Editor’s Note: This article has been updated to reflect information on TSP returns as of the close of the stock market on Tuesday, April 26, 2022.

The performance of the core TSP funds through April 26, 2022, has been lackluster relative to the last few years when the stock market was booming.

2022 has not been a good year for the stock market. Inflation is the highest it has been in more than 40 years, there is a significant war in Europe for the first time in decades, supply chain problems are persisting, and investors are uneasy as indicated by volatility in the stock market.

Bond yields have been going up for several weeks in a row while the S&P 500 stock index, the index on which the C Fund is based, has been in decline for three consecutive weeks. On the other hand, the yields on bonds have been going up for the last several weeks.

As a result of market volatility, four of the five core TSP Funds show losses in 2022. The exception is the G Fund which is now up 0.62% for the year.

So far in April, the F Fund, C Fund, S Fund, and I Fund have declined in share value since the end of March. Here are the differences as of April 26th and the losses sustained by these funds by the end of March:

| Fund | YTD Loss 3/31/22 | YTD Loss 4/26/22 |

| F Fund | -5.79% | -8.44% |

| C Fund | -4.59% | -12.01% |

| S Fund | -9.24% | -17.72% |

| I Fund | -6.77% | -13.46% |

TSP Performance as of April 26, 2022

Along with the core TSP stock funds, all of the Lifecycle Funds have a negative return in 2022 as well.

As of the close of the market on April 26, 2022, here are the year-to-date returns for all of the TSP Funds:

| Fund | Price | Year-to-Date Performance |

| G Fund | $16.8402 | 0.62% |

| F Fund | $19.1244 | -8.44% |

| C Fund | $63.3047 | -12.01% |

| S Fund | $68.6538 | -17.72% |

| I Fund | $34.1334 | -13.46% |

| L Income | $22.7360 | -3.19% |

| L 2025 | $11.5329 | -5.83% |

| L 2030 | $39.9550 | -8.30% |

| L 2035 | $11.9185 | -9.18% |

| L 2040 | $44.8162 | -10.01% |

| L 2045 | $12.2025 | -10.75% |

| L 2050 | $26.5922 | -11.43% |

| L 2055 | $12.9191 | -13.19% |

| L 2060 | $12.9183 | -13.20% |

| L 2065 | $12.9173 | -13.20% |

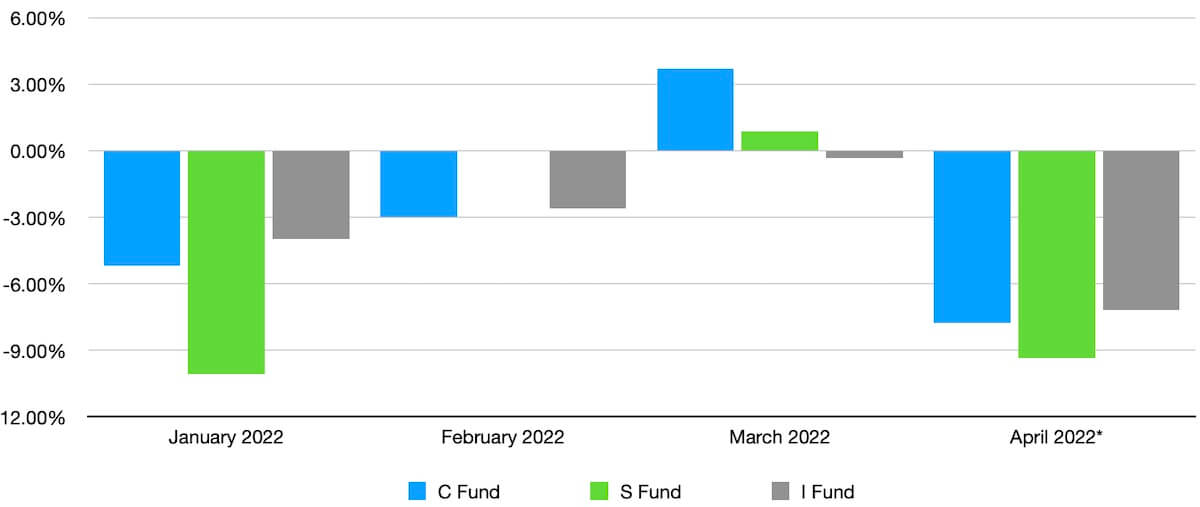

2022 TSP Performance by Month for C, S, and I Funds

| C Fund | S Fund | I Fund | |

| January 2022 | -5.18% | -10.07% | -3.96% |

| February 2022 | -2.99% | 0.03% | -2.61% |

| March 2022 | 3.72% | 0.90% | -0.33% |

| April 2022* | -7.78% | -9.35% | -7.17% |

Data are from TSPDataCenter.com

TSP Facts

Roll-In Transactions

In March, there were more than 3,200 roll-in transactions to the TSP totaling $151 million. This was the highest dollar volume of roll-ins in the past two years and exceeded March 2021 by more than $11 million.

InterFund (IFT) Transfers

The enclosed video presentation features graphics displaying data from the TSP as of the end of March 2022. These charts also display TSP information such as interfund (IFT) transfers, the amount of money under management by the TSP, the number of participants, and the average balance of TSP accounts for different segments of investors.

In March, 1.73% of TSP investors transferred money. About $1.6 billion was transferred from the G Fund, $249 million from the F Fund, $153 from the S Fund, and $412 from the I Fund.

The TSP Funds gaining the most money were the C Fund with a gain of more than $1.45 billion and the S Fund which received $951 million through the transfers.

A chart in the enclosed video visually displays these transfers. These were the transfers in March. The transfers that occur in April will be available at this time next month. The C and S Funds had overall positive returns in March. The end-of-the-month returns for each TSP Fund will be published by FedSmith in early May.

So far, through March at least, TSP investors are not moving money around into the G Fund out of fear that their investment in stocks will continue to drop rapidly in response to inflation or world events. With the drop in stock values going down again so far in April, this trend may quickly turn.

But, as noted in the monthly TSP meeting held on April 26, there has been a relatively small percentage of investors that have been moving money. If the drop in stock values continues, this may change as emotions may start to dominate, based on the previous reactions by TSP investors when the market dropped substantially.