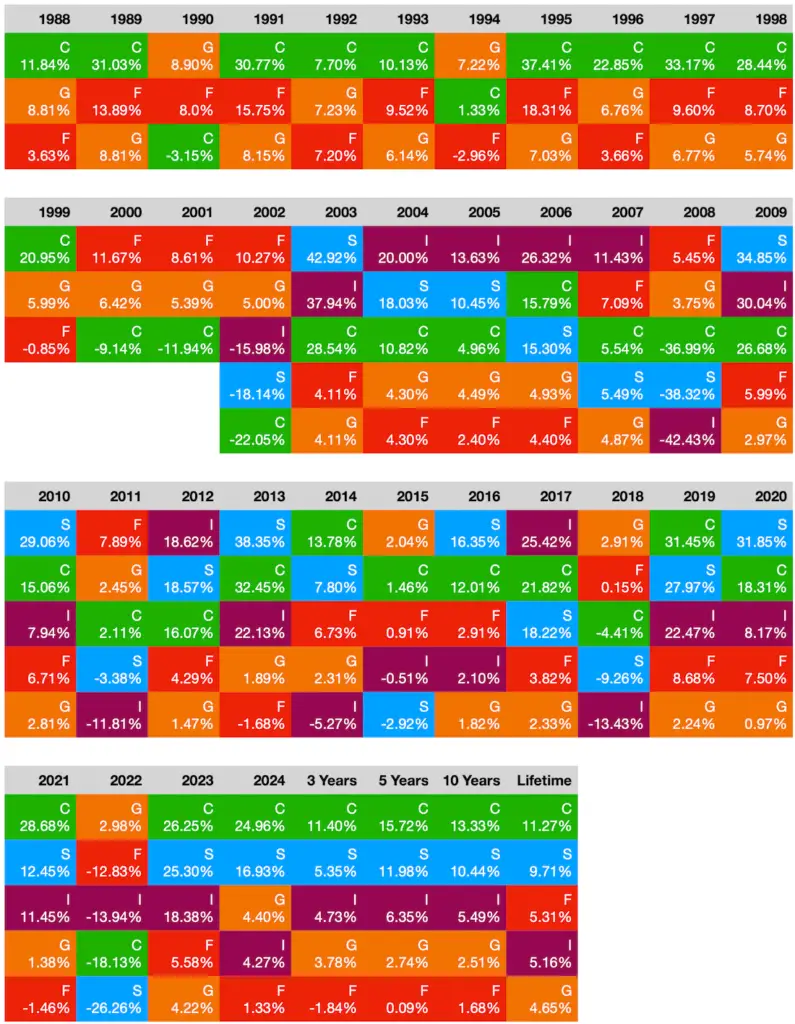

This is an update of a FedSmith article I wrote two years ago, An Asset Allocation Quilt Chart for the TSP Funds. I also provide the TSP funds’ 3- and 5-year annual returns this year. Based on a reader’s suggestion, I also offer an overview of the Lifecycle Fund’s performance in this article.

Remember, financial quilt charts are not meant to be a tool for predicting the best allocation for the current year. Using a quilt chart to source current or future asset allocations would be akin to using your rearview mirror or a map of where you have been to pilot your financial future. Or, as Chris Barfield noted, “If you’re changing your TSP allocation because of what the fund did the best last year, you’ll always be a year behind.”

Financial quilt charts illustrate how individual asset classes take turns being the “winner” or the “loser” over time. Diversifying your portfolio is a strategy that aims to reduce your portfolio risk by varying the type of assets you invest in, knowing they will perform differently over time.

2024 TSP Quilt Chart

Below is a quilt chart for the Thrift Savings Plan’s five core funds.

Benefits of a Quilt Chart

One of the reasons I like the financial quilt approach is that you can use it to orient yourself or others on how the various sectors of the market change, sometimes dramatically, from year to year. The use of colors helps make the data more user-friendly. The colors used in the chart reflect the colors the TSP uses on its website.

For example, the C and S Funds deliver lifetime annual returns of over 9%.

Remember, the TSP funds fluctuate daily and are automatically rebalanced at the close of each business day. In 2024, the C Fund’s daily price changes ranged from $73.11 to $96.14, while the S Fund’s prices were between $73.84 and $96.29.

The TSP C Fund parallels the performance of the S&P 500 index, which has roughly $20 trillion in float-adjusted market capitalization of 500 leading companies, capturing about 80% of the available US market value. The S&P 500 climbed 23% in 2024, and its 24% rise in 2023 made for the strongest back-to-back years since 1997 and 1998.

The TSP S Fund tracks the performance of all the US stocks not in the SP500 index via the Dow Jones Total US Stock Market Completion Index, which would be over 3,400 stocks. The Index returned a 15.47% return in 2024.

Best Investment Strategies

Studies on those who speculate on the market’s daily fluctuations have shown that less than 1% of the day trader population can predictably and reliably earn positive abnormal returns net of fees.

That reality should reinforce your confidence in saving for the long term using a buy-hold strategy instead of attempting to trade shares based on an active strategy such as market timing. Federal employees use dollar-cost averaging if they purchase their funds each pay period. This involves regularly investing a fixed amount of money, regardless of current market conditions.

Another aspect to consider is when one needs liquidity. For investors with a long-term horizon, the Lifecycle Funds offer the attractive feature of selecting from among the blend of TSP funds to buy for their buy-hold strategy, which is especially suited to their future liquidity needs.

Lifecycle or Target date funds are not good candidates for a “quilt chart” because they focus on their overall asset allocation over time. As the target or retirement date approaches, they gradually shift from riskier investments (like the C or S Funds) to more conservative ones (like the G Fund, making the performance of the individual asset classes within the fund less relevant than the overall glide path to liquidity mix. For this reason, Target Date and Lifecycle Funds are sometimes called a “set it and forget it” investment option. This removes an emotional component to the process of investing.

TSP Lifecycle Fund Returns

Below is an overview of the Thrift Savings Plan’s Lifecycle Funds.

| Lifecycle | L Income | L 2025 | L 2030 | L 2035 | L 2040 | L 2045 | L 2050 | L 2055 | L 2060 | L 2065 |

| 1 year | 7.37% | 8.28% | 11.52% | 12.18% | 12.85% | 13.42% | 14.02% | 16.28% | 16.28% | 16.28% |

| 3 year | 4.42% | 3.96% | 5.00% | 5.03% | 5.08% | 5.09% | 5.14% | 5.72% | 5.71% | 5.71% |

| 5 year | 4.77% | 7.68% | 8.50% | 9.19% | ||||||

| 10 year | 4.36% | 7.36% | 8.16% | 8.84% | ||||||

| Since inception | 4.39% | 7.35% | 6.97% | 9.76% | 7.56% | 10.81% | 9.40% | 13.36% | 13.36% | 13.35% |

The last row in the Lifecycle chart illustrates how the funds’ performance reflects the blend of the TSP funds of those different years. The farther out in time we go, the higher the return. It results from the L Income Fund holding a significant portion of its assets in the G Fund, while the L 2065 Fund is mainly tilted toward the C, S, and I Funds. Notice how this trend is shared among all the TSP Lifecycle Funds.

About the Lifecycle Funds

The TSP will automatically roll the 2025 Lifecycle Fund into the L Income Fund in July 2025. The 2070 Lifecycle Fund was introduced in 2024 and is designed for those born after 2004 or who plan to withdraw from the account starting as early as 2068.

So, Lifecycle funds are not just for retirement. I know some older investors who may be retired yet seek out a target-date fund like the 2050 Fund because they intend to use the assets to pay for their grandchildren’s higher education.

Lifecycle funds are ideal retirement vehicles for those not wanting to micromanage their asset allocations. There is considerable evidence that actively managed accounts trail passive, diversified, low-cost options.

Diversity does not guarantee that things will always be better just because of diversity. During significant market downturns like the 2008 financial crisis, many portfolios, even those designed with diversity as a factor, experienced poor performance.