The importance of using your Thrift Savings Plan (TSP) correctly doesn’t need to be stated. Doing so could mean the difference between having a successful or failed retirement.

There are two major phases of your life regarding your savings: accumulation and distribution.

Many federal employees make the mistake of thinking that the only required action is to tell the TSP to begin sending their retirement paychecks. But our clients know that it’s not that simple. They know that by implementing the strategies discussed herein, it’ll give them the best chance of success in retirement.

In this article, we’ll explore a case study of how taking the wrong approach can create challenges for a retirement plan over time, as well as covering how we would approach creating a sustainable retirement income system as professional retirement planners.

Cashflow is King

The first task at hand is to determine your monthly cashflows. This is how much money comes in and how much goes out each month. This provides us with your annual cashflows.

Many federal employees may not know exactly how much they spend each month. They may have an idea of what their mortgage is, how much they travel, and roughly what they spend on groceries and leisure.

But there are other things we often forget, like internet, cell phones, college funds, clothes, insurance policies, liabilities, etc. How often do you buy cars? Do you pay in cash, or do you finance? This should be part of your monthly cashflows. The list goes on.

Determining these figures is no one’s favorite exercise. Hence, here’s a quick way to get a number that will get you pretty close to reality:

- Start with how much you earn on a paycheck, and take out how much you contributed to the TSP, FEHB, taxes, etc. Whatever is left over gets deposited into your bank.

- Now look at your bank accounts. Are your checking and savings accounts growing over time? Or do they grow a bit but then go back down after vacation, then grow some more, then back down during holidays?

For most people, if they look at their balances year-over-year, it fluctuates throughout the year, but they don’t typically finish the year with more cash than they started with.

This means that you’re spending your full net paycheck. Multiply that by 26 pay periods, and there’s your annual cashflow spend rate. And if you want your monthly number, divide that by 12.

Note that if you use credit cards, make sure to understand how those monthly balances correlate to your inflows. If balances are routinely greater than inflows, than your spend rates are actually higher than your income, meaning you’re in net negative cashflow. This needs immediate attention.

Case Study Example

Now that we know your needed cashflows, we can work backwards to figure out how much of that is covered by your Federal Employees Retirement System (FERS) annuity and Social Security.

For our example, let’s assume your outflows are $9K/mo. Keep in mind that this number will need to be inflated as time goes on, by roughly 2.5 – 3%, compounding annually.

We understand that most federal employees don’t have complex retirement planning tools, so if you’re savvy in Excel, you can use the Future Value (FV) function to estimate inflated future needed cashflows.

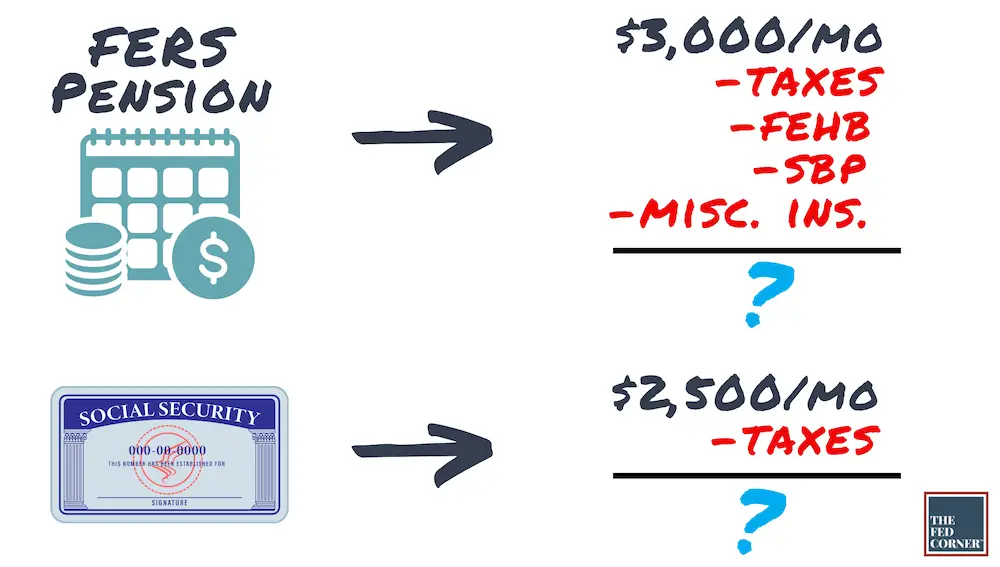

Then let’s assume a FERS pension of $3K/mo and a Social Security benefit of $2.5K/mo, totaling to $5.5K/mo out of the $9K that you need each month, right? Not quite.

Remember that your FERS pension is fully taxable at income tax rates. This means that it’s taxed at the same rates as a salary. While you might be earning $3K/mo, you’ll be receiving less.

Federal Employees Health Benefits Program (FEHB) premiums also are deducted from your pension, as well as the 5-10% cost for the survivor benefit pension so that your spouse can keep some of your pension (and FEHB) if you pass before them.

Your Social Security benefit amount is also likely not your full take-home amount. For most people, part of their Social Security will be taxable.

We can see that the $5.5K/mo of cash inflows from FERS and Social Security is now reduced to something more like $4K/mo, or possibly even less.

Sticking with our example, the $9K/mo of required cashflow is now only partially met with $4K/mo in net after-tax inflows, resulting in a delta of $5K/mo remaining.

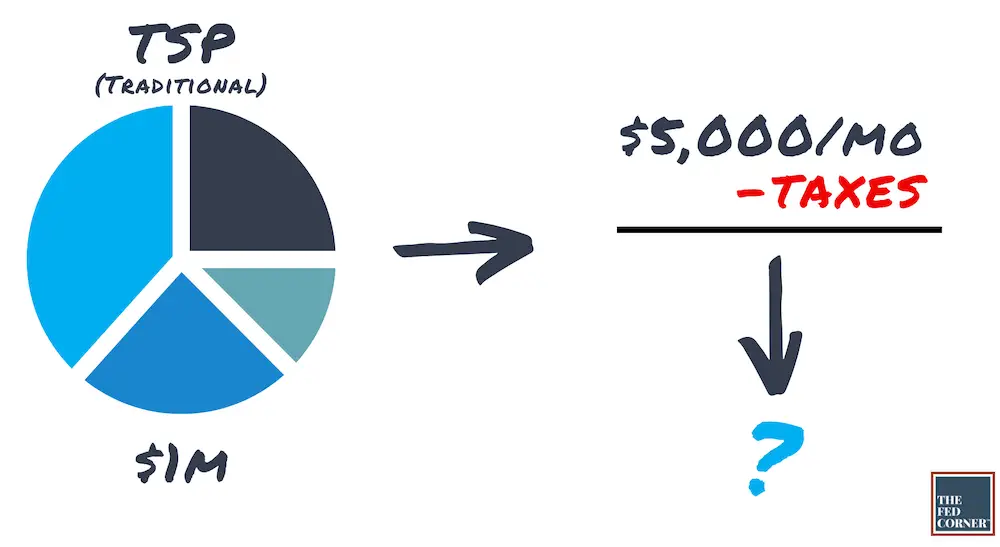

This gap must be filled from your savings. Continuing our case study, we’ll assume a TSP with a nice round $1M. How do you go about withdrawing that money?

Telling the TSP to send you $5K each month will not provide this family with the cashflow they need unless they withdraw from the Roth TSP. Remember that all Traditional (pre-tax) TSP distributions are taxed the same way as your FERS pension and salary. It is considered as ordinary income for tax purposes.

How much do you need to take out so that you still get $5K/mo after paying owed taxes? This will vary on your individual tax situation as well as current tax codes.

The good news is that in retirement you have great control over how you generate your taxes, so proper planning can help greatly reduce your lifetime tax liability. This is outside the scope of this article but will be covered in the future.

For simplicity’s sake, we’ll assume that to get $5K/mo after-taxes they will need to withdraw $6K/mo. This amounts to $72K a year.

When we look at that as a percentage of their liquid assets (TSP), that’s a 7.2% withdrawal rate (72K/1M), which is considered a high and likely unsustainable withdrawal rate in traditional financial planning philosophy.

Many federal employees and retirees have also heard of the 4% rule but understand that it is a large generalization that should be taken lightly. The right answer is more nuanced, including the ability to be higher or the necessity to be lower.

Bringing it All Together

So now we have your monthly cash outflows, we know how much of it is covered by FERS and Social Security, and we’ve calculated how much must come out of the TSP or other investments to cover the gap. This is where many federal employees start to get themselves into trouble.

The next question that needs answering is which investments are going to provide you with the cashflow and growth that you need? The objective is to meet your cash needs now, but also continue growing your money so that future-you can make inflation-adjusted withdrawals as well.

We know that the G Fund doesn’t provide great growth, and it earns like money markets. It provides principal protection which is important in retirement.

The C, S, and I Funds have a lot of growth potential but that also means that they have a lot of volatility. Remember that growth and volatility are two peas in a pod. Volatility is the price you pay for the opportunity of growth.

The C, S, and I Funds are growth-tools. Naturally, this means that you may want to avoid making withdrawals from them and not use them as a cashflow-tool, particularly in volatile years in the markets. This is a challenge not yet solved by TSP.

When you take funds from the TSP, you can’t pick which fund gets sold. All of them get sold proportionally. This lack of control means that you may be selling the C, S, and I Funds at a loss when volatility returns, which is exactly the opposite of what’s required for a successful retirement.

One of the greatest risks to a retirement is something called Sequence of Returns risk. This can be mediated by using various strategies, including a bucketed approach to portfolio management. You can learn more about both here.

Tax Planning is Everything in Retirement

You can have the greatest income and investment systems in place, but if you fail to address your tax plan in retirement, your retirement plan could be a leaky bucket causing you to pay massive amounts of extra taxes.

The right systems can help retirees save hundreds of thousands in taxes throughout the course of their retirement. Diversifying the taxability of your assets is another critical part of successfully using your retirement savings.

Taxes are a major part of retirement, and the case study above showed us how much taxes can affect the heartbeat of retirement: cashflow.

An ideal portfolio has assets in three major tax-statuses:

- Traditional Retirement (pre-tax)

- Brokerage (after-tax, i.e., individual/joint/trust/etc.)

- Roth (tax-free)

If you only have Traditional (pre-tax) TSP dollars for retirement, then you’re stuck with paying income tax on almost every dollar spent in retirement and every dollar you take out increases your tax bracket, which could mean receiving even less of your FERS pension and Social Security, and increasing your Medicare premiums if you’re on Part B.

With variety, you get to design exactly how you’re going to generate that $5K/mo that you still need from your portfolio, and you can develop a strategy to accomplish this with the least amount of tax liability. This helps you keep more of what you’ve earned, and better enjoy your retirement. Strategies like Roth conversions could help you accomplish this, but not for everyone.

Take the time to do the planning so that you can be confident in your financial independence. After all it’s not just your money, it’s your future.