June 30th was the final day for trading stocks for the month and the second quarter of the year, and TSP performance has been strong so far in 2023. The positive performance of the stock market is based in part on the latest inflation report. The personal-consumption-expenditures price index was up 3.8% in May over the last 12 months. While this is still high, it is the lowest increase since April 2021.

The S&P 500 (the index on which the TSP’s C Fund is based) was up in June for the fourth straight month. This is the longest winning streak for this index since August 2021. The Nasdaq also climbed for a fourth consecutive month to score its longest such win streak since April 2021.

The Federal Reserve has been increasing interest rates since 2022 to combat raging inflation. Federal Reserve Chairman Jerome Powell said he does not think inflation will return to its 2% target until 2025.

Best Funds for TSP Performance in 2023

So far in 2023, the C Fund is up 16.88%, the S Fund is up 12.64%, and the I Fund is up 12.16%. Over the last 12 months, the C Fund is up 19.54%, the I Fund is up 19.08%, and the S Fund is up 15.24%.

The most aggressive Lifecycle Funds (L Funds) were up 14.6% (the L 2055, 2060, and 2065 Funds) so far this year.

All TSP Funds are up in 2023. Over the past 12 months, only one TSP Fund has had a negative return. That is the F Fund which is down 0.87% over 12 months.

Why Is the Stock Market Up in 2023?

Some TSP investors may be wondering why stocks are going up. The war in Ukraine continues to destroy much of that country. Inflation is declining but still high. There has been a banking crisis and there is the threat of a U.S. default.

While all of these events may have had a negative impact on investor confidence, the worst-case possibilities have not occurred. A default has been narrowly averted, the banking crisis did not spread into a nationwide banking problem, and raising inflation rates has not ended an expansion of the American economy.

So, despite the possibility of various catastrophes impacting stock investments, and despite some close calls, the overall impact of these potential problems is not as great as some were predicting at the beginning of this year.

There is always risk in stock investments; this year is no exception. Patient investors have been rewarded in the past despite short-term setbacks in all sizes and shapes.

TSP Returns for June 2023, 12 Months and Year-to-Date

| Fund | June Return | Year-to-Date | 12-Months |

|---|---|---|---|

| G Fund | 0.32% | 1.91% | 3.76% |

| F Fund | -0.36% | 2.25% | -0.87% |

| C Fund | 6.61% | 16.88% | 19.54% |

| S Fund | 8.31% | 12.64% | 15.24% |

| I Fund | 4.57% | 12.16% | 19.08% |

| L Income | 1.70% | 5.05% | 7.40% |

| L 2025 | 2.42% | 6.74% | 9.38% |

| L 2030 | 3.74% | 9.59% | 12.81% |

| L 2035 | 4.07% | 10.34% | 13.64% |

| L 2040 | 4.41% | 11.09% | 14.49% |

| L 2045 | 4.71% | 11.74% | 15.20% |

| L 2050 | 5.00% | 12.38% | 15.94% |

| L 2055 | 6.07% | 14.60% | 18.84% |

| L 2060 | 6.07% | 14.60% | 18.83% |

| L 2065 | 6.07% | 14.60% | 18.83% |

TSP Investors Continue I Fund Investments

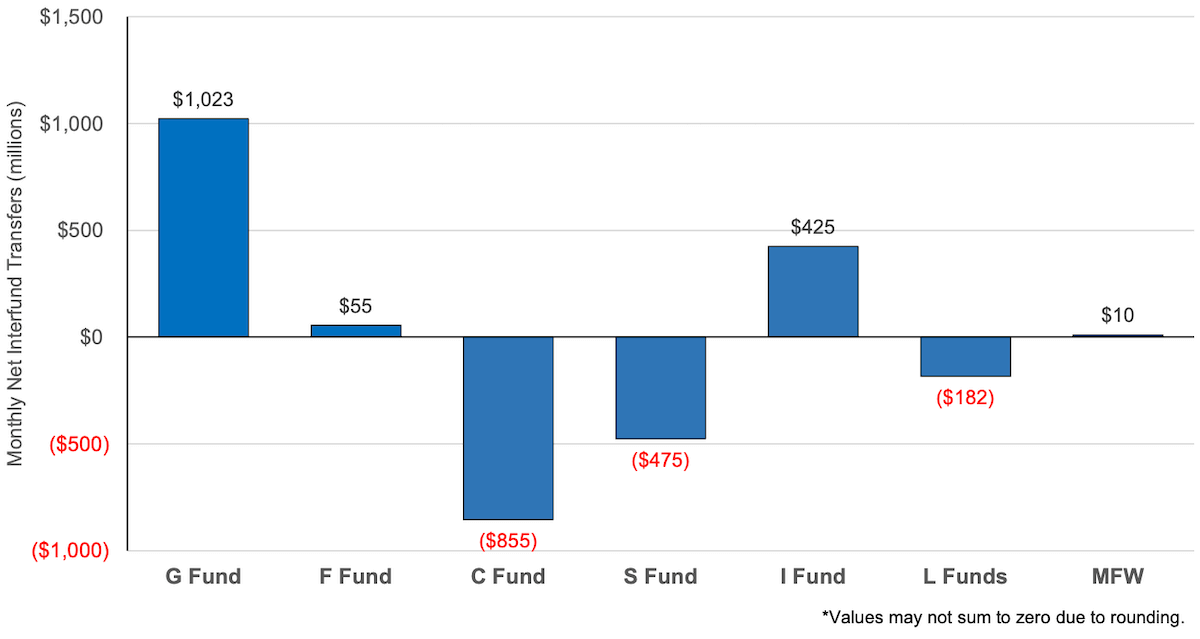

During May 2023, TSP investors added over one billion dollars into the G Fund and another $425 million into the I Fund. They also withdrew $855 million from the C Fund, $475 million from the S Fund, and $182 million from the Lifecycle Funds.

This is a small percentage of TSP assets. As of the end of May, total TSP assets were $767 billion. Obviously, most TSP participants do not actively trade between funds during a given month. Those that do more trading often appear to be reacting to recent investment returns and moving into the safety of the G Fund or the TSP Fund with the highest most recent returns.

How TSP Participants Invest Their Money

As of May 31, 2023, this is how TSP investors are allocating their money:

| Fund | % | Assets (in billions) |

| G | 31.7 | 242.9 |

| F | 2.6 | 20.1 |

| C | 29.7 | 227.5 |

| S | 8.7 | 66.4 |

| I | 3.9 | 30 |

| L | 23.4 | 179.5 |

| Mutual Fund Window | 0.2 | 0.0 |

| Total | 100% | 100% |