We just closed another quarter, and it has been quite a wild ride. Inflation is still high, we had three bank failures, and yet the markets brushed the news right off.

We are soon arriving to the point in which our economy will be gliding into the next season. You see, the Federal Reserve will be reaching its target “terminal rate”, which is the point in which they feel that interest rates are at the level consistent with balancing the economy. As a result, they will stop increasing interest rates.

This means that the next few months will be very transitional as we sit and watch the impact that higher rates will have on the economy. The objective is to reduce inflation plaguing our economy, but like antibiotics, sometimes the cure also causes challenges.

Understanding what’s led us to this point will help federal employees better plan their retirements and other financial decisions going forward.

Is it safe to retire soon? How should I be invested during the rest of this year? Should I be using more bonds now that rates are higher? What do I do with extra cash?

These are important questions that require context to be answered, and our team has pulled together salient information to help you have a greater understanding of how it all comes together. Our hope is to give you enough information about the economy so that you may feel better prepared moving forward.

However, please understand that this is not designed as an economic forecast and is intended to be informational only. It goes without saying that you should always consult with your own professionals before making any decisions.

The Delicate Balance of Rates

By now, most readers are well aware of the fact that interest rates have been rising. Recent home buyers have sticker shock compared to what mortgage rates cost just 12 months ago. What happens after the Fed stops increasing rates? Typically, they hold.

When starting antibiotics, the cure starts to work its way into the system. It is generally believed to be a bad idea to stop doses amid the treatment; so too must interest rates remain high while they work their “cure” against inflation into the system.

However, at some point in the future they’ll start reducing rates again because holding rates this high isn’t good for the economy in the long run. But between now and then, we’re sort of floating in this weird new place where it’s gotten expensive for organizations to do business.

What does this mean for upcoming retirees, or those who recently retired? If you have many years prior to that date, then our mantra remains the key for you: invest as aggressively as is appropriate and tolerable for your needs.

For current or soon-to-be retirees, there are more risks present now than before.

The Equities Markets (Stocks)

In the meantime, the markets have basically ignored three bank failures, inflation, and rising rates in their unrelentless rise, so let me explain why this happens.

The markets are generally trading ahead of our present time. By virtue of how they work, the prices reflected in the markets are its expectations of future profits of a corporation, or group in the case of indexes.

One of the main contributing factors to stocks having a strong first quarter is that they have begun pricing with the assumption that the Fed is going to cut rates by the end of the year.

This is an extremely aggressive assumption given the real data from the economy. With history as our guide, the markets do not always behave rationally, or in line with the data.

For instance, when stocks fell 25% in 1987, the world economy did not decline by a quarter during that time, just the markets.

Sometimes the markets behave in ways that aren’t rational, and this realization is important to understand as investors.

Let’s look at Q1 of this year.

U.S. and Global

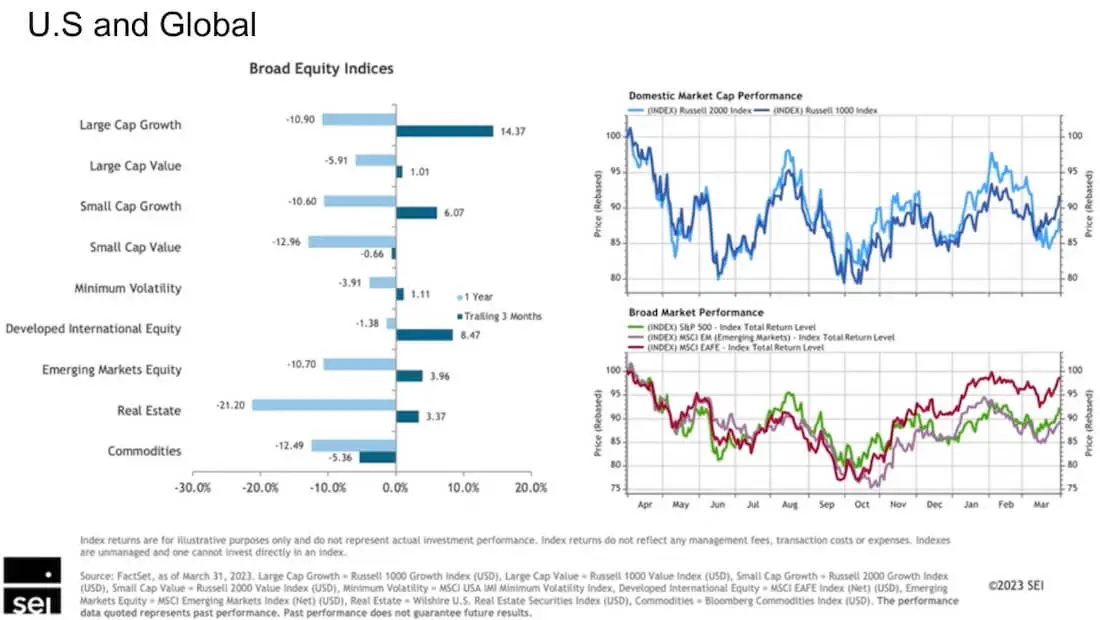

Many of the areas that were strongest this year were ones that were weakest last year.

This illustrates one of the reasons that we must focus on being well diversified within various indexes of the markets.

The markets are cyclical in nature, and this type of behavior remains a constant throughout time. The one thing that’s different now is how quickly the cycles are changing.

For a long time, growth investments, like most of the highest weight stocks in the C fund, did well for about a decade with many others lagging. This was a much longer period than is normal and the environment completely changed last year.

Of note, something that’s gone mostly unnoticed is how strong developed international markets have been.

We’re usually very U.S. focused, but international has been ahead of the curve for quite some time now, and this really helps portfolios that are set up correctly. On a practical note, maintaining geographical diversification may be helpful as you plan long term.

Value vs. Growth

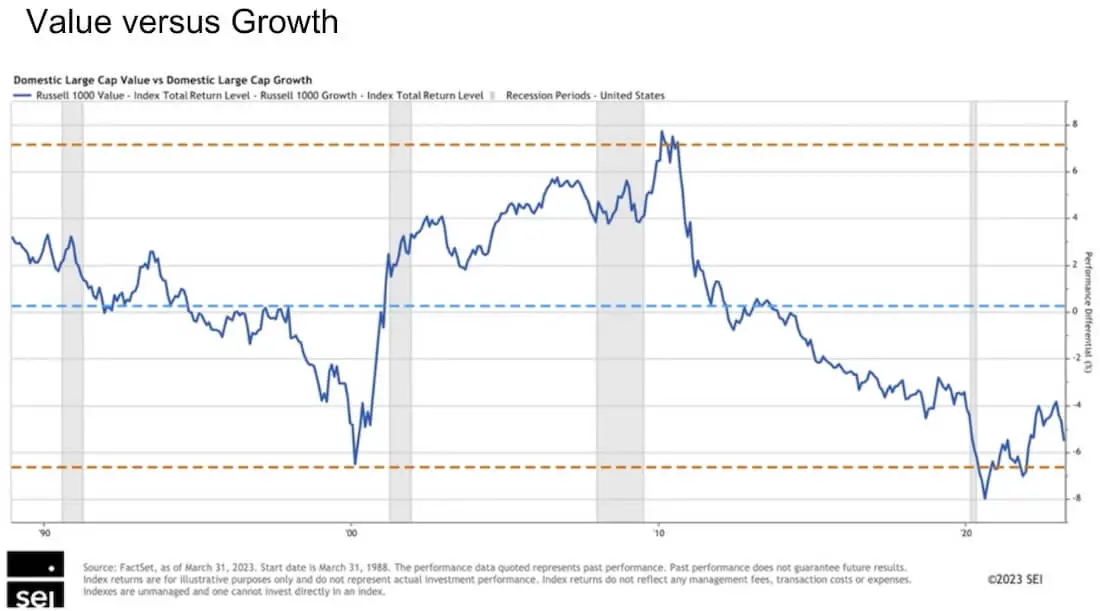

Something else to note is that historically, value stocks do better than growth stocks in periods of higher inflation and interest rates, which is where we’re in now.

When the line from the graph above goes down, growth stocks do better (like the last decade). When it goes up, value stocks do better (like from 2000 to 2010).

We’re seeing this trend be the case right now as value takes lead, so if rates continue to remain high, it could be a signal that value stocks still have an advantage.

For a long time, growth equities were the great beneficiary of extremely low rates. That kind of environment allowed equities to appreciate tremendously. But now the paradigm has shifted.

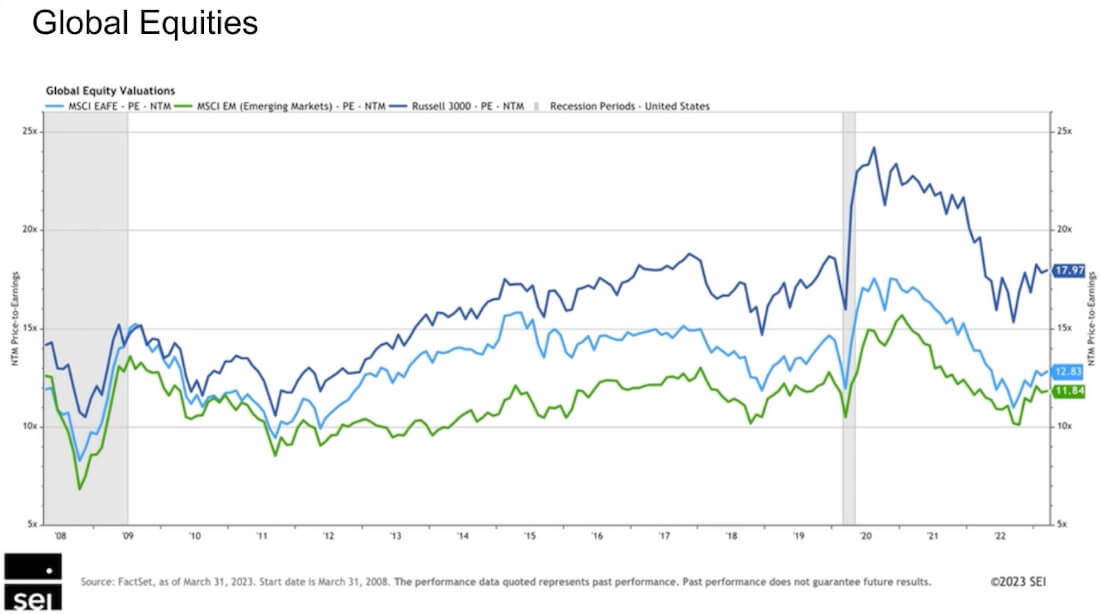

If we expand valuations even further to include stocks outside the U.S., we can see that the U.S. markets (dark blue line) are still trading at a higher premium relative to international, and this is why many economists are still very skeptical about U.S. stocks and equities across the board.

The Fixed Income Markets (Bonds)

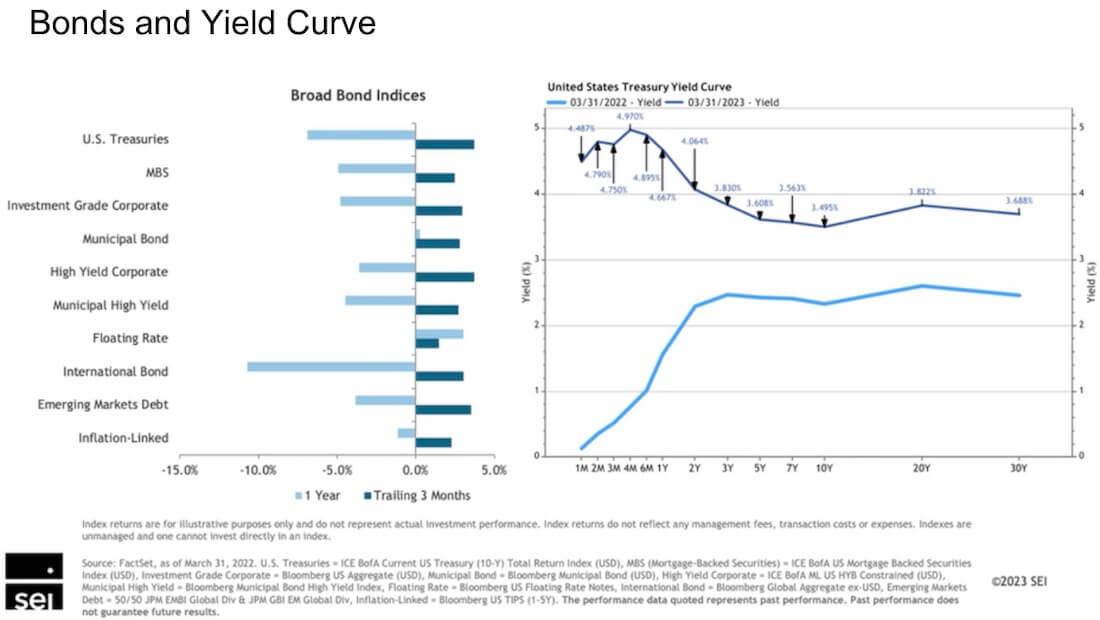

When we look at the fixed income markets or bonds, you can really see how dramatic the shift in interest rates has been.

This next graphic contains the U.S. Treasury percentage yields graphically displayed across all durations (short term U.S. Treasury bonds, all the way to 30-yr).

The light blue line is last year, the dark blue line is this year. Big difference, right? Let’s discuss its importance.

Last year (light blue line), the 1-year Treasury was yielding about 1.5%, while the 30-year was around 2.5%. The shape of this line, called the yield curve, is considered normal.

When we look at this year (dark blue line), we can immediately see that the shape of the yield curve has inverted. Historically, this has been a strong indicator of a recession. Short term bonds are yielding higher than long term, which is a sign of economic stress.

This means investors are not willing to part ways with their money for very long periods of time, and even doing so on a short-term basis requires a higher “reward” (interest payment), explaining the higher yields on short term bonds.

At the same time, this is one of the factors that makes bonds look so attractive right now and presents incredible opportunities in the bond space. Many portfolios have shifted towards bond ladders and other similar strategies.

Rate Cuts by Year End

As mentioned, the market’s strong performance in Q1 of this year was highly attributed to its expectation that the Federal Reserve will begin to reduce interest rates by the end of the year.

If you ever took an economics class, you might remember that the Fed’s goal for inflation is 2%. The likelihood of inflation being that low by year end is not high unless we see a deep recession during the summer.

Given how stubborn inflation has been, it would be surprising if Fed chairman Powell decides to reduce rates before the year end. Two consecutively negative years in the markets are not as common, but rates do not need to be reduced for markets to be resilient, especially given their trait of pricing ahead of reality.

In the 80s, one of the reasons for the extended high inflation was because the Fed “let off the gas” slightly early. This current Federal Reserve is very sensitive to make sure that we don’t repeat that.

I’m always curious about how others feel regarding the rest of this year. There’s no argument that there’s still a lot of mixed feelings. Use the comment section below to share your thoughts:

- How do you think the rest of the year will go?

- Do you think the Fed will cut rates by end of year?

- How do you think corporations will be impacted by higher interest rates?

If you’re curious about more of our thoughts on questions like these, check out our newsletter.

The Good and Bad Summarized

As with most quarters, there’s both good and bad news, so let’s cover those next.

| The Good | The Bad |

|---|---|

| Economic growth was continuing to surprise and markets were strong | The resulting inflation means rates must remain higher for longer |

| The bank scare was not systemic and not at all a rerun of 2008 | Smaller banks are still affected, and lending is tighter going forward |

| Interest rate increases are likely ending soon, which reduces inflation | The markets are priced for cuts, and if they’re wrong could mean volatility |

| Stocks have shown incredible resilience despite rising rates | The gains have been very concentrated and may not be sustainable |

While it was nice to see the markets provide some relief and recovery, this was partly due to a strong labor force and production momentum. This gives tailwind to inflation and means the Fed will likely hold interest rates higher for longer.

With the bank failures, it was nice to see that the issue appeared to be isolated and not systemic. The trauma from 2008 flashed before many investors’ eyes, and we were glad to see authorities act quickly. The challenge is that it did ripple to numerous regional banks, and many have suffered hard losses as a result. While no one wants the banks to earn more than they deserve, the “house” must win for everyone else to play.

It’s also good news to hear that the Federal Reserve may be reaching its terminus rate, where they will stop increasing rates. The bad news is that the markets seemed to have missed that message, and if they’re wrong that could mean more volatility in the markets.

Lastly, stocks showed nice resistance and allowed portfolio values to recover some, but these gains were concentrated and not market-wide, which means many corporations are still struggling in the shadows. There are many more opportunities in the bond markets today that could be beneficial to investors going forward.

I hope this high-level update offers perspective and helps you as you think about your own planning going forward. Remember that planning is a process and not an event, so make sure to keep up with the maintenance. After all it’s not just your money, it’s your future.