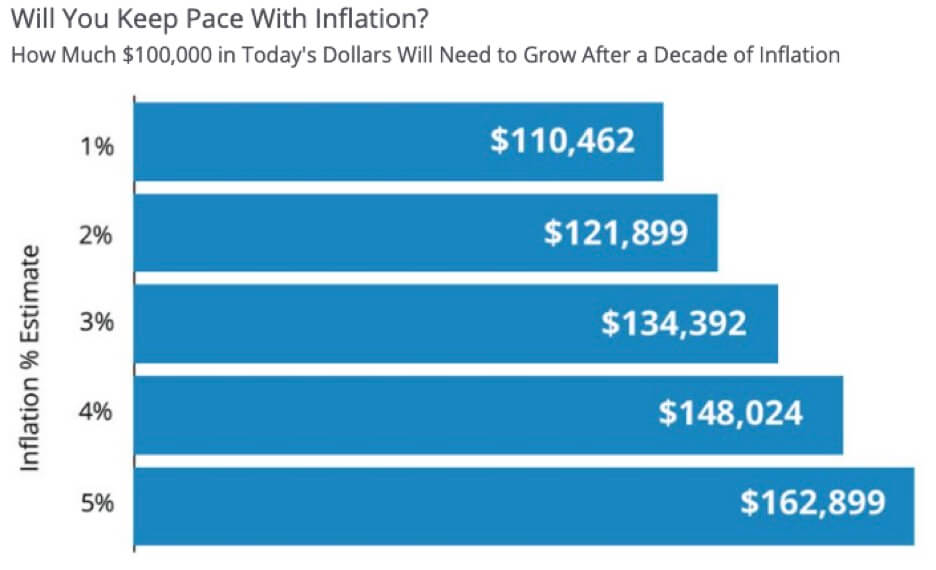

You may have heard of inflation references as CPI, or Consumer Price Index. A more accurate measure is the CPI-U and CPI-W. This chart from Hartford Funds does a nice job of illustrating the impact of inflation on money:

Why are we seeing inflation now?

Our economy received massive stimulus as a response to the global pandemic, given the levels of uncertainty surrounding the virus and where the economy was headed. This helped keep consumer demands higher, thus stimulating the economy, but supply-chain issues mean that the supply simply cannot keep up. The addition of labor shortages driving wages higher has caused a perfect storm of rising inflation.

What do rates have to do with inflation?

As mentioned earlier, one of the tools the Fed uses to help curb inflation is to increase the federal funds rates. This baseline influences interest rates on everything from mortgages, car loans, HELOCs, SBLOCs, savings accounts, etc. It has an indirect impact to some, but the bottom line is that when the fed hikes rates, at some point, investors will feel an impact.

When rates are increased, it can discourage spending by both companies and consumers. This helps reduce demand for growth and help to pull the reins on inflation. The challenge is that rising rates doesn’t only pump the brakes on inflation, it has an impact on several other components of the economy as well.

What kind of impact is there?

Families will begin to see an increase in goods and services and the cost of borrowing money. In moderation, inflation is an important part of a healthy economy, as it signals strength in a growing economy. However, too high inflation means that prices rise faster than wages, and families’ spending-power is reduced, causing strain.

Rising costs don’t remain unchecked, however. The Fed attempts to curb inflation through various means. A “healthy” averaged, annualized rate is somewhere around 2% over the long term.

What ends inflation?

Supply-chain issues that have persisted could resolve, which would allow companies to stabilize prices. The Fed raising interest rates makes it more expensive to do business, to both consumers and companies, which in term dampens demand and suppresses inflation. If the Fed acts too harshly, we could see deflation, which may be a sign of a weakening economy, as without enough demand companies may cut productions and jobs.

Can inflation impact my portfolio?

Yes, rising rates heavily impacts fixed-income vehicles and certain stocks. Inflation is sometimes followed by volatility, and volatility is a major risk to someone nearing or in retirement.

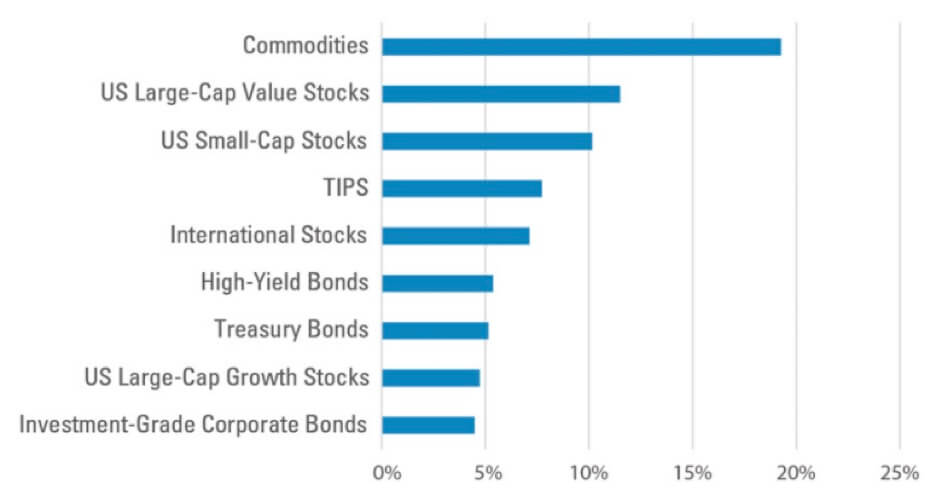

The challenge is that so is inflation – not investing aggressively enough during periods of high inflation could mean your portfolio suffers to keep up. Certain asset classes have historically thrived during periods of rising inflation, particularly financials, international, and value.

Average Returns During Eight Inflationary Periods Since 1970

How may rising rates impact federal employees?

For home buyers, increased federal funds rates might make the cost of borrowing more expensive in due time. While mortgage rates have an indirect relation to a rising federal funds rates (because of how mortgages are priced), they can still rise over time.

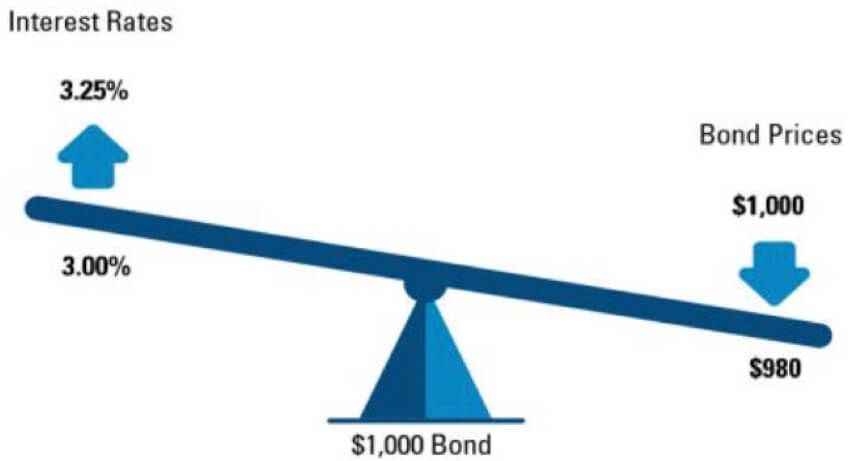

But mortgages are not the only element that’s impacted. We discussed how fixed income takes a hit during rising rates. Fixed income can include bonds, pensions, notes, treasuries, CDs, etc. Bonds have an inverse relationship with interest rates. As rates rise, the value of a bond will fall.

For your investment portfolios, federal employees that own bonds or similar (F Fund and G Fund) should understand the impact that a rising rates environment will have on their investment. This is one reason why we dislike when bonds are referred to as “safe” investments. They’re different. “Safeness” should not be measured by levels of volatility. A stocks/bonds portfolio of 30/70 is not necessarily “safer” than a 50/50. Correlating risk and volatility simply to whether something is a stock or bond is oversimplifying the concept, especially as we enter this new economic environment.

Volatility is normal but is a significant risk in the short term. In the long term, it’s opportunity. Consequently, it’s important that investors not conflate risk and volatility. They are not the same, and federal employees need to understand the relationship between how rates impact all types of investments.

There are specific types of equities (stocks) that do better during rising rates environments. Remember that markets are cyclical, meaning that what works well in one decade may not work the next.

We can’t predict how long inflation will be around, despite the Fed’s best attempts at reducing it. Further, that gives signs of a cooling economy, which in turns throws the markets into turmoil and we start to see unfavorable market returns. It is for this reason—one of many others—that having a rational investment policy will do you wonders. Investing during times of volatility can be incredibly temperamental, so make sure your advisor has updated your plan for this year.

The importance of diversification

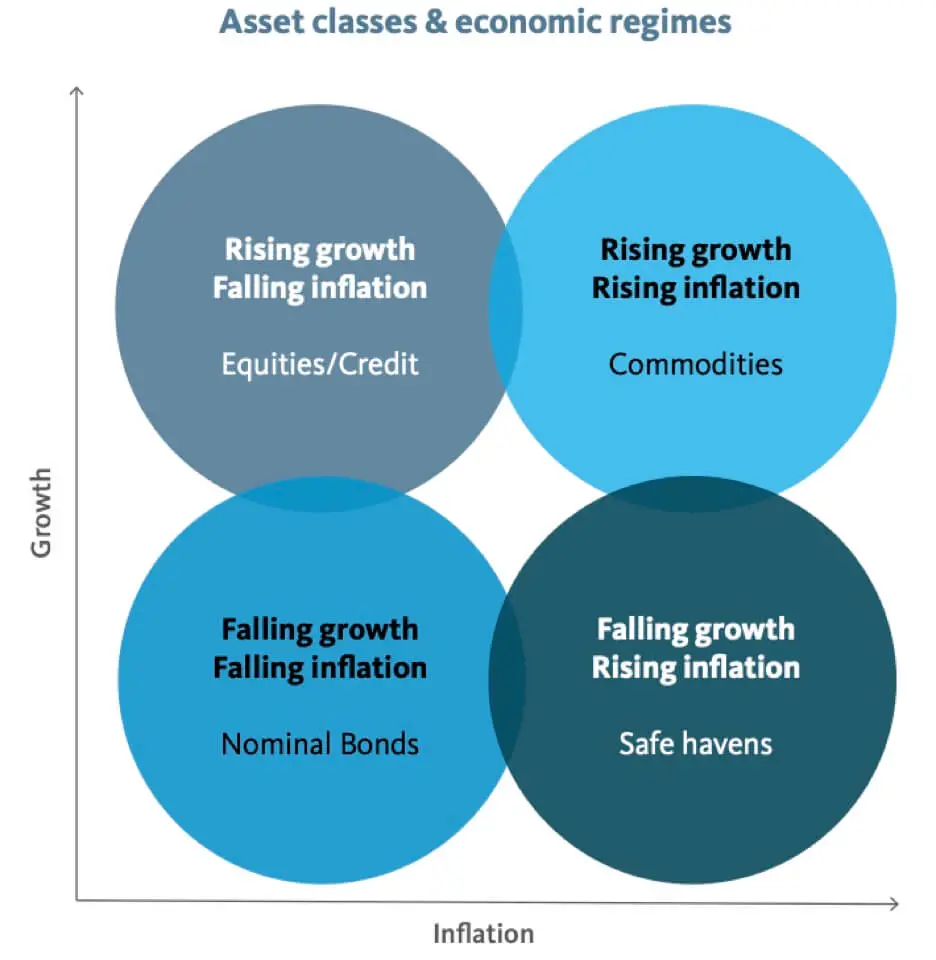

As the environment changes, we continue to see signs of an economy and markets that are entering a new cycle. This graphic helps explain some of the changes:

When investors look to diversify their investments, they should be taking a top-down approach. Markets will typically begin their rotation of strong asset classes after a period of strong returns in the markets.

It is at this point that investors need to reassess their strategy. In the beginning of last year, we first saw meaningful reversals in many long-standing trends—including the relative performance of U.S. versus global stocks, emerging versus developed markets, small cap versus large cap, value versus growth, and inflation- sensitive assets versus traditional stocks and bonds, to name a few.

Many of the top S&P 500 holdings (C Fund) are highly correlated to Treasuries compared to value stocks, which could impact the overall performance of index funds going forward. As we learned above, fixed income instruments are negatively impacted by rising rates.

Investors should aim to have broader, more diversified portfolios, especially relative to portfolios that have become concentrated in large technology stocks, over-valued stay-at-home stocks, growth stocks, or the expensive areas of the market that are particularly vulnerable to rising interest rates.

This is where having a portfolio that is more intelligently diversified than simply creating a stock to bond ratio comes into play.

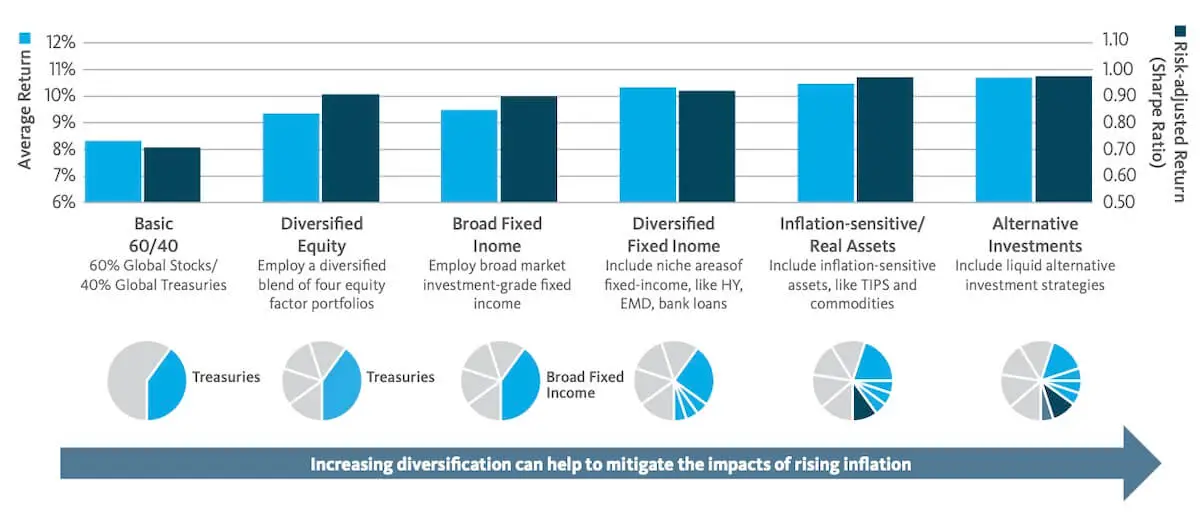

To illustrate this, view the graphic below. We start with the basic 60/40 portfolio, its calculated return as well as risk-adjusted return.

Every portfolio has risk and is subject to volatility, and another core tenet in portfolio management involves determining this ratio, called the Sharpe Ratio. We back-tested performance during a rising inflation environment:

There are limitations to this example, and it’s impossible for us to predict or guarantee any level of return, but using history and characteristic of asset classes allows investors to build an asset allocation based on economics and not just gut-feelings, sage neighborly advice, or blanket portfolio advice.

Practicing Rationality Under Uncertainty

An investment policy allows you to align your wealth and resources to your intangible goals, dreams, and desires as defined by your retirement plan. The matrimony of these two items—your retirement plan and your investment plan—can be beautiful, or it can end in a crippling divorce, where both parties are left counting whatever money is left over.

When beautiful, an investor can have reasonable expectations of how their portfolio may behave over long periods of time. They can understand the relationship between what they’re investing in and how that impacts their lifestyle. Further, an investor might participate in the growth offered by “the markets” as seen on TV, but when crafted properly, significantly reduces the downside and volatility offered by the same.

This is rationality under uncertainty—using history, not headlines. But don’t turn a blind eye. Recency bias is ramped because of how certain specific sectors of the markets have behaved in the last decade. Just because we encourage you not to panic doesn’t mean that you adopt a “set it and forget it” mentality. There are real things in your life in which you place value; your children, your family, your time, your retirement, your lack of stress (that’s coming, don’t worry), traveling, etc., that all have price tags and timelines. Planning helps you align your resources in a way that best helps you meet—and perhaps exceed—those goals.

Wouldn’t it be nice to know how much more your family can do in retirement, or perhaps knowing that you can already retire despite having a sense of duty to your service? It’s not infrequent that our clients have become emotional during our meetings with them. They experience relief, happiness, and the release of no longer having to carry the burden of uncertainty about whether they’re going to be okay.

It’s a good feeling, and it’s what you should be working toward. One day the hard work and saving pays off, and you get to enjoy what it was all for, after all it’s not just your money, it’s your future.