There are some big changes coming to Required Minimum Distributions (RMD) in 2023 and beyond. As is usual, Congress has passed yet another law that has sweeping changes to tax laws. These changes were brought forth by the SECURE Act 2.0. You can learn more about the various impacts of this rule here.

This article will cover one topic in particular, required minimum distributions (RMD). We’ll discuss three major changes and how they present an opportunity for federal employees plan a better retirement.

New RMD Ages

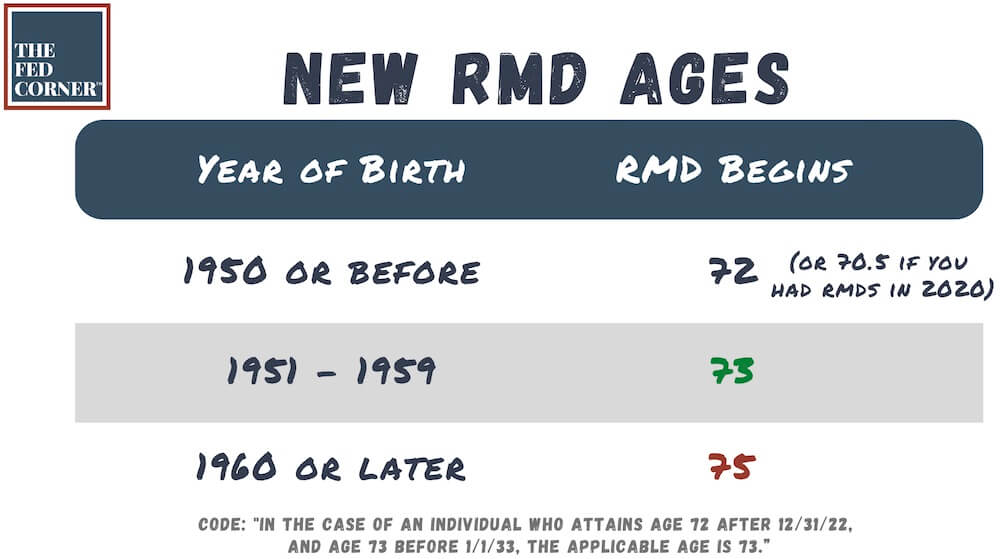

The first major change that will impact most families planning their retirements is the age in which their RMDs begin. The year in which you were born is what’s going to impact which rule you fall under.

If you were born in 1950 or earlier, you’re still under the RMD age of 72, or 70.5 if you were already on RMDs prior to the first SECURE Act. If you were born between 1951 to 1959, now your RMD age is 73. And if you were born in 1960 or later, your RMD age is now 75.

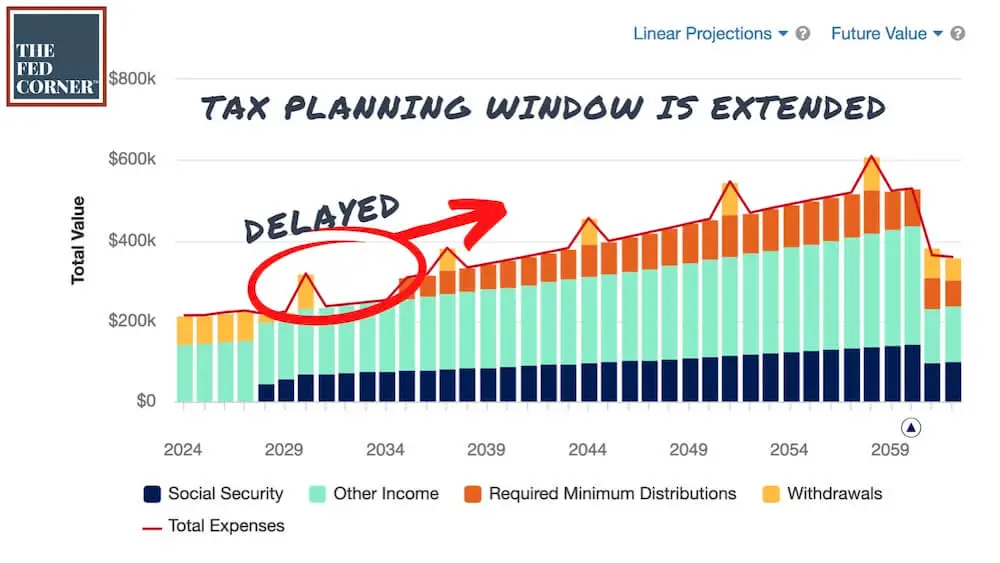

The immediate benefit to retirees is the ability to delay having to increase your taxable income by way of Required Minimum Distributions. Remember, all dollars taken out of traditional retirement accounts are taxable as ordinary income.

Inevitably, many families get stuck with minimum distributions that cause them to be pushed into higher tax brackets. As a result, they owe more taxes on their family’s wealth than if they had planned carefully.

The window of time between when you retire and when you begin RMDs is what we call your Tax Planning Window. There are many strategies that can be used to save incredible amounts of taxes in your retirement, like max-the-bracket, roth conversions, and others.

Roth RMD and Penalty Reduction

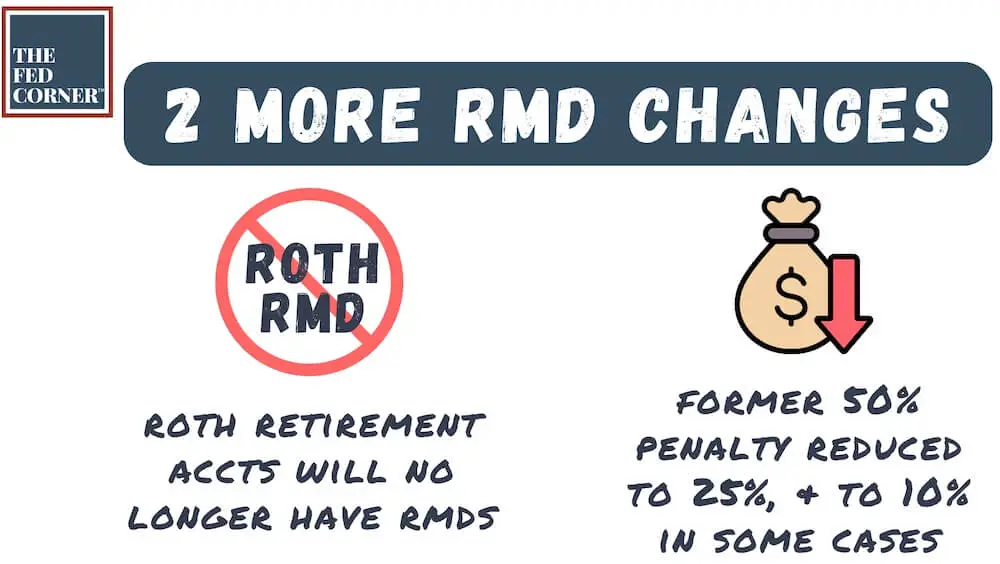

This next change has been highly anticipated. Prior to the SECURE Act 2.0, Roth retirement accounts, like the TSP-Roth, were included in Required Minimum Distribution calculations. This forced federal employees to take more out than you needed.

The whole point of RMDs is so that the IRS receives their tax money, so this rule had no reason to exist.

Another major change was to reduce the penalty for missing your RMD. The RMD penalty was one of the worst penalties in the IRS code. If you missed an RMD because you forgot, or maybe you thought your spouse or your advisor was taking care of it and never did, or you took the wrong amount—your penalty was 50% of what wasn’t distributed.

Let’s say you had a $16K RMD and only took $10K. Under the old rule, you would owe $3,000 in penalties to the IRS (50% of the last $6K you missed). The new rule reduces this to 25%, and even further to 10% in certain cases.

How Does This Impact My Retirement?

A question we receive regularly from federal employees is how these changes will impact their retirement plans. First, I think it will impact just about everyone given how the rule is structured, but some families will have a much bigger impact than others.

For example, if you’re someone who is behind on their tax reduction system, let’s say maybe you’re 67 or 68 years old and you just realized you have an RMD problem that needs to be fixed. There’s certainly a little bit of relief know that you have an extra year to implement those tax savings strategies, since your new RMD age is 73.

For those of you who are younger, maybe mid 50s to mid 60s, you have several extra years before you’ll have to take RMDs, so you have an even greater benefits in your tax planning window.

If you can pay taxes from your money in the 12% bracket rather than the 22% or 24% brackets, think about what kind of impact that can have on your family’s wealth if you implement these strategies for several years.

And that’s using our current tax brackets, which you’ll recall are lower than historically because of the Tax Cuts and Jobs Act (TCJA).

The savings are even higher if tax rates increase in the future. Your window of opportunity may be closing: the Tax Cuts and Jobs Act is set to sunset in 2025, and it’s widely accepted that tax rates will likely go up in the future. If you can start taking advantage of those strategies now, you can give yourselves the best chance of achieving your ideal retirement. After all it’s not just your money, it’s your future.