A month after the U.S. stock market suffered its worst consumer-price index release day in over a year, investors will be concerned that inflation data could test the Federal Reserve’s monetary policy expectations and test stocks’ 2024 stock market returns.

When Consumer Price Index (CPI) data were released in February, core US consumer prices increased by the most in eight months. As a result, the S&P 500 stock market index dropped 1.4%. That was the worst “CPI day” for stocks since September 2022.

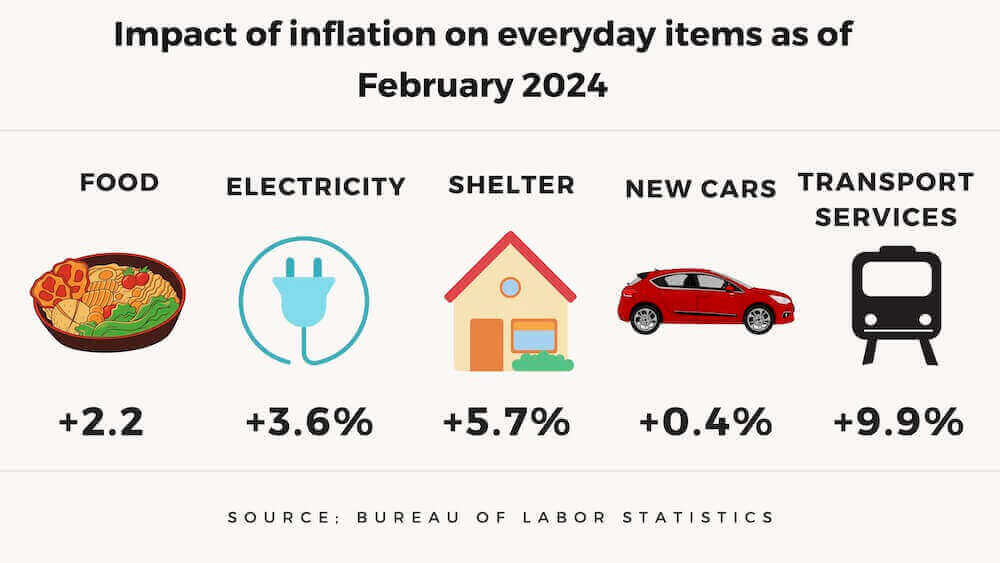

This month, the CPI report, which measures inflation in February, the Consumer Price Index for All Urban Consumers (CPI-U) increased 0.4%. That is a faster pace than January’s 0.3% increase. Over the last 12 months, the all items index increased 3.2%.

The all-items index rose 3.2% for the 12 months ending in February, a larger increase than the 3.1% increase for the 12 months ending January.

Core inflation, which excludes volatile food and energy costs, was up 3.8%.

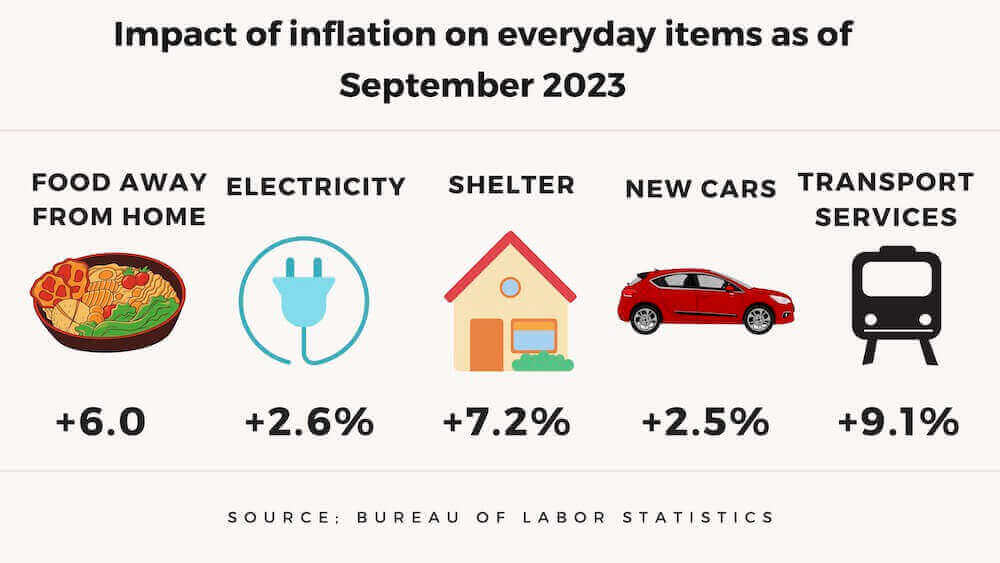

The report notes that the inflation increase was largely due to higher gas prices and housing costs. This was the largest increase since last September and signifies that inflation is not yet under control.

Impact of The Latest Inflation Data on Interest Rates

When the Federal Reserve policymakers meet next week, there were hopes that interest rates would go down. Last week, Fed Chair Jerome Powell told lawmakers that the central bank was “not far” from being able to cut interest rates. After the increase in inflation just reported, an interest rate cut seems unlikely.

Interest rates have been raised in recent months and the cost of borrowing money was at a 23-year high in 2022 and 2023. The purpose of raising rates was to slow down the rate of inflation.

Today, while inflation has fallen from a 40-year high that appeared earlier in the Biden administration, prices are still rising faster than the target inflation rate set by the Federal Reserve.

What is Inflation?

Inflation is the rate at which the cost of goods and services increases. As a result of inflation, the purchasing power of money decreases over time. Inflation impacts prices that affect our everyday lives, from the cost of groceries and restaurant meals to home prices, energy, and buying a new car.

Inflation goes up or down for several reasons. The inflation we have experienced in the last several years has gone up because of issues with the supply chain, consumer demand, and government economic stimulus from the COVID-19 panic.

Most of us focus on inflation from month to month or, in the federal community, by looking at how much the annual COLA rises or the amount of the annual federal pay raise. To look at inflation in a broader context, consumer price inflation was up 19.6% between January 2020 and January 2024.

Inflation and the Annual COLA for Social Security and Annuity Payments

The Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) increased 3.1% over the last 12 months to an index level of 304.284 (1982-84=100). In January, the index increased 0.7% before seasonal adjustment.

The annual COLA is calculated by comparing the change in CPI-W from year to year based on the average of the third-quarter months of July, August, and September.

The Biden administration has proposed a 2% pay raise in the 2025 budget. That is just the opening of the long process of determining the pay raise for the next year. In part, the pay raise amount is based on expectations (whether justified or not) of lower inflation for the year. With national elections coming in November and wars in Ukraine and Israel, many things can happen that would impact the next pay raise.