Thanks to financial media, “the markets” are most often identified by, or labeled as, the S&P 500 index. While it’s merely one index that measures one portion of the markets, the news doesn’t start publishing official bear market headlines until the S&P 500 closes a trade day down 20% from its high.

That happened this week, not unexpectedly. But the fact is that the overall markets have been in bear territory for quite some time, even though the S&P 500 just caught up. Several other parts of the markets are down much more than that. PayPal and Netflix, for example, are down from their highs roughly -76% and -75% respectively, as of mid-June.

If you’re wondering why the overall markets have taken such a big hammering while the S&P 500 has strangely lagged, a major contributing factor was how big the top five holdings have become, as well as how imperative to business [most] of them were in a post-pandemic world. These five positions are:

- Apple

- Microsoft

- Amazon

- Tesla

These top 5 organizations make up almost a quarter (25%) of the entire index, creating a disproportionate ratio to the overall remaining ~495. As such, and because they’re such staples of how business was done this year, they have been able to slow down the index’s price decline. Big ships take longer to turn. They do, nevertheless, still turn. But don’t get too comfortable; the same characteristics that caused a lag this time may be the fuel to a faster fire in a different type of market.

But what matters most is not what’s happening with each individual company, but rather how and when you should be participating in certain parts of the market so that your portfolio helps you meet your objectives.

As we enter “official” bear market territory, there are some important concepts that federal employees need to keep in mind as they approach the middle of the year and take another look at their plans.

Asset Location and Allocation

Your portfolio’s allocation and location are two important categories that should be reassessed as you move into the second half of this year.

This market volatility is presenting you with opportunity for tax-managing your investments. Institutional investors know that the best time to rebalance taxable accounts is during volatile markets. You can reposition yourself for the impending growth while minimizing your taxes. This strategy, over time, can offer significant value to a portfolio in a lifetime than you might imagine, if not for your lifetime, for your heirs.

We have a free short white paper on how this works. If you’re interested in receiving a copy, send an email to info@rmgadvisors.com with the Subject Line “Tax PDF”.

Taxes are often one of the top factors in separating people from their retirement dreams. Be proactive about putting strategy around the location of your assets, whether Traditional, Roth, individual/joint, or trusts.

For your allocation, indexing is “the way”over time but each section of the market behaves differently, as clearly demonstrated by the last 6.5 months.

The importance of a well-diversified portfolio has never been more important to upcoming retirees. Investors need to create an investment policy so that they can be reasonably sure they will still meet their financial goals despite what’s happening in the markets.

More plainly: how much of an investment type should you own, when, for how long, tax considerations if not inside a retirement account, should it become the source for taking monthly income, and more.

Whether the S&P 500, the DOW, large cap, small cap, fixed income, international or others—the same questions need to be answered for the various other indices you should own in a properly allocated portfolio.

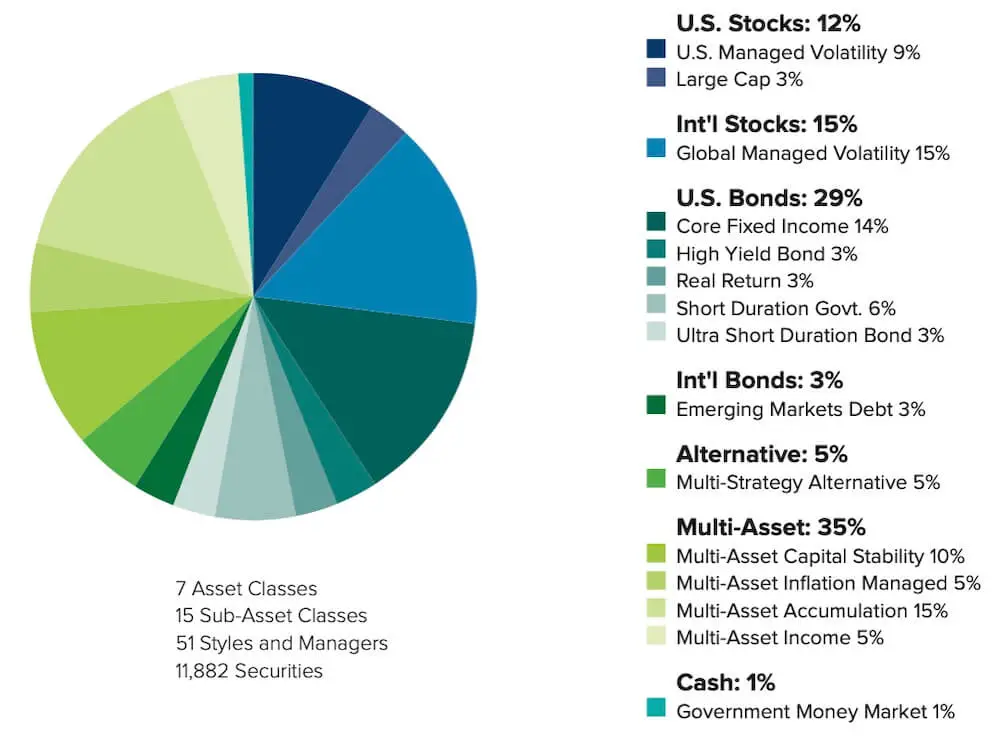

To help you understand what a well-diversified portfolio allocation may look like, here is a sample allocation that an investor may choose to use to support their financial goals. This is not a recommended allocation, nor personal advice to you as a reader. It’s meant to illustrate what this concept looks like, because who doesn’t like pictures:

Then, how do you adjust these allocations as time goes on? The answer to all lies in your financial plan.

At the risk of sounding like a broken record, I say once more: your plan becomes the beacon from which your investment plan should be derived. Once you have timelines and goals, you can set your GPS to head toward that direction.

There are various other factors that you might wish to consider, such as whether your spouse works in the private sector and participates in corporate stock, making your family’s wealth overweighted in a particular stock or sector. Your taxable income is another consideration; perhaps you wish to be doing Roth conversions in years of low income, and thus your allocation should reflect that kind of planning ahead of time.

The moment to readjust a portfolio to a proper allocation is now. The concept that it’s bad to touch your portfolio while the markets are falling is incorrect. This notion comes from the fact that most investors doing this are moving to a more conservative allocation, typically once they’ve already sustained losses, thereby making those losses permanent by not being aggressive enough to participate in the markets’ accretion thereafter. Remember, markets are cyclical. But past is not prologue, to be sure, and what goes down must not always come back up.

Re-Run Retirement Projections

If the last time your ran retirement projections was before the markets corrected, then you need a realistic check on where you stand now that your portfolio sits at a reduced value. Has this decline in the markets impacted your ability to retire safely? What kinds of adjustments do you need to make in order to help make sure that you can continue to live a life of financial independence?

Sometimes they’re practical in nature, such as postponing your home renovation by a year, or perhaps doing it over time rather than all at once. Perhaps it’s utilizing a HELOC (home equity line of credit) to pay for the renovation instead of liquidating your portfolio. Remember, HELOC interest payments may be deductible if used for the renovation of your primary home.

If you choose to use OPM’s money (other-peoples’-money, such as your bank’s HELOC program), does that merit changes to your portfolio allocation since your earmarked cash is no longer being used? All important questions.

Investing Cash

Many federal employees have been bearish, or pessimistic about the markets lately. As a result, many have been hoarding cash on the sidelines to help against losses.

During volatile years, it may make sense for you to increase your cash holdings, especially if you’re no longer earning an income. How much cash depends on your lifestyle and timelines, but right now anything beyond 12 months of your anticipated expenses should be considered for redeployment.

If you have cash from which you will not need to withdraw in the next year or two, you should consider redeploying the capital while investments are down from their highs. But make no mistake: just because we’ve seen damage in the markets does not mean we’ll immediately rocket back to the all-time highs we saw in January.

It is a typical characteristic of bear markets to have lower highs than the previous bull market. Newer investors often become too aggressive in certain parts of the markets once it’s an “official bear”, anticipating the highs they once saw. Just because the markets may begin to recover does not mean they will recover to the values last engraved in your memories.

Be careful with this. Don’t fall prey to the recency bias of how quickly the markets have returned to new highs the last time we saw any volatility.

From 1929-1932, the Dow Jones experienced a steep decline during the Great Depression. Imagine trying to rebalance your portfolio through a period like the 30s.

Now, it’s important to understand that this period was significantly different than our current one. We are not in a depression, although layoffs have started, and we’re possibly headed towards a recession. Notwithstanding, the principal remains that you cannot know what lies ahead and you must craft your portfolio in a way that supports your financial plan, not trying to guess the markets.

I’m not saying any of this—however you define “this”—is over. Nor am I saying that the equity market has bottomed, or soon will. I would have no basis for such a call, as that would require us to know:

- the exact future of both inflation and interest rates

- whether a recession will take place, and if so, how deep and protracted it will be

- what said recession would do to corporate earnings, and

- how the markets would or would not react to 1-3.

We know none of these things. No shame in this; neither does anyone else. Moreover, they should all be irrelevant to your investment policy, which is centered on which, how, and when to utilize certain investments as a tool to help you accomplish your post-work goals.

Your plan needs to be able to pivot and adjust to your continuing needs despite what the markets bring you. As we say in finance: bulls make money, bears make money, pigs get slaughtered.

Put in the resources necessary to build a plan from which you can live a life of financial independence, free from the burden of uncertainty, and proud of the legacy you leave behind. After all it’s not just your money, it’s your future.