2024 Federal Pay Raise and 2024 COLA: Differential Favors Current Federal Employees

The cost of living adjustment (COLA) in January 2024 will be 3.2%. This is substantially less than the 8.7% COLA awarded in 2023. It is also less than the 2022 COLA of 5.9%.

In 2023, the differential between the annual pay raise and the COLA amount was 4.1%. The 8.7% COLA was substantially higher than the 4.6% average federal pay raise that became effective in January.

While we cannot be certain about the average federal pay raise in January, the average pay raise will likely be 5.2%. As often happens, Congress has not been inclined to legislate a different percentage than the amount approved by President Biden in his alternative pay letter.

The result is that there will most likely be a differential of 2% in 2024 between the pay raise and the COLA. And, in another difference, the 2024 differential will favor current federal employees who receive a pay raise.

While all FedSmith readers are likely looking forward to a 2024 pay raise or COLA, the actual change in your economic security is a continued loss of purchasing power despite receiving more money each month. As of 2023, one estimate is that purchasing power has declined 36% since 2000.

Pay Raise vs. COLA by Year

| Year | Pay Raise % | COLA % |

|---|---|---|

| 2010 | 2 | 0.0 |

| 2011 | 0 | 0.0 |

| 2012 | 0 | 3.6 |

| 2013 | 0 | 1.7 |

| 2014 | 1 | 1.5 |

| 2015 | 1 | 1.7 |

| 2016 | 1.3 | 0.0 |

| 2017 | 2.1 | 0.3 |

| 2018 | 1.9 | 2.0 |

| 2019 | 1.9 | 2.8 |

| 2020 | 3.1 | 1.6 |

| 2021 | 1 | 1.3 |

| 2022 | 2.7 | 5.9 |

| 2023 | 4.6 | 8.7 |

| 2024 | 5.2 | 3.2 |

| Average | 1.9 | 2.3 |

There were three years (2010, 2011, 2016) without a COLA increase. The reason for the lack of any increase was because of low inflation. (Also see Why Your Costs May Be Up But Your Retirement Income Goes Down)

FERS vs. CSRS COLA Calculations: Why Are They Different?

Overall, the federal pay raise percentage has averaged less than the annual COLA. Of course, those under FERS, now a large percentage of federal employees, often receive a lower COLA.

When inflation is up more than 2%, a FERS pension increase will fall behind. This difference is likely to be substantial over time for a person who may be retired for many years. When inflation is above 3% using the CPI-W index, FERS pensions will lag 1% behind this inflation rate every year in which this occurs. Because of this, interest groups and some in Congress want to modify FERS to make it more like CSRS (while keeping the FERS advantages passed by Congress when it created the FERS system).

The rationale for the differences in the two systems is that CSRS employees do not receive Social Security. Some CSRS employees receive Social Security based on employment other than working for Uncle Sam. It is not included as part of the CSRS system.

FERS makes it easier to leave federal service. CSRS provided a retirement plan after a long career of working for the federal government. The federal retirement system was a system with “golden handcuffs.” It assumed a federal employee would remain a federal employee until dying or retiring.

FERS employees receive Social Security and the entire Social Security COLA every year. So, unlike those under CSRS, they do receive the full COLA for Social Security.

FERS employees also have access to invest for their future retirement through the Thrift Savings Plan (TSP) for their entire career with the federal government. The federal government provides an extra matching amount that goes into the TSP to provide a greater income stream during retirement. The TSP gives employees a chance to invest money for future retirement income as they see fit and also receive a tax break. The Federal Retirement Thrift Investment Board invests this money into funds selected by the employee.

Diluting the Impact of the 2024 Pay Raise & COLA

Some current federal employees will see a larger check if a person receives a promotion or a within-grade increase (WIG). Retirees are more likely to be living on an income that only increases with an annual COLA.

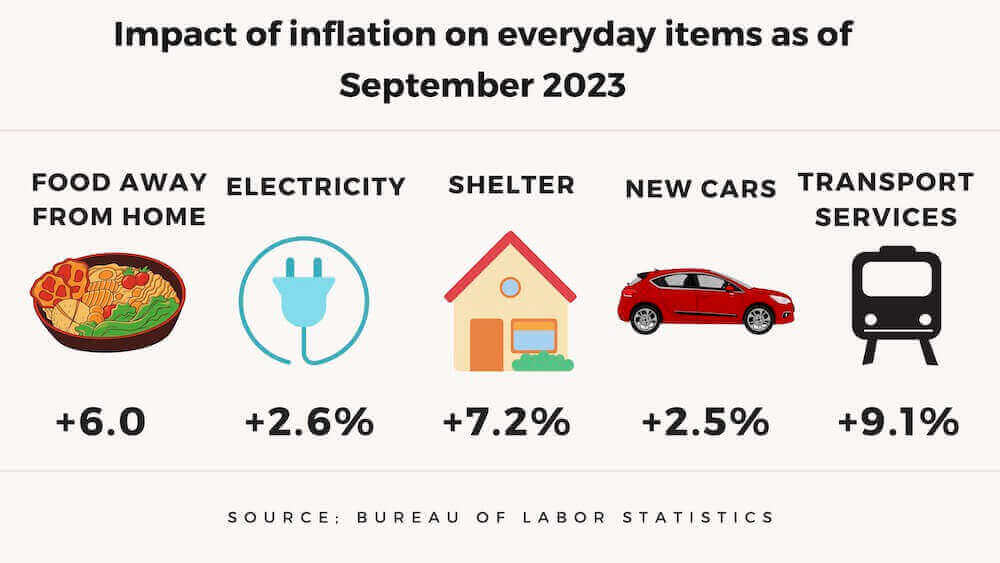

No doubt, the COLA increases help. For those who think a COLA will retain purchasing power, that may be a mirage, even with relatively low inflation. The Senior Citizens League estimates that the average Social Security benefit lost over one-third of purchasing power between 2000 and 2023.

COLAs have not kept up with more expensive prescription drugs, food, and housing.

Some federal employees have an advantage of possible promotions or at least a within-grade pay increase (WIG) coming up. For example, the average federal employee pay went up despite a pay freeze during the Obama administration, during a period of very low inflation.

Comparing 2023 to 2022

2023 has been substantially different than 2022.

In 2022, the stock market dropped significantly. The C Fund went down 18.13%. The S Fund was down 26.26%, and the I Fund dropped 13.94%. TSP investors were generally unhappy, particularly if they were planning on retiring in 2023, and their TSP investments may have dropped significantly in the year before retirement.

So far in 2023, the TSP Funds have performed well. The C Fund is up more than it was down at the end of 2022, and the S and I Funds are also way ahead of 2022 performance. Those planning on retiring in the near future probably have a larger nest egg to support them as they start their retirement years.

As of this writing, TSP investors will look back on 2023 as a good one for their financial future.

As always, significant negative events are lurking. The war in Ukraine is continuing, and the United States is spending a significant amount in support of their war effort. A war in the Mideast erupted after Israel was attacked in October, and it is unlikely to end in the near future. This war has the potential to become a world war. How these events unfold will impact stock market returns.

Inflation is still higher than the target set by the Federal Reserve. There is the possibility of entering a recession in 2024, and how the Federal Reserve handles raising or lowering interest rates will also impact stock prices.

The last two years are an example of how the stock market rewards and sometimes terrorizes investors. One year stocks are substantially down. Those who remained invested recovered and moved ahead financially in the second year. Probably some investors panicked as stocks declined and sold their stock shares before they went back up. In that case, the losses became real and were locked in.

As always, the future is unknown, and there is some financial risk when investing in stocks. Generally, stock market investors make money despite the inevitable fluctuations and the inherent risks.