Comparing Recent COLAs and Projecting 2025 COLA

The annual cost of living adjustment (COLA) impacts federal retirees in two ways. Most federal employees are now covered by Social Security. Federal employees also receive a defined annuity. The annual COLA calculation impacts both of these programs so it has a significant impact on current or future retirement income.

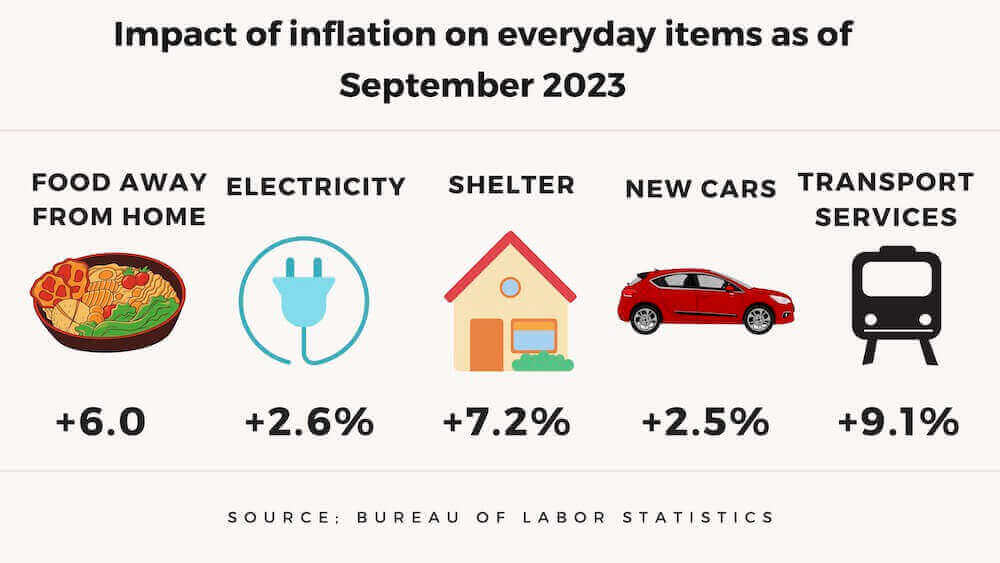

We will not know the amount of the next COLA until mid-October. The last several years have provided a significant bump in income for retirees. Of course, the adjustments were as high as they were because inflation hit highs not seen in 40 years. As a result, the COLA adjustments were the highest in 40 years. Despite the increases, the reality is a loss of purchasing power because of inflation.

The 2024 cost of living adjustment (COLA) for federal retirees was 3.2%. Some retirees were probably disappointed with the 2024 increase because of the larger increases in the two previous years.

In 2023, the COLA was 8.7%. This was the highest in more than 40 years. In 2022, the COLA was 5.9%—the highest in 40 years. The 2024 COLA was 3.2%—considerably less than the previous two years.

What About the 2025 COLA?

The January CPI-W (Consumer Price Index for Urban Wage Earners and Clerical Workers) was 2.9%. That’s higher than the inflation trends had indicated. Based on this trend, The Senior Citizens League (TSCL) is adjusting its long-term forecast COLA to 1.75% in 2025.

COLA estimates often change monthly based on the most recent CPI data. This forecast from the Senior Citizens League is the forecast based on data through January 2024. The final COLA for 2025 will probably be different.

There are eight more months of data to factor into the calculation. Many unpredictable events will occur between now and next October, including electing a president and a new Congress, impacting the final calculation.

How the COLA Calculation Works

Here is how the COLA calculation works:

- CPI-W readings are taken from the third quarter (July – September) of the current year.

- These data are compared to the average CPI-W reading from the previous year’s third quarter (2023).

- The average reading from the current year’s third quarter (2023) is compared to the figure from the third quarter of 2024.

- If the average CPI-W reading goes up in 2024, then the difference, rounded to the nearest 0.1%, is what beneficiaries will receive as an increase in 2025.

- If the figure is lower— indicating deflation—no adjustment is made. That happened several times under the Obama administration.

FERS vs. CSRS and Calculating the Annual COLA

When approaching retirement, most people calculate how much they will need to maintain an acceptable standard of living. For federal employees, this means considering how much is in your Thrift Savings Plan (TSP) account, how much you will receive from a federal annuity payment, Social Security payments, and other sources of income.

Not many federal employees are still working under the older Civil Service Retirement System (CSRS). The number of CSRS employees currently working is 0.77% of the federal workforce. Most federal employees are now covered by the Federal Employee Retirement System (FERS).

Calculating the COLA for FERS

- For Federal Employees Retirement System (FERS) or FERS Special benefits, if the increase in the CPI is 2 percent or less, the Cost-of-Living Adjustment (COLA) is equal to the CPI increase.

- If the CPI increase is more than 2 percent but no more than 3 percent, the Cost-of-Living Adjustment is 2 percent.

- If the CPI increase is more than 3 percent, the adjustment is 1 percent less than the CPI increase. The new amount is rounded down to the next whole dollar.

- To get the full COLA, a retiree or survivor annuitant must have been in receipt of the payment for a full year.

- If a person has not received the payment for a full year, the increase is prorated under both plans. Prorated accounts receive one-twelfth of the increase for each month they have received benefits. COLAs were first prorated in April 1982.

- Adjustments to benefits for children are never prorated.

- Federal Employees Retirement System (FERS) and FERS Special Cost-of-Living Adjustments are not provided until age 62, except for disability, survivor benefits, and other special provision retirements.

- FERS disability retirees get the adjustment, except when they are receiving a disability annuity based on 60 percent of their high-3 average salary.

- Also, under FERS, if you have a CSRS component, the component is subject to the CSRS COLA calculation.

The table below illustrates this:

| If the CPI is: | Then the COLA is: |

|---|---|

| <= 2% | COLA = CPI increase |

| > 2% and <= 3% | COLA = 2% |

| > 3% | COLA = CPI – 1% |

The extra COLA amount for CSRS employees is the result of Congress having decided the benefit of the TSP investments, including a matching amount provided by the federal government for an employee who invests in the Thrift Savings Plan, and the additional income provided during retirement by the Social Security system justified a lower COLA than the one provided for CSRS employees.