The stock market continues its downward trend in 2022. Unfortunately, this means the 2022 TSP performance has been negatively impacted as well. The June stock market returns added to the overall losses for the year in the Thrift Savings Plan (TSP).

Accelerating inflation and rising interest rates led to a rout in stocks over the last six months. The S&P 500 index (the index on which the TSP’s C Fund is based) is down 21% through June 30, 2022 (the C Fund is down 19.96%). This loss is the worst six months in the start of a year since 1970.

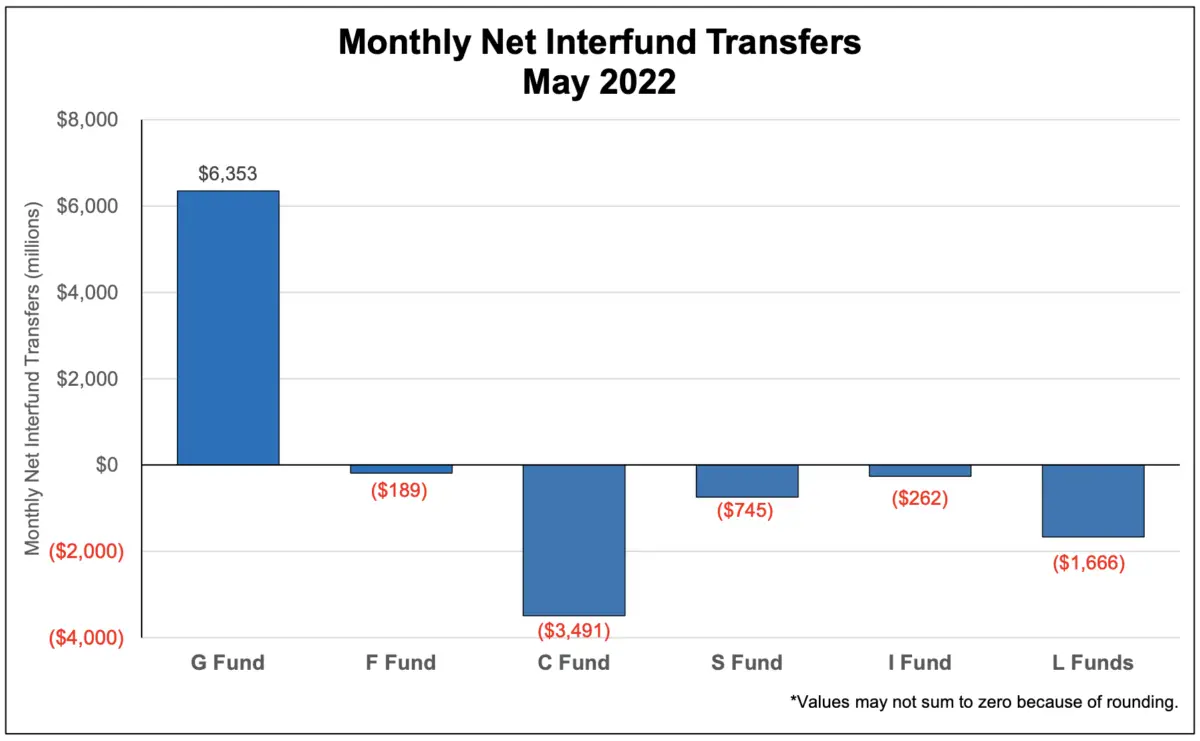

As noted in the headline, the amount of money transferred into the G Fund went from about $1.82 billion in April to about $6.35 billion transferred in May. As a percentage of the approximate $740 billion in the TSP at the end of April, these dollar amounts are a small percentage of the total.

However, an increase of about 249% (about $4.5 billion) in the total amount transferred into the G Fund in one-month displays a definite trend among TSP investors, how they are investing their money, and the performance they expect in stocks in the short-term future.

TSP Performance for June, Year-to-Date, and Last 12 Months

The G Fund is up 1.15% so far in 2022. That is normally not a great return, but it is the only TSP fund with a positive return in 2022. The G Fund serves as a source of relative calm in a volatile market.

All of the other TSP Funds are down so far this year. The more aggressive Lifecycle Funds are down more than 20% so far in 2022. Of course, for those who will retire in about 2055 or later, the stock market will be much higher and these losses will long be forgotten.

For those federal employees who are retired or close to retirement, the return rates are scarier. The C Fund is down about 20% so far in 2022 and the S fund is down almost 28% so far this year.

These are the June 2022 TSP performance returns for all of the TSP Funds:

| Fund | June 2022 | Year-to-Date | 12 Month |

|---|---|---|---|

| G Fund | 0.29% | 1.15% | 1.89% |

| F Fund | -1.94% | -10.08% | -10.05% |

| C Fund | -6.55% | -19.96% | -10.62% |

| S Fund | -7.95% | -27.92% | -29.80% |

| I Fund | -8.21% | -18.95% | -17.11% |

| Fund | June 2022 | Year-to-Date | 12 Month |

| L Income | -1.60% | -4.84% | -2.87% |

| L 2025 | -2.98% | -8.98% | -6.02% |

| L 2030 | -4.37% | -12.88% | -9.29% |

| L 2035 | -4.84% | -14.22% | -10.43% |

| L 2040 | -5.29% | -15.49% | -11.50% |

| L 2045 | -5.69% | -16.62% | -12.51% |

| L 2050 | -6.07% | -17.66% | -13.40% |

| L 2055 | -7.25% | -20.54% | -15.69% |

| L 2060 | -7.25% | -20.55% | -15.69% |

| L 2065 | -7.25% | -20.55% | -15.70% |

It is likely that more volatility is ahead this year for stock prices. The Federal Reserve plans to continue raising interest rates to slow down inflation. This will probably slow economic growth as rates rise. This action may tamp down inflation and could lead to a recession which may reduce stock prices even more. What will happen with the war in Ukraine remains to be seen.

In effect, stock prices will likely be volatile as we get closer to the national elections in November.

Many readers, perhaps most, may feel that a recession is already here. Gas and food prices have gone up rapidly. The latest annual inflation figure showed a yearly inflation amount of 8.6% and a 9.6% inflation rate as measured by the CPI-W index. In effect, the purchasing power of that 2022 raise or COLA has already been decimated by inflation.

There is at least some good news. According to the Wall Street Journal:

The good news for investors is that markets haven’t always done poorly after suffering big losses in the first half of the year. In fact, history shows they have often done the opposite.

When the S&P 500 has fallen at least 15% the first six months of the year, as it did in 1932, 1939, 1940, 1962 and 1970, it has risen an average of 24% in the second half, according to Dow Jones Market Data.

TSP Transfers into G Fund Increase 249% in One Month

In May, transfers into the G Fund increased significantly over the dollar amount transferred in April as the stock market continued to decline.

Here are the amounts transferred in May in the TSP:

- $6.35 billion into G Fund

- -$189 million from F Fund

- -$3.49 billion million from C Fund

- -$745 million from S Fund

- -$262 million from I Fund

- -$1.66 billion from L Funds

At the monthly meeting of the TSP, Board members emphasized a small number of TSP participants transferred funds. Nevertheless, the amount of money being transferred into the G Fund in May was about 249% higher than the amount transferred in April as investors moved money out of the falling stock funds.

While a large majority of TSP participants have not moved money, the number of dollars being transferred into the G Fund increased from $1.8 billion in April to $6.35 billion in May. Money leaving the C Fund went from $17 million in April to $3.49 billion in May.

Transfers Make G Fund Largest TSP Fund As C Fund Participation Declines

The transferring of money into the G Fund from the TSP stock funds is reflected in total assets and the percentage of participant assets in each fund. This table shows the changes from December 31, 2021 to May 31, 2022.

| Fund | % of Total Assets December 2021 | % of Total Assets May 2022 | Total Fund Assets December 2021 (Billions) | Total Fund Assets May 2022 (Billions) |

| G | 26% | 31.3% | $270.1 | $283.2 |

| F | 3.1% | 2.9% | $37.4 | $32.4 |

| C | 33.1% | 30.2% | $326.8 | $275.0 |

| S | 11.2% | 9.2% | $106.9 | $82.0 |

| I | 3.8% | 3.5% | $70.5 | $61.7 |

In effect, the transfers into the G Fund have altered the percentage and dollar amounts in the TSP Funds.

As with previous significant downturns in the last 20 years or so, investors head for the safety of the G Fund and that is reflected in the relative size of the G Fund compared to the stock funds. While various articles and pronouncements suggest investors should not panic and should leave their investments as they stand, many investors will not do that as the losses grow larger. Human emotions are intense, often repeat in similar situations, and losing a lot of money (and at least the statements show a paper loss) is a very emotional topic.

A relatively small percentage of investors have transferred their funds. If the markets continue to fall, the size of the G Fund is likely to increase if, as in past significant downturns, more TSP investors move money into the G Fund.

How Do TSP Investors React to a Falling Stock Market? Will 2022 Be a Repeat Experience?

2002 Market Downturn: Buy High and Sell Low

For example, from June through October 2002, when stocks were at their lowest levels during a market cycle, TSP participants pulled $3.8 billion out of the C fund (at a time when the total size of the TSP was much smaller than it is today) and put their money into bond funds.

The timing of these investors was as bad as it could have been. They sold their stock funds at the lowest levels just before the C fund jumped up 29% in 2003 (the I fund went up 38% and the S fund went up 43% in 2003).

2008, 2009 Market Falls And Investors Transfer to G Fund

In 2008, the C Fund dropped almost 37% for the year. Obviously, TSP investors in the C Fund were losing money and had been losing money for some time. In early 2009, that downward trend in the stock market continued.

At the end of February 2009, 56% of the TSP money from FERS employees was invested in the G fund; 62% of investments from CSRS employees were in the G fund. (Compare these percentages to the 31.3% in the G Fund at the end of May 2022.)

The large percentage of money in the G Fund was not accidental. TSP investors had been withdrawing money from the C fund for a number of months. Most of this money was flowing into the G fund in most months. But, for the month of January 2009, there were more transfers out of the G fund ($155 million) than the amount going in–perhaps as TSP investors were sensing the market was nearing a bottom.

In December 2009, the C Fund turned positive (1.94%). With this positive change, money started flowing back into the TSP stock funds. During January 2010, the market tanked again. When it did, more than two billion dollars was moved back into the safety of the G fund and money flowed out of the other four underlying funds and into the G Fund.

Unfortunately, some of these investors who had been transferring money into the G Fund missed out on a positive return of almost 27% for the C Fund in 2009, along with a positive return of almost 37% for the S Fund and more than 30% for the I Fund.

Did Investors Quickly Return to Stocks?

Some of these TSP investors never put money back into the C fund after they sold. In 2006, for example, 35% of CSRS employees’ investments and 36% of FERS employees’ investments were in the C fund. At the end of January 2012, only 23% of CSRS employees’ investments and 24% of FERS employees’ investments were in the C fund.

By July 2014, 27% of TSP assets were in the C Fund. By the end of 2021, after a long-running bull market, the C Fund held more than 33% of TSP investors’ assets.

Based on past experience, if the fall in stock prices continues, more money will be transferred from stock funds and into the G Fund. Many of these investors will be selling their stock funds at a lower price than when they were purchased and, perhaps, buying back the stock fund shares after the stock market goes back up.

Summary

Unfortunately, no one can accurately predict exactly when the market decline will be reversed and stocks will go back up again. Human emotions are fairly predictable. Based on past experience, some TSP investors will bail out of stocks when the market is near its lowest point. They do not know that, of course, but that is when “capitulation” often occurs and prices start going back up.

The longer an investor holds on to stocks, the greater the chance of success. Anyone who invests and sells within the first year of the investment may lose money as accurately predicting the short-term direction of the market is difficult at best.

Of course, some investors are not long-term investors and a diversified portfolio with a greater percentage in bond funds makes more sense for them. For those who are retired or are about to retire and are relying on their TSP investments for a regular income stream, putting a higher percentage of investments into bond funds as a cushion against stock losses may be a good idea. A financial advisor can help you develop a plan that best meets your needs and financial situation.

As the TSP Board has noted in recent months, a relatively small number of TSP investors transfer money out of one fund and into another in any given month. With the recent disruption in the TSP converting to a new recordkeeping system—and a number of investors having a negative experience with this process—combined with the continuing decline in the stock market, we can reasonably anticipate more assets going into the G Fund until the current stock market trend is reversed and stocks start back up again.