Historically, federal retirees haven’t had to pay much attention to Medicare Part D. Prescription drug coverage from any FEHB plan has been generally as good or better than what’s available from a Part D plan without having to pay an extra premium.

Major Medicare Part D reform that passed last year will change this, however, because of provisions that significantly lower out-of-pocket prescription drug costs when you have Part D coverage. Expect to see new plan options as soon as this fall that will alter how prescription drug coverage will be received by federal annuitants.

Medicare Part D Reform

The Inflation Reduction Act (IRA) that passed last year seeks to lower prescription drug costs for Medicare beneficiaries and the federal government. Included in the legislation are several provisions that improve Part D benefits. These provisions have already started to roll out this year with more to come.

2023 and 2024 Changes

Insulin Prices Capped

Insulin covered by Part D plans is capped at no more than $35/month starting this year. Part D plans will not have to cover all insulin products but will have to offer one of each dosage form—vial, pen—and insulin type—rapid-acting, short-acting, intermediate-acting, and long-acting.

Catastrophic Coverage Coinsurance Dropped

Once total spending between the Part D enrollee, Part D plan, and drug manufacturers reaches $7,400 in a year, catastrophic coverage begins. Currently, the enrollee pays 5% of expenses in the catastrophic coverage phase. Beginning in 2024, Part D plans will eliminate the 5% enrollee share.

Medicare Part D Premium Increase Limits

Starting in 2024 and lasting through 2030, the IRA limits Part D premium growth to no more than 6% per year. Part D premiums increased 10% on average from 2022 to 2023, so the 6% cap offers some protection from large price hikes in the future.

2025 Change

Out-of-Pocket Spending Cap

In 2025, there will be a new $2,000 enrollee out-of-pocket spending cap in Medicare Part D plans. Additionally, enrollees will have the ability to spread out that $2,000 over the course of a year. This provision will limit out-of-pocket drug costs to no more than $167 a month for any Part D enrollee.

This change will produce substantial savings for annuitants with high out-of-pocket drug costs. For those needing expensive brand or specialty drugs to treat cancer, multiple sclerosis, or other medical conditions, joining a Part D plan will be a huge cost saver unless FEHB plans modify their offerings to match this benefit.

Why such big savings? Because the soon-to-be $2,000 out-of-pocket maximum in Part D is significantly lower than almost all catastrophic limits seen in FEHB plans, which range from as low as $1,500 to as high as $9,100 when using in-network providers for self-only enrollment.

Two Medicare Part D Enrollment Options For 2024

In its annual carrier call letter, OPM has indicated its desire to have federal annuitants receive improved prescription drug coverage from Part D plans and is allowing Federal Employees Health Benefits (FEHB) carriers to offer two Part D enrollment options—FEHB Medicare Advantage Plans (MA) and FEHB Prescription Drug Plans (PDP).

FEHB MA Plans

These plans bundle Medicare Part D for prescription drug coverage, and a handful of them have been available to federal annuitants over the last couple of years. By joining an FEHB MA plan, you’ll receive improved Part D benefits going forward. Moreover, because Medicare is the primary payer for annuitant medical bills, these plans pass on most of their FEHB enrollee costs to Medicare and offer low FEHB premiums, rebates on the Medicare Part B premium, or both.

There are several nationwide FEHB MA plans currently available—Aetna Advantage, APWU High, Compass Rose, Foreign Service, MHBP Standard, NALC High, Rural Carrier, and SAMBA. There are also local FEHB MA plans available from Humana, Kaiser, UnitedHealthcare, and UPMC that between them cover most states. Expect to see even more FEHB MA plans in 2024.

To join one, you must be enrolled in the FEHB plan offering MA, plus Medicare Parts A and B. All FEHB MA plans either reimburse or reduce some or all the Part B premium. Many have $0 out-of-pocket costs for medical and hospital expenses from providers that accept Medicare, except for prescription drugs.

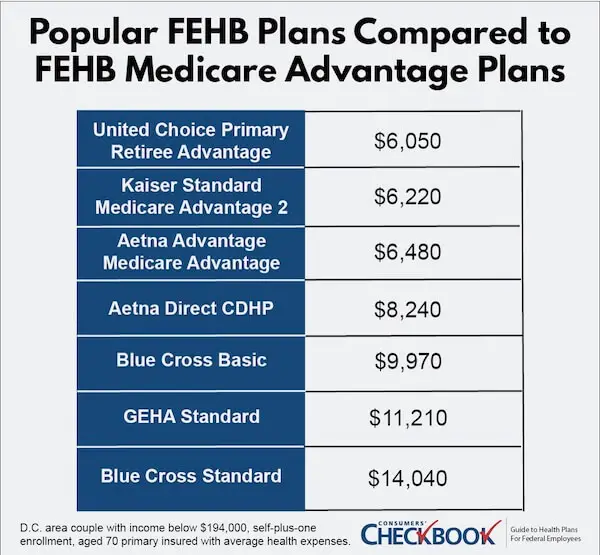

For most annuitants, the FEHB MA plans will be the least expensive plan choice considering premium savings as well as $0 out-of-pocket medical and hospital spending. Checkbook’s Guide to Health Plans ranks all FEHB plans based on a total cost estimate that’s a combination of for-sure expense (premium) plus likely out-of-pocket costs you’ll face based on age, family size, and expected healthcare usage.

For 2023 coverage, we calculate that a D.C.-area couple enrolled in Medicare Parts A and B with income below $194,000 could have saved $7,990 in estimated total costs this year by switching from BCBS Standard to United Choice Primary Retiree Advantage—a cost savings likely to remain the same in future years assuming no major plan changes.

While most annuitants would benefit financially from enrolling in an FEHB MA plan, it may not be the best choice for everyone.

If you fall into a high-income category—more than $97,000 for individuals or $194,000 for couples— you’ll be subject to higher Part B premiums called Income Related Monthly Adjustment Amounts (IRMAA). If you expect high income to persist throughout retirement, the higher Part B premium you’ll pay will erode the financial value of enrolling in an FEHB MA plan. With FEHB MA plans, you’ll get hit twice with IRMAA, which means you’ll be paying both a higher Part B and Part D premium. But, if you fall into just the first tier of IRMAA, you should still consider FEHB MA plans as they’ll likely remain the least expensive plan choice available to you.

Additionally, if you spend a large portion of time abroad, only one FEHB MA carrier (UnitedHealthcare) provides reimbursement for routine overseas care. Of course, since you stay enrolled in an FEHB plan with any FEHB MA plan, you’ll always have the emergency overseas care coverage that every FEHB plan provides.

Finally, make sure to check the plan provider directory before enrolling. While many claim you can see any provider that accepts Medicare, there are a handful of examples where certain networks might be excluded from coverage.

FEHB PDP Plans

For the first time ever for plan year 2024, OPM will allow FEHB carriers to offer supplemental prescription drug Part D plans along with their FEHB plan offerings. To receive OPM approval, the FEHB PDP coverage must be as good or better than the prescription drug coverage offered from just the regular FEHB plan. This should mean, like FEHB MA plans, there will be no extra premium to join an FEHB PDP.

OPM is also allowing FEHB carriers the possibility of auto-enrolling their Medicare plan members into an FEHB PDP. However, plan members will be able to opt out if they wish, and FEHB carriers will have to show how they’ll inform their members, process enrollments, and provide customer service before OPM approves auto-enrollment.

Even though annuitants likely won’t be subject to an extra premium with an FEHB PDP, IRMAA still applies if you have a high income. For 2023, Part D IRMAA was an extra $12.20/month in the first income tier and up to an extra $76.40/month in the fifth income tier.

Annuitants will need to pay close attention to OPM announcements and communication from their existing FEHB plan this fall before and during Open Season. If you’re auto-enrolled, you will receive a notification from your FEHB plan at least 30 days prior to the start of coverage. If you’re not auto-enrolled, you can consider enrolling in the FEHB PDP offered by your FEHB plan.

While the FEHB PDP drug coverage is supposed to be as good or better than your FEHB drug coverage, you’ll need to carefully review plan materials to confirm that the cost-sharing arrangements are the same or lower, in-network pharmacies remain the same, and that any existing prescription drugs you take are still on the plan formulary.

You can enroll in a Part D PDP if you have Medicare Part A or Medicare Part B. For annuitants who aren’t enrolled in Part B and would be subject to a Part B late-enrollment penalty, you’ll qualify for PDP enrollment with Part A coverage.

The Final Word

Federal annuitants and soon-to-be annuitants have even more healthcare decisions to consider: Whether to enroll in Part B at age 65 (which opens the door to FEHB MA plans), which FEHB plan to select during Open Season, and now whether to enroll in Part D either through an FEHB MA plan or FEHB PDP.

The right choice will largely be determined by your anticipated prescription drug usage, whether you have Part B coverage, and whether you are subject to higher Part B and Part D premiums (IRMAA).

If you have low prescription drug usage and aren’t auto-enrolled in an FEHB PDP, you can delay Part D enrollment. There is no late enrollment penalty since your FEHB plan drug coverage is considered creditable coverage by OPM. If your situation changes, you can enroll in Part D then.

For annuitants with moderate or high prescription drug usage, including annuitants that take insulin, joining Part D will be an important way for you to save on your out-of-pocket drug expenses.

For annuitants that aren’t subject to IRMAA and have Part B coverage, FEHB MA plans will be the best way to receive enhanced Part D benefits and save a considerable amount of money on total healthcare expenses. Annuitants subject to IRMAA will need to decide if enhanced Part D benefits are worth paying the extra premium amount.