The stock market has taken a beating in 2022 and TSP fund performance has suffered as a result. Inflation is rising fast and not showing any signs of stopping, there is a war between Russia and the Ukraine, and it’s an election year here at home, all things that can create volatility in the markets. The S&P 500 is down about 19.5% so far this year. How have TSP participants responded to the falling stock market?

The Federal Retirement Thrift Investment Board (FRTIB), the agency which oversees operation of the Thrift Savings Plan, has released its latest monthly data on the TSP.

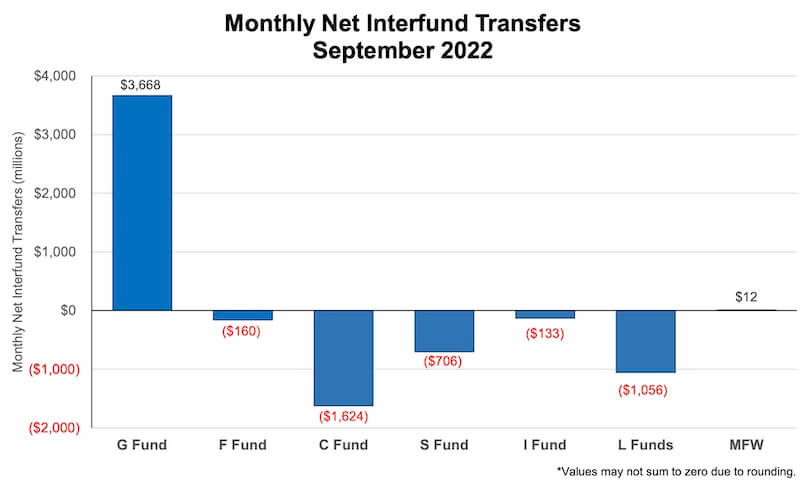

TSP Interfund Transfers in September 2022

In September, TSP participants collectively moved $3.668 billion into the G Fund. $1.624 billion was moved out of the C Fund and $1.056 billion out of the L Funds.

Here are the complete figures for interfund transfers last month. Note that figures are in millions and positive numbers indicate transfers into a fund.

| Fund | Net Transferred |

| G Fund | $3,668 |

| F Fund | -$160 |

| C Fund | -$1,624 |

| S Fund | -$706 |

| I Fund | -$133 |

| L Funds | -$1,056 |

Although the figures show that some TSP participants were likely fleeing a falling stock market, the moves out of stock funds are not reflective of the majority of TSP participants since the total assets in the TSP are around $700 billion.

As the FRTIB noted, “A net $3.668 billion flowed toward the perceived safety of the G Fund in September and away from riskier investments. Monthly numbers like these are not concerning, however, given the size of the TSP. As always, we observed that the vast majority of participants seem to be sticking with their investment programs.”

How Have TSP Participants Responded in 2022?

How do the figures look for 2022 as a whole? After all, September was not the first month of negative returns this year.

In the table below, I have listed the interfund transfers to the G Fund for each month this year along with outflows from the core TSP stock funds and the monthly performance of the C Fund. I chose the C Fund since it tracks the S&P 500 which is the standard barometer for performance of the U.S. stock market. Note that the values are in the millions; a negative number means money flowed out of the fund that month and a positive number means money was moved into the fund.

| 2022 | G Fund | C Fund | S Fund | I Fund | C Fund Return |

| September | 3,668 | -1,624 | -706 | -133 | -9.21% |

| August | -1,711 | $1,312 | $942 | -$270 | -4.08% |

| July | 2,635 | -$994 | -$540 | -$29 | 9.22% |

| June | 4,197 | -$1,863 | -$633 | -$171 | -6.55% |

| May | 6,353 | -$3,491 | -$745 | -$262 | -1.65% |

| April | 1,820 | -$17 | -$856 | -$122 | -8.72% |

| March | -1,591 | $1,454 | $951 | -$153 | 3.72% |

| February | 7,647 | -$3,676 | -$2,210 | -$337 | -2.99% |

| January | 5,922 | -$2,461 | -$2,018 | -$634 | -5.18% |

| Total | 28,940 | -$11,360 | -$5,815 | -$2,111 | |

| Average | 3,215.56 | -$1,262.22 | -$646.11 | -$234.56 |

It does appear that net inflows and outflows to the G Fund were triggered by the stock market going down and up, respectively.

However, once again, TSP participants are, generally speaking, not panicking with moves to the G Fund when looking at the size of the TSP as a whole. $29 billion out of $700 billion is only 4% (just to use some broad figures).

This is important because if one has a long-term time horizon for investing, such as over the course of an entire federal career, staying the course in the stock market has always been more beneficial than trying to time the market on the short term. Federal employees will also have the opportunity to contribute more to their TSP accounts in 2023 because of rising inflation.

TSP Fund Performance in 2022

The table below lists the TSP funds’ performance so far in October and for the year-to-date in 2022 as of October 24, 2022. October appears poised to be a redeeming month for stock funds amidst the ongoing bear market.

| Fund | Month-to-Date | Year-to-Date |

| G Fund | 0.26% | 2.21% |

| F Fund | -2.55% | -16.49% |

| C Fund | 5.99% | -19.30% |

| S Fund | 3.74% | -27.23% |

| I Fund | 3.76% | -24.51% |

| L Income | 1.26% | -4.81% |

| L 2025 | 1.97% | -9.45% |

| L 2030 | 2.92% | -13.79% |

| L 2035 | 3.16% | -15.33% |

| L 2040 | 3.41% | -16.76% |

| L 2045 | 3.62% | -18.04% |

| L 2050 | 3.85% | -19.19% |

| L 2055 | 4.83% | -22.02% |

| L 2060 | 4.83% | -22.03% |

| L 2065 | 4.83% | -22.04% |

Why the sudden optimism in October? Have the bears decided to dress up as bulls for Halloween?

According to CNN Business, “…the market has rallied this month on hopes that the Federal Reserve may soon take a break from its series of aggressive rate hikes to fight inflation. More big rate increases are expected at the Fed’s next meeting on November 2 as well as in December. Still, some hope the Fed may pause hikes in 2023.”

The Wall Street Journal writes, “October has a reputation as a ‘bear killer’—a month during which an above-average number of past bear markets have ended.”

It goes on to note that this is a historical trend due to above average levels of selling that tend to occur in September, due at least in part to end of quarter tax loss sales in the market.

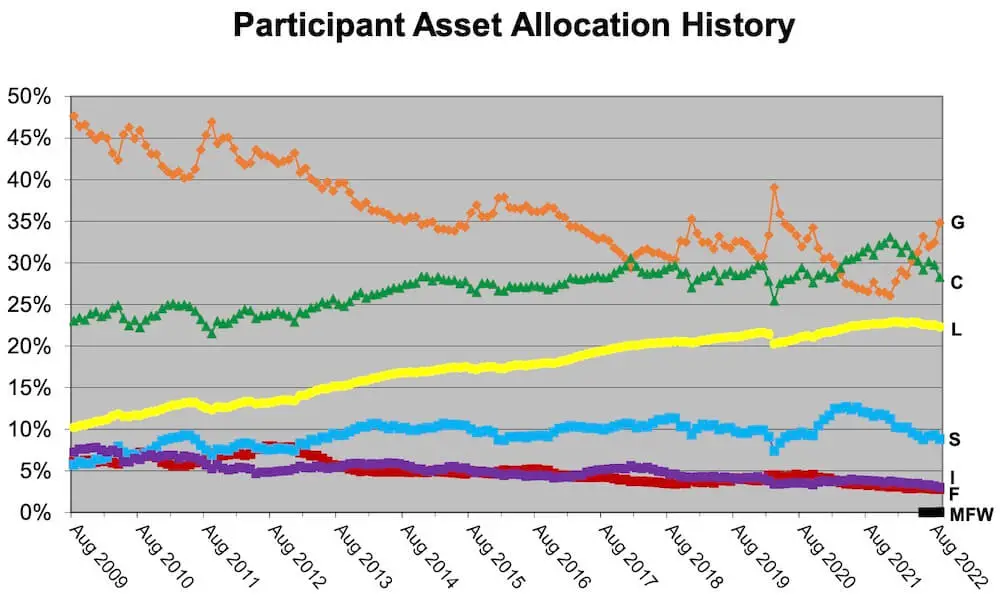

Where Are TSP Participants Putting Their Money?

Which funds have the largest holdings within the TSP? Here is a breakdown:

| Participant Allocation | Individual TSP Funds | |||

| Assets (Billions) | % of Total | Assets (Billions) | Share of Total | |

| G Fund | $239.9 | 34.8% | $289.9 | 42% |

| F Fund | $19.3 | 2.8% | $29.4 | 4.3% |

| C Fund | $195.1 | 28.3% | $243.0 | 35.2% |

| S Fund | $60.6 | 8.8% | $73.5 | 10.7% |

| I Fund | $21.1 | 3.1% | $54.0 | 7.8% |

| L Funds | $153.7 | 22.3% | N/A | N/A |

| MFW | $0.1 | 0% | $0.1 | 0% |

| Total | $689.9 | 100% | $689.9 | 100% |

The G Fund is still the king, but the FRTIB noted in its monthly meeting that the L Funds have seen a lot of money flowing into them, adding over 23,000 investors, due to auto-enrollment, particularly from uniformed services participants in the Blended Retirement System. Uniformed Services participation rates hit 84% in September.