A recent study released by the Government Accountability Office has found that low savings rates inside of defined contribution (DC) plans is hindering many Americans’ retirement prospects.

GAO was asked to review the trends on DC plans (401(k)s, Individual Retirement Accounts, etc.) because they have become the dominant form for how Americans save for retirement, replacing the once common pension plans offered by the government and many private companies.

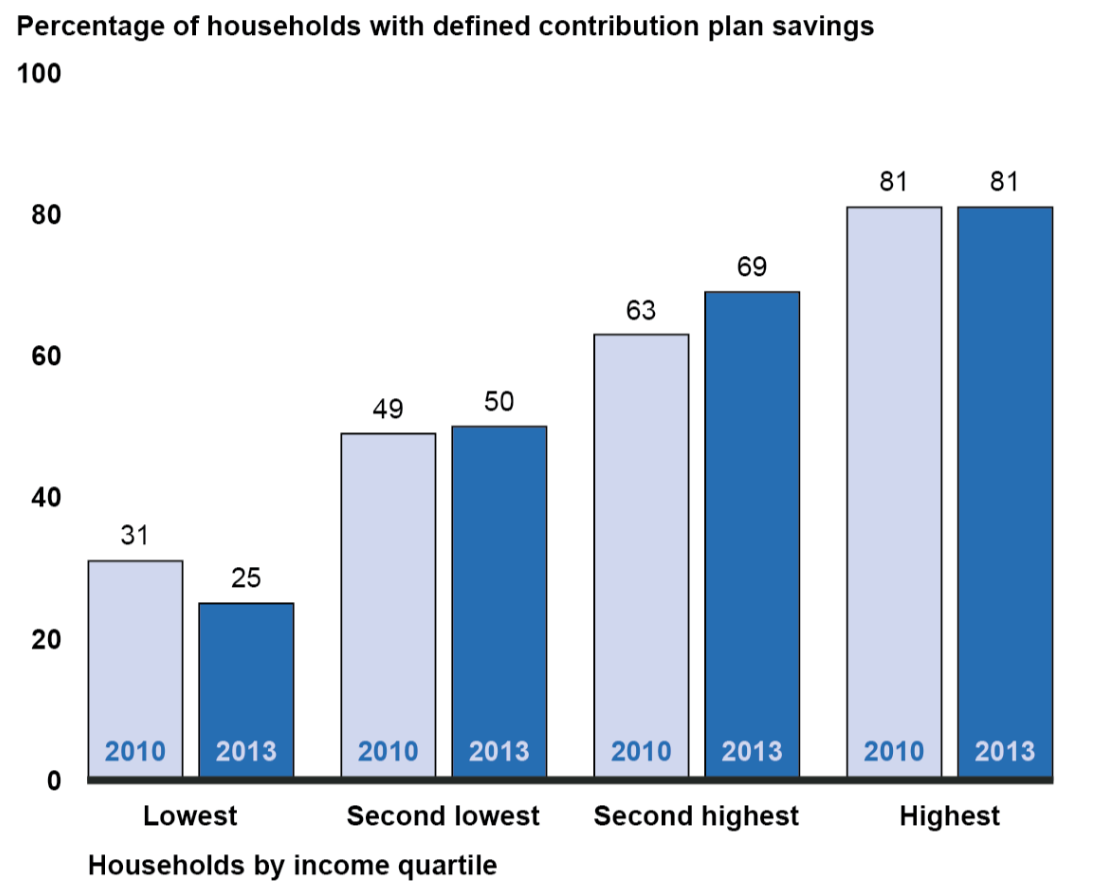

GAO found that 60% of working households have no money in any type of DC plan. The biggest reason by far for this was due to lack of access. The majority of those with no money in any plan (39%) did not have access to one. 34% of working households had no DC plan from either a current or previous job.

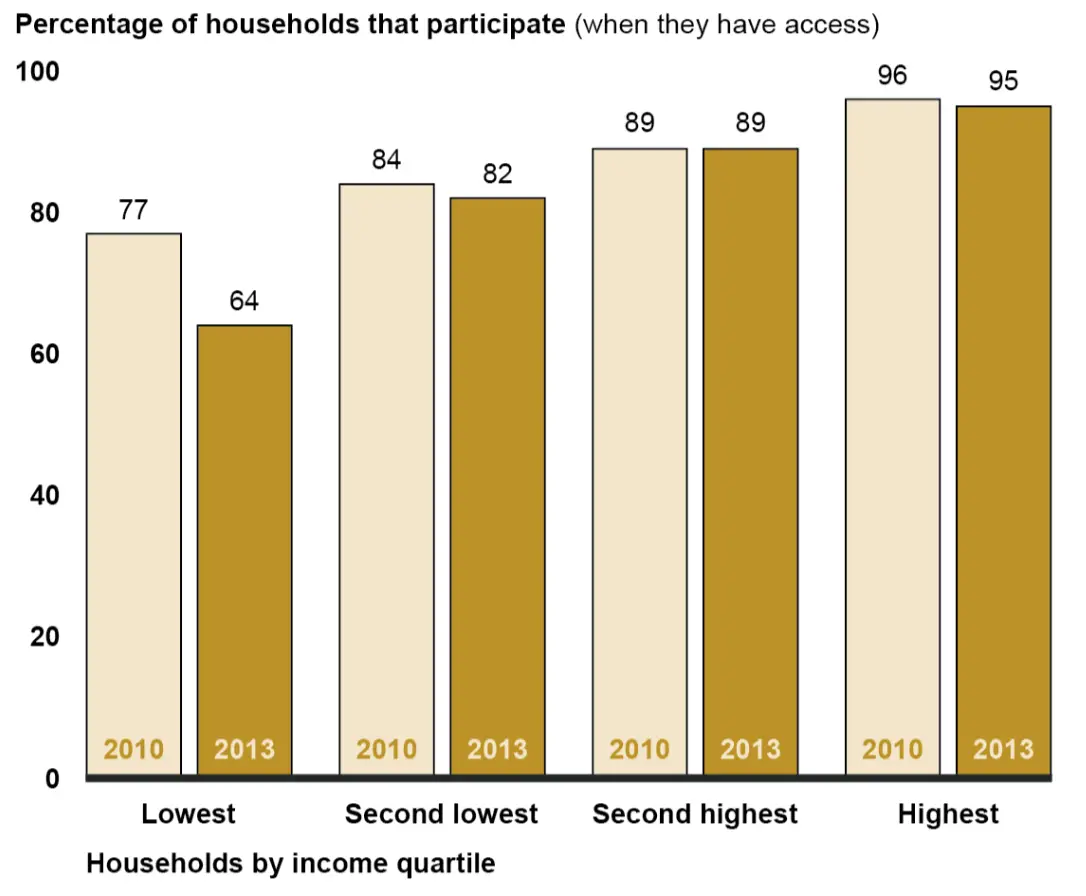

However, there was some good news from the study: 61% of working households have access to a DC plan, and of those, a majority participate. According to 2013 data, 86% of working households that could participate in a DC plan of some sort were doing so.

Discrepancies stood out even more based on income. Lower income families were much less likely to have any savings inside of a DC plan, even if they worked in a job that offered one. For example, GAO found that 35% of lower income families had access to a DC plan, however, only 64% of those that did participated. In higher income families, 95% who had access to a DC plan were participating. Higher income households also had more access (80%) to a DC plan of some kind.

So what are the reasons that lower income households are less likely to participate in retirement savings plans? GAO offered these reasons:

- Less disposable income to set aside for saving after paying for necessities

- Less financial literacy than high income households (thereby not understanding why or how to take advantage of a retirement savings program)

- Less incentive to participate due to the progressivity of the US tax code – GAO noted that because the income tax rate rises as one’s income increases, higher income households have more tax incentive to offset this with saving in a DC plan

- Progressivity of Social Security – GAO said that Social Security replaces a higher percentage of earnings for low-earners than high-earners, which may make DC plan participation seem less urgent for low-income households

For more details, be sure to see the full GAO report.

Good news for federal employees

Federal employees have access to their own DC plan to help them with saving for retirement: the Thrift Savings Plan. How do they stack up to the rest of working Americans in this GAO report?

Overall, generally better: recent data from the TSP indicated that the average participation rate for FERS employees hit a new high in January with a rate of 88.9%. By comparison, in January 2015, it stood at 88%. That was nearly in line with what GAO found in its study: 86% of working households that had the ability to participate in a DC plan were doing so.

If you are a federal employee who is not yet participating in the TSP, you should definitely consider doing so. A small amount contributed from each paycheck can become hundreds of thousands if not millions of dollars over the course of a federal career.

And if you contribute at least 5%, you will get the added benefit of a match from the government, thereby boosting your savings rate even further.