Insurance is a critical part of someone’s financial and retirement plan. Insurance is a safety net in maintaining financial freedom and stability.

There are some risks for which we can self-insure simply by saving enough money to cover them if they arise. If your water heater goes out, you can buy a new one—there’s no need for water heater insurance. An appropriate emergency fund on your Net Worth statement can absorb this cost.

However, other risks are just too large for many families to bear all on their own. This is where competitively priced insurance with proper coverage guards your goals from potential catastrophe.

Insurance planning—life, long-term care, health, and liability—is possibly one of the most overlooked components in retirement plans. In our experience, this is because the traditional wealth management business has really only offered investment advice and hasn’t added any additional value in the myriad other categories of financial planning. The lack of prudent advice in these other categories causes gaps in a retirement plan that may implicate and cause significant risk to a family’s financial independence.

We will not go into the individual specifics of FEGLI. This information is easily acquirable from OPM or your agency. Instead, as with many of our columns, we’ll focus on the advanced planning concepts in which federal employees can use as they make decisions that best suit their family’s needs.

Acquiring Insurance

Many who are experts in insurance products, like insurance agents, may be conflicted in the advice they are offering to federal employees because of their relationship with the insurance carrier. They may be incentivized to sell a specific insurance product. This creates a conflict of interest, and unfortunately there are many federal families who were sold products that were not in their best interest.

FEGLI, or the Federal Employee Group Life Insurance program is a benefit offered to federal employees as a part of their overall FERS benefits. As group life insurance, you have life insurance available to you while you are working, and you may be able to carry it into retirement under certain conditions.

Young feds are encouraged to purchase life insurance through FEGLI if they have a need, especially if they have a family or would leave someone for whom they’re responsible if they die. How much insurance you need depends on various components, but FEGLI is cheap and can generally be afforded to the maximum level at younger ages. As you begin to age, FEGLI increases in cost and may no longer become a viable solution, especially if your retirement plan determines that you also will need long-term care insurance coverage as well.

Life Insurance Considerations

Life insurance can be important for both young and old. The most typical use of life insurance is for income replacement during your earning years. The cheapest way to cover this need while you’re working is generally through FEGLI. After that, the lowest immediate cost is found through term insurance.

It is important to remember that there are differing schools of thought on how much life insurance a person should have. When you pass away, what will you want to have done to provide for your family? One simple answer is to replace the financial resources you would have otherwise provided. Many people wish to pay off their mortgage and college for the kids in a premature death.

Another way of looking at it is to simply make sure the goals you have now would still be attainable for those you leave behind. As a qualifying federal employee, your FERS pension is guaranteed until your death. If you elected a survivorship benefit, your surviving spouse may earn as much as 50% of your FERS annuity. That reduction, along with the reduction of one of your Social Security benefits, can be significant over time, especially if one spouse dies much younger than the other.

Term insurance is life insurance coverage for a finite period of time (term). This can typically be purchased in 5-year increments between 5 and 30 years. This is best used to cover a specific risk during portions of your life. Things like having capital for mortgage payments, student loans, preschool, college, weddings, etc., in the event one of you dies, or worst case, both of you.

The cost to renew beyond your “term” is very expensive. Sometimes, insurance carriers may offer term policy holders the ability to convert to a permanent policy at your attained age with no additional medical exams. Your attained age may greatly increase the cost for having waited. Additionally, the policy you would choose today, and the policy offered to you on conversion, may not be identical.

Long-Term Care Insurance Considerations

One of the most important considerations to remember is that neither FEHB nor Medicare will cover extended long-term care needs. There is a component of Medicare that covers the first few months of an event, but costs beyond that will be on you.

Statistically, long-term care events last around 2-3 years. This is when you may need to live in an assisted living facility, a skilled nursing facility, or perhaps have personnel come to your home to help you with activities of daily living. The advancement of medical care has extended the duration of long-term care events to sometimes as much as 5 or 6 years.

Some families may be perfectly capable of self-insuring against a long-term care event. Those costs can vary greatly and depend on your location and kind of service received. Here in Washington, DC, our clients have routinely experienced costs of $100K/year for long-term care services.

FLTCIP appears affordable when first acquired, but it has incremental cost increases over time.

One excellent benefit of FLTCIP is the Premium Stabilization Feature (PSF). As you age, these traditional types of long-term care insurance policies generally have costs that are prohibiting. Many families will drop their coverage at or nearing the age when they need it the most because of the cost. Traditional Long Term Care insurance premiums rise significantly over time, but not when built inside certain insurance policies. FLTCIP has the PSF which is calculated as a percentage of premiums paid under the FLTCIP 3.0 group policy.

The PSF amount may be used to offset your future premiums or possibly provide a refund of premium death benefit. This is available if you’ve not opted out, you are age 85+, and you have been enrolled in FLTCIP 3.0 for at least 10 years. You must also have a PSF amount that is sufficient to pay for 50% of your monthly premiums for the next 12 months or more. The premium refund death benefit is based on your coverage being current upon your death. Your beneficiary would receive the left-over balance.

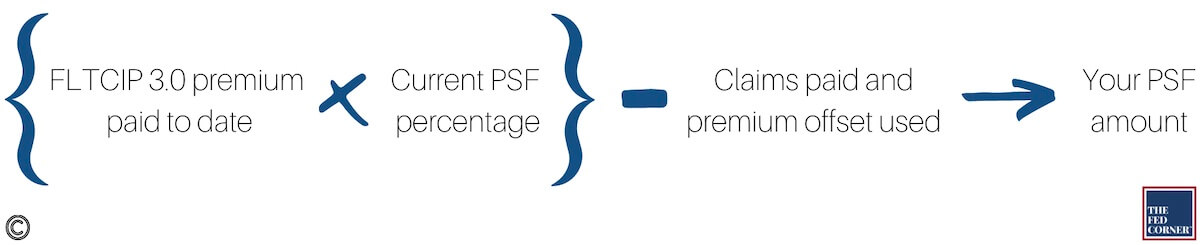

Your PSF amount is calculated as follows:

The PSF amount is reduced dollar-for-dollar by benefit amounts already paid, so your PSF amount may be reduced to zero. Your premiums paid to date are premiums that were out-of-pocket for coverage and the amount of premium offset used under the PSF.

This figure is calculated based on a percentage, and it’s important to know that is not a fixed percentage. This figure can be adjusted based on what the current long term care environment costs. Medical care costs rise faster than normal inflation, so there is a risk of the percentage being changed. These changes must still go for approval by OPM.

Another risk that cannot be ignored is that the PSF may be discontinued. If the costs of medical care continue to outpace coverage, then it is possible that we will see either a reduction or discontinuation of the PSF.

There are certain kinds of life insurance policies that allow you to have a Long-Term Care benefit built in. They should be considered carefully when creating a policy that’s right for you.

There is no cookie cutter answer for what kind of policy that you need. There is a mathematical component of calculating the risk and cost of a long-term care event depending on timing, but there is also a peace of mind component.

Many families struggle with the idea of becoming a burden on their children or other family members. It is incredibly taxing to take care of a loved one, especially if the caretaker has a family of their own. We’ve found that people who have had a family member need long-term care truly understand the need for it.

You may not need to cover your entire need with insurance. Perhaps you’ve been a diligent saver and you have a retirement plan built that allows you to be able to absorb some of these costs. In that circumstance, we would recommend that a federal family consider the cost of insurance versus the risk of having to pay from their portfolio, as well as the potential impact to their economic well-being in the future in various circumstances, like bad markets or changing legacy goals.

Investments combined with insurance

A quick word on combination products that have both investments and insurance—these most commonly appear in the form of annuities. If you’ve followed our content, you may already know that we’re not the biggest fans of annuities for federal employees, except for in very few specializes circumstances. We’re not annuity critics, we’re just critics of those who try to use an insurance product to solve various solutions. Insurance is a tool, and not everything is a nail.

In general, life insurance and long-term care needs should not be solved with annuities. Start with the problem, then work backwards to find out if an insurance policy can solve your challenge. You should be wary of someone that uses insurance to solve many different problems.

One of the ways you know you’re being presented some of these products is if you’re told that you can “…participate in market growth without any downside risk”. Risk and reward go hand in hand—this is a core tenet in portfolio management. There are dozens of risks to a portfolio, all mitigated differently. The downside risk in these annuity programs is usually backed by a rather crippling “ceiling” on your growth. So, while it may appear to be a great program, you may be leaving 4%, 5%, sometimes even 6% or more growth on the table.

Another phrase for a retired federal employee is a FERS Annuitant. You may have seen this term in some of your agency or benefits documentation. This is because your FERS pension is essentially an annuity, and so is Social Security. Using your portfolio to purchase yet another annuity vehicle has not made sense in the majority of the retirement plans we’ve created for federal employees.

Closing

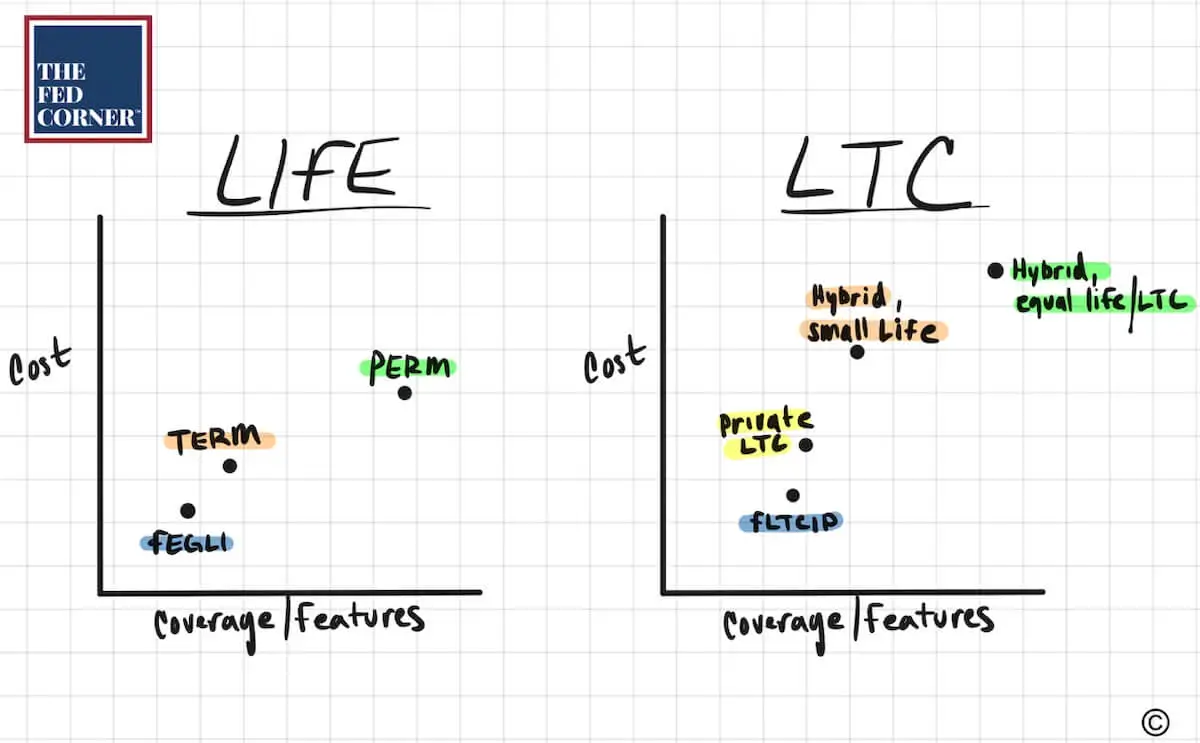

Life insurance and long-term care insurance are two different needs but can be covered by one policy. Sometimes getting one of each may end up being more cost efficient. Here’s what you should remember:

In the life insurance category, you have:

- Group life (FEGLI)

- Term life (increments of 5 years, generally)

- Permanent life

In the long-term care category, you have:

- FLTCIP (straight LTC)

- Private straight LTC

- Hybrid Life/LTC (small death benefit to stabilize premiums, large LTC coverage)

- Hybrid Life/LTC (equal death benefit and LTC coverage)

Each has pros and cons. Some are cheaper with less features, others are more expensive with more coverage, features, and flexibility. You can use this simple chart below to see how they compare:

With insurance, the sooner you plan and acquire the coverage you need, the less expensive your costs may generally be. But this doesn’t mean to rush into purchasing insurance. Like buying a car, it requires due diligence and research, and must have features that meet your needs.

Also like buying a car, it too can have many hidden and unnecessary costs if you’re not careful. Different carriers specialize in different kinds of policies. Some of them are brilliant in one arena and have less favorable solutions in others. Make sure your advisors are having these important discussions with you, because it’s not just your money, it’s your future.